Purchase Intentions Up 0.6%p Since November Last Year

Top Reasons for Buying: Home Ownership and Relocation

Sell Intentions Down 1.7%p Since End of Last Year

It has been found that the number of actual buyers and investors considering purchasing a home in the second half of this year and the first half of next year has increased compared to the end of last year. The proportion of respondents who expressed an intention to sell decreased compared to the end of last year. This is due to the increase in transaction volume in the first half of this year and the heightened expectations for price recovery.

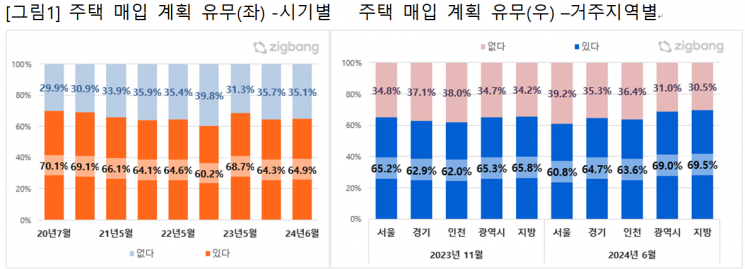

On the 1st, Zigbang conducted a survey on housing purchase and sale plans from the 4th to the 18th of last month targeting users of its application. Among 865 respondents, 64.9% answered that they have plans to purchase a home. This is a 0.6 percentage point increase compared to the 64.3% who expressed an intention to purchase a home in November last year.

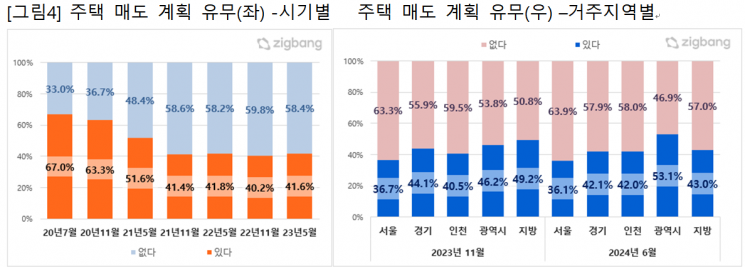

The proportion of respondents who said they intended to sell was 42.1%, a decrease of 1.7 percentage points compared to the end of last year. While the intention to purchase increased, the intention to sell decreased. This is analyzed as a result of an increase in buyers switching from actual demand and those delaying their selling timing in hopes of price recovery.

The region with the highest proportion of respondents expressing an intention to purchase was the provinces (69.5%). This was followed by metropolitan cities (69.0%), Gyeonggi (64.7%), Incheon (63.6%), and Seoul (60.8%). Compared to the survey results from November last year, the intention to purchase slightly increased in all regions except Seoul.

The regions where respondents expressed an intention to sell were metropolitan cities (53.1%), provinces (43.0%), Gyeonggi (42.1%), Incheon (42.0%), and Seoul (36.1%) in that order. The intention to sell was relatively higher in provincial areas than in the metropolitan area.

The main reason for purchasing a home was "owning a home instead of renting" at 44.7%. This was followed by ▲relocation (18.9%) ▲moving to a larger or smaller space (15.0%) ▲investment purposes such as capital gains (11.1%). Overall, there was a strong intention for actual demand purchases, but the proportion of those considering purchase for investment purposes such as capital gains increased by 2.4 percentage points compared to the November last year survey.

Respondents who answered that they had no plans to purchase a home cited reasons such as ▲housing prices being too expensive (31.6%) ▲expectation of future price decline (22.0%) ▲already owning and residing in a home with no intention to purchase additionally (21.4%) ▲burden of rising loan interest rates (10.2%).

In the survey at the end of last year, the most common answer was "already owning and residing in a home with no intention to purchase additionally" (30.0%). The increase in transaction volume in the first half of this year and localized record-high price increases have led to a heightened sense of price burden.

The most common reason for wanting to sell a home was "relocation" (31.3%). Other reasons included ▲moving to a larger or smaller space (19.5%) ▲realizing capital gains or switching investments (13.5%) ▲expectation of housing price decline (11.8%).

Reasons for not planning to sell a home included ▲actual residence (one household, one home) or not owning a home (46.5%) ▲waiting for an appropriate selling timing (23.2%) ▲expectation of rising or recovering housing prices (11.2%) ▲transaction prices not matching desired selling prices (10.0%).

Currently, the real estate market is showing localized price strength depending on preferences and development conditions in some areas of the metropolitan area. The burden of loan interest costs has decreased due to interest rate cuts and low-interest loans, and the continuous rise in Jeonse (long-term lease) prices has led to increased demand for switching to purchase. Additionally, concerns about supply reduction in some areas of Seoul and the metropolitan area have stimulated buying demand, driving up transaction volume and prices.

Kim Eun-seon, head of the Zigbang Big Data Lab, explained, "There is little room for short-term supply reduction to be resolved, and Seoul apartment prices continue to rise as demand concentrates on preferred complexes such as those along the Han River, downtown areas near subway stations, and new constructions. The average transaction price will continue to increase." She added, "The implementation of the second phase of the stress DSR (Debt Service Ratio) regulation has been postponed to September, and the anxiety to complete transactions before loan regulations tighten is also expected to have an impact."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.