Large Construction Companies Have Low PF Guarantee Contingent Liability Risk

Problematic Projects Are 'Local + Bridge Loan + Contract Work'

Hyundai, Daewoo, DL E&C

All Have Bridge Loan Proportion for Local Contract Work at 1% of Equity Capital

Taeyoung Construction, which is experiencing a liquidity crisis due to real estate project financing (PF), has applied for a workout. On the 5th, the construction site of Taeyoung Construction's Seongsu-dong development project located in Seongdong-gu, Seoul, has come to a halt. Photo by Jinhyung Kang aymsdream@

Taeyoung Construction, which is experiencing a liquidity crisis due to real estate project financing (PF), has applied for a workout. On the 5th, the construction site of Taeyoung Construction's Seongsu-dong development project located in Seongdong-gu, Seoul, has come to a halt. Photo by Jinhyung Kang aymsdream@

As the normalization of real estate project financing (PF) sites emerges as a major issue in the construction industry in the second half of this year, large construction companies are found to have relatively low PF guarantee contingent liability risks.

On the 27th, Jang Yoon-seok, a researcher at Yuanta Securities, released the 'Key Checkpoints for the Second Half of the Year,' analyzing that as the government disposes of PF sites with concerns of insolvency through auctions or restructuring, construction companies will also be affected. However, he analyzed that most of these high-risk projects are handled by small and medium-sized construction companies, and large construction companies face almost no risk.

Researcher Jang explained to Construction, "If PF loans remain unpaid by the project operator even after auctions, the PF guarantee contingent liabilities of construction companies responsible for credit enhancement of the operator may materialize." Contingent liabilities refer to debts that may arise in the future but are not yet confirmed. Real estate PF involves the project operator borrowing money from financial institutions based on the expected revenue from the project, and the construction company, as the contractor, provides a payment guarantee to reduce interest rates. If the project does not proceed properly and the operator fails to repay the loan, the construction company must repay it on their behalf.

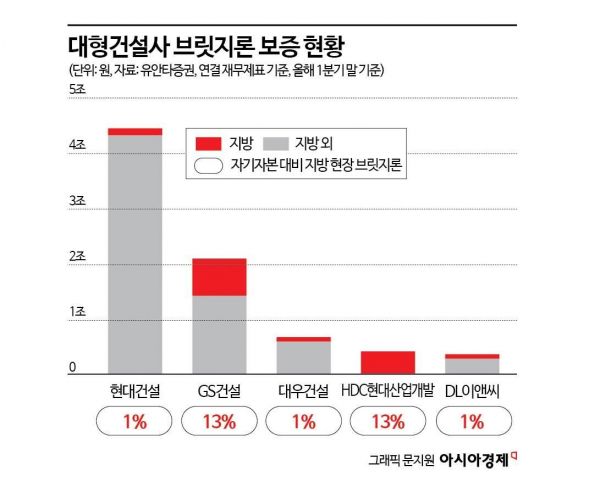

He explained, "In reality, projects with a high possibility of insolvency are more likely to be located in provincial areas rather than the metropolitan area, new construction contract projects rather than redevelopment projects with secured land, and at the bridge loan stage rather than the main PF stage." A bridge loan refers to the initial funding provided before the main PF is raised, including land acquisition. Considering contract projects at the bridge loan stage in provincial areas as the main risk, the ratio of 'bridge loans for provincial contract projects to equity capital' was only about 1% for Hyundai Engineering & Construction, Daewoo Engineering & Construction, and DL E&C.

According to Researcher Jang's analysis, as of the first quarter of this year, Hyundai Engineering & Construction had 60 billion KRW (0.6%) in bridge loans for provincial contract projects out of 10.621 trillion KRW in equity capital; DL E&C had 65 billion KRW (1.4%) out of 4.736 trillion KRW; and Daewoo Engineering & Construction had 44 billion KRW (1%) out of 4.114 trillion KRW. However, GS Engineering & Construction (634 billion KRW out of 4.987 trillion KRW) and HDC Hyundai Development Company (403 billion KRW out of 2.997 trillion KRW) had a relatively high proportion of about 13% in bridge loans for provincial contract projects compared to other large companies.

Researcher Jang said, "In the case of HDC Hyundai Development Company, the proportion of provincial projects is high due to a site in Cheonan, but the risk will decrease when the Cheonan site bridge loan converts to the main PF in the second half of the year." He added, "GS Engineering & Construction has multiple sites in Cheonan, Asan, and Gwangyang, but as a top-tier construction company in terms of construction capability, the impact of insolvency handling will be limited."

He continued, "Large construction companies have relatively small amounts of bridge loan guarantees and possess the financial capacity to absorb defaults if they occur," explaining, "The risk burden from PF insolvency restructuring in the second half, as calculated by the Bank of Korea, is greater for small and medium-sized construction companies."

According to the government's announced roadmap for normalizing real estate PF sites, from the end of June to early July, financial companies will evaluate sites with many delinquencies or maturity extensions, and by the end of July, they must submit plans for auction insolvency disposal or project restructuring for each site to the Financial Supervisory Service. The disposal of insolvent sites will begin in August.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.