Goldman Sachs and Others Selling Commercial Real Estate Non-Performing Loans

"Asset Losses Processed in Preparation for Expanding Real Estate Crisis"

Major financial institutions on Wall Street in the United States have been disposing of their commercial real estate loan receivables. This is interpreted as a proactive risk management response to the expansion of non-performing assets caused by prolonged high interest rates and high vacancy rates that have persisted since the COVID-19 pandemic.

According to the New York Times (NYT) on the 24th (local time), two German financial firms, including a subsidiary of the global investment bank (IB) Deutsche Bank, sold delinquent loans related to the office complex 'Argonaut' located in Manhattan, New York, to billionaire George Soros's family office at the end of last year. Around the same time, Goldman Sachs also disposed of non-performing loan receivables related to office buildings it held in New York, San Francisco, and Boston. In May, the Canadian Imperial Bank of Commerce (CIBC) completed the sale of office building-related loan receivables worth approximately $300 million.

The NYT noted, "Banks on Wall Street, fearing they would not be able to recover their loans, have quietly started to clean up commercial real estate loan receivables to reduce losses," adding, "This is a sign that broader problems are emerging in the commercial real estate market, which has been hit by high interest rates and vacancy rates." It also explained, "From the banks' perspective, seizing the assets of delinquent borrowers or selling loan receivables at a discount converts theoretical losses into actual losses, but they judged that it is better to take losses now than to risk greater damage if the real estate market worsens."

Following the bankruptcies of Signature Bank and First Republic, major commercial real estate lenders in the U.S. last year, U.S. regulators and investors have pressured major banks to reduce their commercial real estate portfolios. In particular, with the activation of remote work after the pandemic leading to increasing vacancies in U.S. offices, banks are believed to have started risk management. According to data provider Statista, the vacancy rate for U.S. commercial real estate reached 20% as of the first quarter of this year.

Jay Nebelov, head of real estate law at Kramer Levin, diagnosed, "Banks recognize that they have too many loans on their books," and "They have started investigating how large a discount is needed to induce investors to buy the worst products (non-performing loans)." He added that large banks are contacting some family offices they represent to sell loan receivables at discounted prices and are quietly conducting transactions with a small number of people to avoid attracting attention from the market and shareholders.

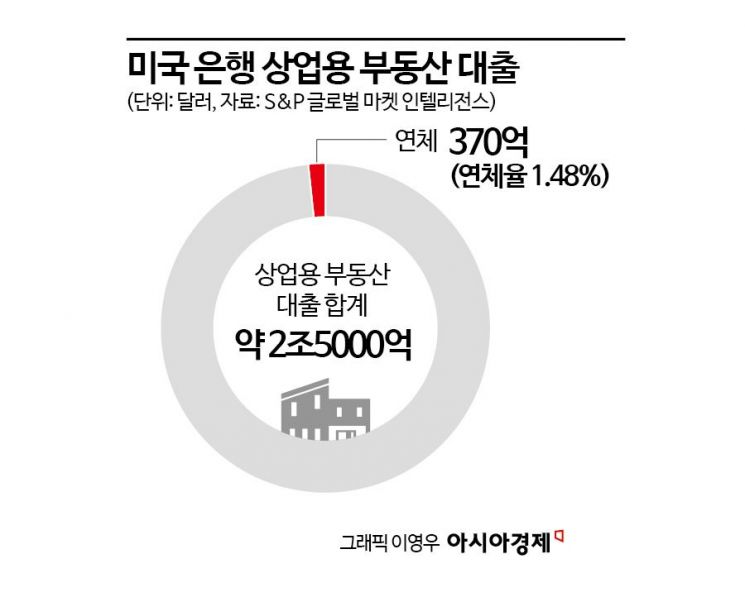

However, some analysts argue that although the commercial real estate loan problem is serious, it has not yet reached a crisis level. This is because the scale of non-performing loans subject to disposal is only a very small portion of the total real estate loans held by banks. According to financial market research firm S&P Global Market Intelligence, the scale of commercial loan receivables held by banks in the U.S. is $2.5 trillion. Among these, loans overdue by more than 30 days amount to $37 billion, about 1.5% of the total. The delinquency rate for commercial real estate loans peaked at 10.5% in early 2010, following the subprime mortgage crisis.

Nathan Stovall, director at S&P Global Market Intelligence, evaluated the banks' successive sales of non-performing loans as "transactions made to reduce exposure (risk exposure)" and said, "The sales currently occurring are one-off events."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)