Korea Asset Management Corporation (KAMCO) announced on the 24th that it acquired securitized bonds issued based on non-performing bridge loans and land-secured loans held by savings banks to support the normalization of the project financing (PF) market on the 21st.

This acquisition support for non-performing loans of savings banks was promoted to enhance credit soundness and support the soft landing of the real estate market amid the recent continuous increase in delinquency rates of savings banks.

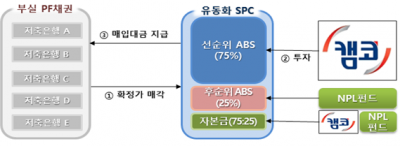

Twenty savings banks and a special purpose company (SPC) signed a contract on the 24th of last month to transfer and assign non-performing bridge loans and others with a total claim amount of approximately 148.8 billion KRW, and the SPC issued securitized bonds worth a total of 104.8 billion KRW to raise purchase funds.

KAMCO acquired all of the approximately 78.6 billion KRW senior securitized bonds issued by the SPC, while subordinated securitized bonds were acquired by private non-performing loan (NPL) funds to support the prompt resolution of non-performing loans of savings banks.

Lee Jong-guk, Head of KAMCO’s Real Estate Finance Stability Support Group (Chief Director of the Management Support Division), stated, “Through KAMCO’s swift capital injection, we were able to timely resolve the large-scale non-performing loans of savings banks. KAMCO will continue to make its best efforts to contribute to the stability of the national economy by enhancing the soundness of financial institutions.”

Meanwhile, following the acquisition of non-performing loans of Saemaeul Geumgo worth 1.1 trillion KRW last year, KAMCO is actively working to stabilize the financial system this year by acquiring securitized non-performing loans of savings banks and additional non-performing loans of Saemaeul Geumgo.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.