"Criticism of Speculative Mentality Prevailing Due to Low Capital and High Guarantee Structure"

A national research institute has suggested reforming the low-capital, high-guarantee structure by raising the equity ratio of real estate project financing (PF) projects from the current 3% to 30-40%, which is the level of advanced countries.

According to the report titled 'Galapagos-style Real Estate PF, Fundamental Structural Improvement Needed' published by the Korea Development Institute (KDI) on the 20th, the project operator invests only 3% of the total project cost as equity and finances 97% through debt to carry out PF projects.

Analyzing the financial structures of about 300 PF projects worth a total of 100 trillion won carried out over the past three years (2021-2023), the average total project cost per project was 374.9 billion won, but the operator invested only 11.8 billion won (3.2%) of equity and covered 96.8%, or 363.1 billion won, with borrowed money. In contrast, the equity ratios in the U.S. were 33%, and major advanced countries such as Japan (30%), the Netherlands (35%), and Australia (40%) maintained levels of 30-40%.

The report pointed out, "In Korea, loans are made because construction companies that win construction contracts from operators with small equity guarantee the PF loans," adding, "This low-capital, high-guarantee structure causes the operators to become small-scale, triggers 'blind investments' due to high profitability relative to invested capital, and leads to deterioration in project feasibility assessments."

Hwang Sun-joo, the research fellow who authored the report, noted, "When defaults occur, small operators have already failed and disappeared," and added, "The construction companies that provided guarantees must repay the loans; some large construction companies may survive, but others collapse like Taeyoung Construction." He argued that the equity ratio should be raised to the level of major advanced countries, third-party guarantees such as those from construction companies should be abolished, and capital expansion regulations are necessary to achieve this. As a regulatory method, he proposed that financial institutions should set aside more loan loss provisions when the equity ratio is lower while supplying PF loans.

In fact, in the U.S., if the project operator does not invest at least 15% equity relative to the total project value, the loan for that project is classified as a 'high-risk commercial real estate' loan, and banks are regulated to set aside 1.5 times more loan loss provisions (or bank capital) compared to general corporate loans.

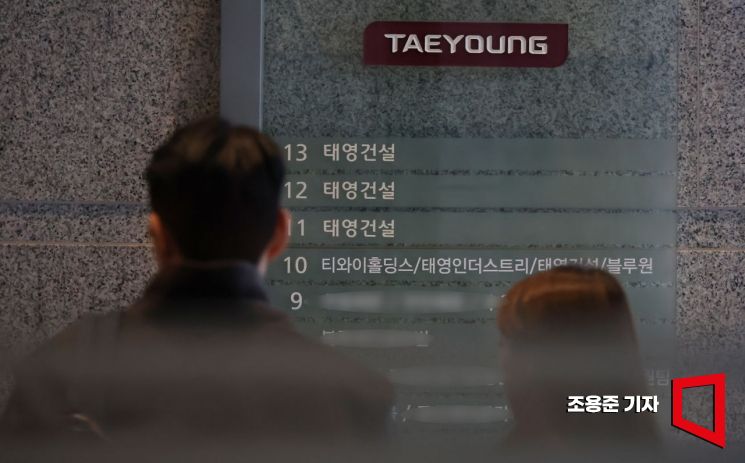

On the 11th, when the fate of Taeyoung Construction, which applied for a workout (corporate restructuring) after failing to repay real estate project financing (PF) loans worth about 9 trillion won, is decided, employees are arriving at Taeyoung Construction in Yeongdeungpo-gu, Seoul. Photo by Jo Yongjun jun21@

On the 11th, when the fate of Taeyoung Construction, which applied for a workout (corporate restructuring) after failing to repay real estate project financing (PF) loans worth about 9 trillion won, is decided, employees are arriving at Taeyoung Construction in Yeongdeungpo-gu, Seoul. Photo by Jo Yongjun jun21@

There was also a suggestion to actively utilize Real Estate Investment Trusts (REITs), which are indirect real estate investment companies. REITs are already subject to equity ratio regulations and have an obligation to offer more than 30% of their shares to the general public subscription, which has the advantage of sharing development profits with the public.

During the transitional phase toward this direction, support policies should be introduced to encourage operators to either expand their own capital or attract equity investors.

In the U.S., there is the 'LIHTC' system that provides tax benefits when operators increase housing supply for low-income groups through housing development projects. Operators share 'tax credits' with equity investors, making it easier to attract them.

Additionally, the U.S. operates the 'UpREIT' system, which defers capital gains tax on land when it is contributed in kind to a REIT. In Japan, large banks transfer their held assets to REITs and manage financing and asset management through a 'sponsor REIT' system, promoting the enlargement of REITs, and have also partially relaxed the separation of banking and commerce. This allows banks to develop real estate they hold for leasing purposes when requested by local communities.

Research fellow Hwang emphasized, "Also, establishing a comprehensive real estate PF database (DB) is a very important task," adding, "Real estate PF lacks sufficient financial data and project feasibility information for each project site."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.