4 Deals Closed This Month Out of 8 in H1

Genome&Company, IM Biologics

April Bio, Isu Abxis Announce Good News

Largest $3.4B Deal in H1 Completed

Interest Grows Over 'Reclaza' Profitability in H2

Overseas technology exports from the domestic bio industry, which had been sluggish in the first half of the year, have surged since June. As global bio investment sentiment recovers, the high technological capabilities of the Korean bio industry are being highly evaluated, creating an active trading atmosphere.

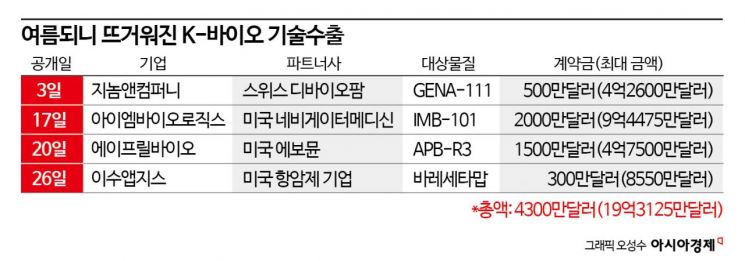

According to the industry on the 28th, four overseas technology export deals from the domestic bio industry have been disclosed just this month. Considering that a total of eight major technology transactions were made in the first half of the year, half of them were concluded this month.

ISU Abxis exported the technology of Varecetumab (ISU104), an anticancer new drug under development, to a U.S.-based anticancer drug development company on the 25th (local time) with an upfront payment of $3 million (approximately 4.1592 billion KRW), development milestones of $7.5 million, approval milestones of $20 million, and sales milestones of $55 million, totaling up to $85.5 million (approximately 118.5372 billion KRW). Varecetumab is a human epithelial growth factor receptor (HER) 3-targeting anticancer antibody therapeutic developed by ISU Abxis. Notably, this contract limits the partner company's development utilization conditions to specific modality therapeutic development, leaving the possibility open for additional technology exports.

On the 3rd, Genome & Company exported the technology of GENA-111, an antibody for anticancer antibody-drug conjugates (ADC), to Swiss company Diviopharm with an upfront payment of $5 million (approximately 690 million KRW) and a total amount of $426 million (approximately 586.4 billion KRW). On the 17th, IM Biologics exported the autoimmune disease treatment candidate IMB-101, jointly developed with HK Innoen and Y-Biologics, to U.S.-based Navigator Medicine with an upfront payment of $20 million (approximately 2.76 billion KRW) and a maximum of $944.75 million (approximately 1.309 trillion KRW). On the 20th, April Bio successfully exported APB-R3, a candidate for autoinflammatory disease treatment that recently completed Phase 1 clinical trials, to U.S.-based Evomune with an upfront payment of $15 million (approximately 2.07 billion KRW) and a maximum contract amount of $475 million (approximately 655.9 billion KRW).

Combining the cases concluded this month, the upfront payments total $43 million (approximately 5.96 billion KRW), and the maximum amount reaches a staggering $1.93125 billion (approximately 2.6757 trillion KRW). Additionally, including LG Chem (January, up to $305 million), Alteogen (February, up to $432 million), and Aribio (March, up to $770 million), the total expected maximum revenue from technology exports by domestic companies this year is up to $3.43825 billion (approximately 4.7637 trillion KRW). Nexai, which exported the immune-oncology drug NXI-101 to Japan's Ono Pharmaceutical in March, has not disclosed detailed contract figures.

Although the total number of technology exports in the first half of this year was eight, which is fewer than in previous years, an industry insider said, "Although the number of deals decreased, contracts exceeding 1 trillion KRW in maximum scale were signed, and substances not yet in human clinical stages were also exported," adding, "Korean technology is being highly evaluated." Big pharma companies have traditionally purchased mainly mid-to-late stage clinical substances with relatively high prices but low risks. In contrast, GENA-111 is a preclinical substance, and IMB-101 and APB-R3 were exported immediately after or during Phase 1 clinical trials. This suggests that despite the risks, they are actively acquiring early-stage candidate substances from Korea with proven technological capabilities.

In the second half of the year, attention is focused on whether any of the exported substances will become global blockbusters. Yuhan Corporation's lung cancer treatment drug Rexlaza is awaiting FDA approval in August for combination therapy with Johnson & Johnson's (J&J) antibody anticancer drug Libtayo, its technology export partner. J&J expects this therapy to generate annual sales exceeding $5 billion (approximately 7 trillion KRW). Accordingly, if FDA approval is successful, sales are planned to commence immediately, with actual sales expected to begin as early as this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)