Q2 Earnings Announcements Begin Next Month

Q2 Earnings Forecasts Continue to Be Revised Upward

Strong Exports Expected to Support Q2 Performance

Leading Semiconductor Stocks May See Further Upward Revisions

As the KOSPI surpassed the 2,800 mark for the first time in 2 years and 5 months, interest is growing in the upcoming Q2 earnings season. This is because Q2 earnings are likely to act as a driving force for further gains in the KOSPI. In particular, earnings forecasts for the leading semiconductor sector are being revised upward, which is expected to further boost expectations for Q2 results.

According to financial information provider FnGuide on the 24th, the consensus operating profit (average securities firms’ forecast) for 256 KOSPI-listed companies with estimates from three or more institutions was revised upward by 0.9% compared to a month ago, totaling KRW 57.3792 trillion for Q2.

Yang Hae-jung, a researcher at DS Investment & Securities, said, "The current level of the index is maintained because expectations for earnings remain alive," adding, "For the upward momentum to strengthen, there must actually be good earnings, and the total operating profit for KOSPI in Q2 is expected to approach the levels seen in 2021, which was a very strong quarter."

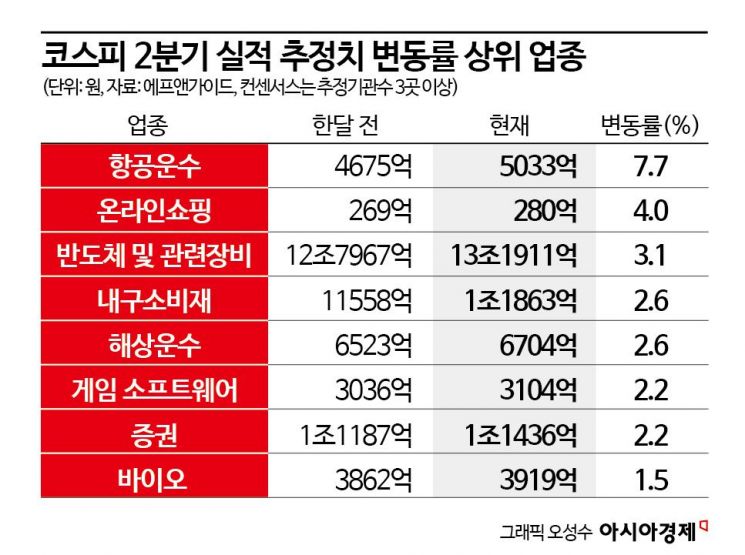

By sector, according to FnGuide’s classification, air transportation saw the largest increase in consensus, rising 7.7% compared to a month ago, followed by online shopping at 4.0%, and semiconductors and related equipment at 3.1%. Other sectors with upward revisions in operating profit forecasts compared to a month ago include durable consumer goods (2.6%), maritime transportation (2.6%), game software (2.2%), securities (2.2%), and bio (1.5%).

Kim Dae-jun, a researcher at Korea Investment & Securities, analyzed, "Now is the time to focus more on corporate earnings changes rather than macroeconomics. The fact that KOSPI net profit forecasts are being revised upward consecutively is positive, with IT, especially semiconductors handling high-bandwidth memory (HBM), leading the improvement in earnings outlooks. Following that, sectors such as finance and materials are also contributing to upward revisions."

Strong export performance supports expectations for Q2 earnings. According to the Korea Customs Service, exports from June 1 to 20 reached USD 35.8 billion, an 8.5% increase compared to the same period last year. May exports recorded USD 58.15 billion, up 11.7%, marking eight consecutive months of growth. Researcher Yang said, "Even just looking at exports, which can gauge earnings, April and May were strong, and June is continuing a good trend through mid-month," adding, "Looking at export performance by sector for April and May, sectors such as IT semiconductors, shipbuilding, cosmetics, and pharmaceuticals showed high growth rates, which roughly aligns with the positive earnings momentum calculated by reflecting sector-specific forecasts."

In particular, earnings forecasts for the leading semiconductor sector continue to be revised upward. SK Hynix’s Q2 operating profit consensus rose 8.4% from KRW 4.394 trillion a month ago to KRW 4.761 trillion. Samsung Electronics’ Q2 operating profit consensus was revised up 0.4% from KRW 8.2029 trillion a month ago. There are also expectations for further upward revisions in semiconductor sector forecasts. Yang Il-woo, a researcher at Samsung Securities, said, "While the EPS indices for IT hardware and semiconductors in major countries such as the U.S., Taiwan, and Japan are hitting record highs, Korea has yet to surpass the peak levels of 2017 and 2021," adding, "Considering the high operating leverage of Korean IT companies, further upward revisions of forecasts are possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)