Full-Scale Entry into Private Equity Management

Shift to Core Businesses like Processed Oil... Streamlining Inefficient Food Service

Profitability-Focused Portfolio Strengthening Strategy

Enhancing Shareholder Value through Treasury Stock Acquisition

Namyang Dairy Products ended its 60-year owner-led management system, and nearly five months have passed since the private equity firm Hahn & Company (Hahn & Co) became the largest shareholder at the end of January. Since the new owner began actively participating in management in March, there has been a noticeable acceleration in restructuring efforts focused on profitability and improving management efficiency. To recover accumulated losses caused by owner-family risks, the company is concentrating on reorganizing its portfolio around competitive businesses to enhance shareholder value. However, ongoing litigation with former Chairman Hong Won-sik remains a potential risk.

According to industry sources on the 27th, Namyang Dairy Products reported consolidated sales of 234.2 billion KRW in the first quarter of this year, a 2.4% decrease compared to the same period last year, but operating losses were reduced by 52.9% from 15.7 billion KRW in the previous year to 7.4 billion KRW. The company explained, "We reduced cost of goods sold and selling and administrative expenses, and restructured the portfolio focusing on profitability in products such as infant formula, fermented milk, and processed milk to recover losses."

According to Namyang Dairy Products' first-quarter business report this year, the cost of goods sold, which includes raw materials and production costs, decreased by nearly 10 billion KRW compared to 196 billion KRW in the same period last year. Selling and administrative expenses were reduced by nearly 5 billion KRW compared to the previous year, with significant decreases in commission fees (-2.6 billion KRW) and advertising expenses (-1.7 billion KRW). An industry insider familiar with the situation explained, "When a private equity fund participates in management, they minimize artificial restructuring and instead focus on areas that can maximize profits in the short term or eliminate unprofitable businesses to increase corporate value. They operate budgets for new businesses, brand promotion, and sales promotion very conservatively."

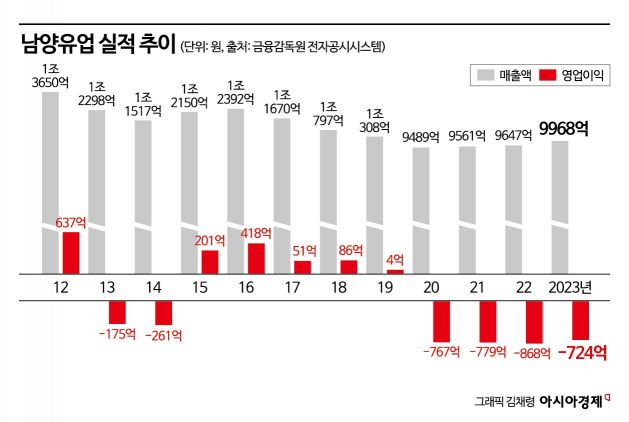

Namyang Dairy Products' performance, which had been declining since the COVID-19 pandemic, appears to have bottomed out last year. The company's annual sales, which exceeded 1 trillion KRW until 2019, dropped to the 900 billion KRW range starting in 2020, and operating losses continued in the 70 to 80 billion KRW range. However, last year, the deficit was reduced by about 17% compared to the previous year.

Namyang Dairy Products is strengthening its profitability-focused portfolio by shifting its focus from white milk, which has seen decreased consumption, to the processed milk market. A representative example is the expansion of the dessert lineup last year using the flagship brand 'Choco Emong,' including Choco Emong ice cream and Choco Emong fresh cream bread. Additionally, targeting the premium milk market, products like Mat-it-neun Milk GT and Bulgari have been transformed into lactose-free products, and the company is expanding into protein drinks, health functional foods, and plant-based beverages based on the 'Takefit' brand launched in 2022.

An industry insider commented, "Namyang Dairy Products suffered a direct hit in product sales due to a decline in corporate image, forcing them to compete with discount strategies in the existing white milk market. Therefore, shifting the core business to other areas was an inevitable choice."

Namyang Dairy Products is also reportedly exploring plans to gradually phase out low-profitability food service businesses. This includes Italian restaurants 'Il Cipriani' and 'Osteria Stesso,' as well as the teppanyaki specialty restaurant 'Cheol Grill.' In fact, Il Cipriani closed its locations at Shinsegae Department Store Main Branch in Jung-gu, Seoul, in April and at Hyundai Department Store Apgujeong Main Branch in Gangnam-gu, Seoul, last year upon contract expiration. The other stores are expected to follow suit.

On the 24th, the company decided through its board of directors to enter into a trust contract for acquiring treasury stock worth 20 billion KRW. Through a contract with NH Investment & Securities, it plans to acquire its own shares by December 24. A Namyang Dairy Products official stated, "Despite difficult market conditions such as management disputes and intensified competition in the dairy industry, we are steadily working to improve corporate value by reducing losses through improved business strategies. This treasury stock purchase decision reflects our commitment to responsible management and enhancing shareholder value as management normalization becomes visible following recent changes in management rights."

The market has responded positively as well. Namyang Dairy Products' stock price has risen for four consecutive trading days recently.

Meanwhile, the conflict remains unresolved as former Chairman Hong filed a lawsuit against the company on the 30th of last month, claiming over 44 billion KRW in severance pay. Although Hong transferred all company shares to Hahn & Co earlier this year following a Supreme Court ruling, additional litigation continues over damages incurred during the period before the Supreme Court's final decision. Hahn & Co has also filed a lawsuit seeking damages exceeding 50 billion KRW, alleging that Hong failed to fulfill the stock purchase agreement signed in 2021 in a timely manner.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.