Virtual Asset Act, One Month Before Enforcement on July 19

Related Enforcement Decree Passed at Cabinet Meeting on the 25th

Includes Numerous User Protection Measures

The 'lawless zone' of South Korea's virtual asset market is changing. With the country's first industry-specific law for the virtual asset market, the "Virtual Asset User Protection Act (Virtual Asset Act)," set to take effect on the 19th of next month, the industry is busy preparing to avoid becoming the first violator of the regulations. Under the Virtual Asset Act, if an exchange, like FTX which was once the world's third-largest virtual asset exchange, goes bankrupt or ceases operations, financial authorities can take the lead in implementing user protection measures. Although legal gaps remain, such as the absence of provisions related to listing and delisting, the establishment of this first-stage law for user protection is significant.

Financial Authorities Complete Preparations for Virtual Asset Act Enforcement

The enforcement decree related to the Virtual Asset Act, scheduled to take effect on the 19th of next month, passed the Cabinet meeting on the 25th. The draft regulations for the "Virtual Asset Business Supervision Regulation" and the "Virtual Asset Market Investigation Business Regulation," which are delegated by the law and enforcement decree, are also expected to be approved by the Financial Services Commission on the 10th of next month and then promulgated. Preparations for the law's enforcement are complete. The "Digital Finance Policy Office," the control tower for virtual assets under the Financial Services Commission, was recently elevated to a regular organization. Kim Joo-hyun, Chairman of the Financial Services Commission, met with virtual asset operators and urged compliance with the law, emphasizing that "while opening up the potential of new technologies, a balanced approach that mitigates risks through appropriate regulation and protects users is important."

The Virtual Asset Act includes many provisions related to user protection by virtual asset operators. Representative provisions include: △trust and deposit of customer deposits with banks, etc. (Article 6), △substantial holding of virtual assets of the same type and amount as entrusted by users (Article 7), △mandatory subscription to electronic financial transaction liability insurance (Article 8), △creation, preservation, and destruction of transaction records (Article 9), and △supervision and inspection provisions including the authority of financial authorities to order measures in case of virtual asset operator bankruptcy (Article 13).

According to the enforcement decree announced on the day, exchanges must keep users' deposits in reputable banks and manage them as safe assets. At this time, deposits refer to cash and do not include the virtual assets themselves. If a virtual asset operator goes bankrupt or its business registration is canceled, the bank must announce the payment timing and location in a daily newspaper and on its website and pay the deposits directly to users.

Protection measures for virtual assets entrusted by users are also specified in detail. Under the enforcement decree, virtual asset operators must store at least 80% of the users' virtual assets, as determined by the Financial Services Commission, within the scope of 70% or more of the entrusted virtual assets, in cold wallets. Cold wallets are separate wallets disconnected from the internet, designed to prevent hacking and protect customer assets. The specific storage ratio and calculation criteria will be included in the "Virtual Asset Business Supervision Regulation." A representative from Exchange A said, "The standard of '70% or more' in the Korea Blockchain Association's self-regulation proposal has been raised to '80% or more,' excluding the minimum level necessary for business operations." This means that all virtual assets except the minimum required for the exchange's core operations must be stored separately.

The enforcement decree also stipulates legitimate reasons for virtual asset operators to block deposits and withdrawals of users' deposits and virtual assets, such as △information and communication network system failures △unavoidable cases like maintenance, inspection, or hacking incidents. If deposits and virtual assets are related to illegal assets such as criminal proceeds generated from serious crimes under the Act on the Regulation and Punishment of Criminal Proceeds Concealment, withdrawals can be blocked for up to six months if the terms and conditions include such provisions. In the past, some exchanges delayed payments, causing investors to suffer damages. According to the Korea Consumer Agency's "Status of Damage Relief Related to Virtual Currency," there were a total of 174 cases of 'unfair acts' such as delays in trading or deposits and withdrawals from 2017 to 2020, averaging 43.5 cases per year.

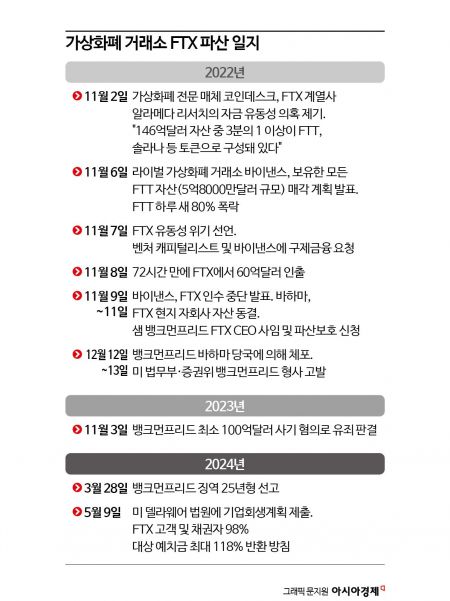

The Nightmare of FTX Bankruptcy Continues for Three Years

The market welcomes the enforcement of the Virtual Asset Act because the nightmare of FTX's bankruptcy three years ago has not ended. In November 2022, FTX, then one of the world's top three exchanges, filed for bankruptcy protection immediately after a bank run (massive withdrawal incident). FTX, which went through rehabilitation procedures, attempted to raise additional funds to rebuild the exchange but ultimately failed. In February of this year, it chose corporate liquidation, fully repaying customers with company assets. At that time, the amount FTX had to distribute to creditors ranged from $14.5 billion to $16.3 billion. Subsequently, in May, FTX submitted a corporate rehabilitation plan to the Delaware Bankruptcy Court in the U.S., offering to return 118% of the deposits at the time of bankruptcy to exchange customers and creditors who claimed $50,000 or less. Approximately 98% of FTX customers fall under this category. Remaining funds after repayment are expected to be used for additional interest.

The bankruptcy of a mega global exchange triggered a chain reaction of market shocks. One of South Korea's top five exchanges, Gopax, is a representative case hindered by FTX's bankruptcy. Gopax's "Gopay operation loan business," a virtual asset deposit and operation service, was affected because Genesis Global Capital, the operator, went bankrupt due to FTX's collapse. Unable to return principal and interest to investors, Gopax bore the corresponding virtual asset as debt. Although Gopax tried to turn the situation around by bringing in Binance, a Chinese exchange, as a major shareholder, the financial authorities' disapproval worsened Gopax's financial condition. According to the audit report of Streamy, the operator of Gopax, capital erosion continued through 2023 following 2022 due to excessive current liabilities. As of the end of 2023, unpaid balances amounted to 63.728 billion KRW.

Gopax has stated its intention not to neglect user protection obligations in line with the new law's enforcement. A Streamy official said, "We already hold more than 100% of customer entrusted assets in virtual assets, including cold wallets and hot wallets (wallets connected to the internet)," adding, "We continue to report the storage ratio to authorities." Other exchanges are also busy to avoid being stigmatized as the first violators of the law. Supervisory authorities are continuing official and unofficial communication efforts, such as workshops and meetings, focusing on the top five KRW exchanges.

Professor Hwang Seok-jin of Dongguk University's Graduate School of International Information Security said, "Provisions such as cold wallet storage and separate storage of virtual assets are included in the Virtual Asset Act," adding, "The law requires exchanges to separately store the virtual assets entrusted by customers, and as long as this is observed, the related risks (even in extreme situations like bankruptcy) are not expected to be significant."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.