Construction Contract Amount in Q1 63.1 Trillion Won... 7.9% Decrease Compared to Same Period Last Year

Small construction companies that do not rank within the top 1000 in the construction industry have been found to be more vulnerable to the economic downturn in Gyeonggi Province. Unlike medium and large construction companies, their construction contract amounts in the first quarter of this year significantly decreased. Due to the decline in orders, the share of small construction companies in the total construction contract amount fell to the 20% range.

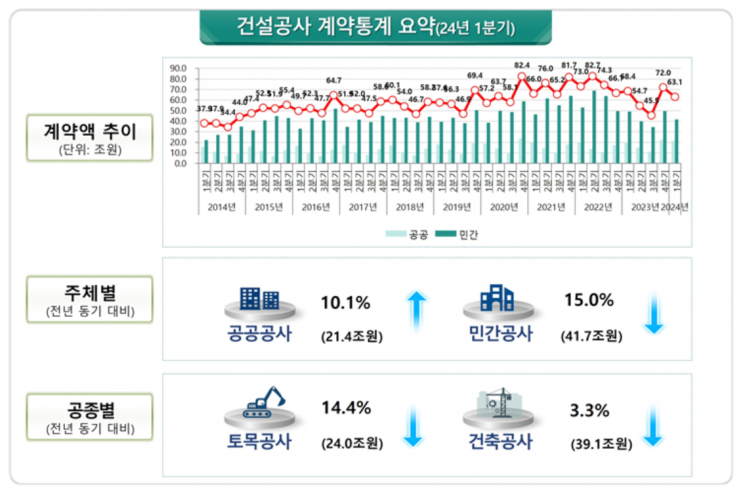

The Ministry of Land, Infrastructure and Transport announced on the 25th the results of an analysis of construction contract amounts for the first quarter of this year, as reported to the Construction Industry Comprehensive Information Network (KISCON). The total construction contract amount was 63.1 trillion KRW, down 7.9% compared to the first quarter of last year.

Construction Contract Statistics for Q1 2024.

Construction Contract Statistics for Q1 2024. [Image provided by Ministry of Land, Infrastructure and Transport]

Based on the scale of construction contracts reported to KISCON last year, the contract amount of construction companies outside the top 1000 ranked 18.5 trillion KRW in the first quarter of this year, a decrease of 18.4% compared to the same period last year. Following this, the construction companies with the largest decreases in contract amounts were those ranked 101st to 300th (down 12.8%) and those ranked 1st to 50th (down 5.2%). The contract amount for companies ranked 101st to 300th was 5.2 trillion KRW, and for companies ranked 1st to 50th, it was 29.4 trillion KRW.

On the other hand, the construction contract amount for companies ranked 51st to 100th in the first quarter of this year was 3.8 trillion KRW, up 6.1% compared to the same period last year, and for companies ranked 301st to 1000th, it was 6.1 trillion KRW, up 18.9%.

In particular, as the decrease in order amounts for construction companies outside the top 1000 intensified in the first quarter of this year, the share of these companies' contract amounts in the total construction contract amount also recorded 29.4%. This share had previously been maintained at 30%. Looking at it quarterly, the ratio of contract amounts for companies outside the top 1000 to the total contract amount was 33.2% in the first quarter of last year, 36.4% in the second quarter, 37.9% in the third quarter, and 33.3% in the fourth quarter. By year, it was 35% in 2019, 35.4% in 2020, 35.6% in 2021, 35.1% in 2022, and 34.9% last year.

Meanwhile, public construction contracts in the first quarter of this year amounted to 21.4 trillion KRW, an increase of 10.1% compared to the same period last year. Private sector construction contracts totaled 41.7 trillion KRW, a decrease of 15% during the same period. Although the government increased public construction projects such as the Metropolitan Area Express Train (GTX) and the Sejong~Anseong Expressway, the reduction in private construction caused the contract amount to shrink significantly from 68.4 trillion KRW in the first quarter of last year to 63.1 trillion KRW this year.

By construction type, civil engineering contracts including industrial facilities and landscaping amounted to 24 trillion KRW, down 14.4% compared to the same period last year, while building contracts were 39.1 trillion KRW, down 3.3% during the same period. The large decrease in civil engineering is believed to be a base effect due to a large-scale project (Shahin Project) worth 9.1 trillion KRW contracted last year.

By project location, construction contract amounts in the metropolitan area reached 29.5 trillion KRW, up 6.9% compared to the first quarter of last year, but in non-metropolitan areas, the amount was 33.5 trillion KRW, with a larger decrease of 17.8% during the same period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)