'Best Practices for Supporting Virtual Asset Transactions' Final Steps

Authorities Encourage Self-Regulation to Induce 'Bad Coin' Self-Correction

False Information Circulates on Communities and SNS... Altcoin Types ↓

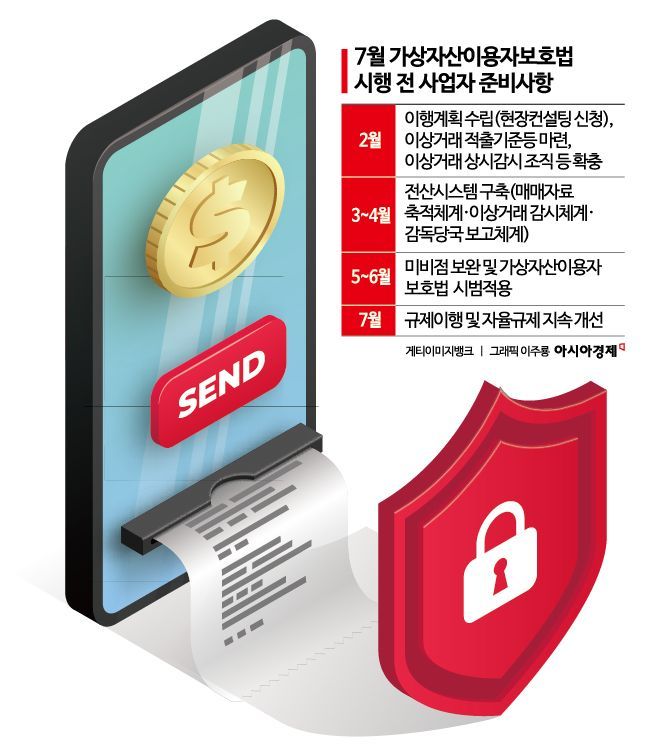

The 'Best Practices for Exchange Trading Support' that will determine the fate of over 600 domestic virtual assets is expected to be unveiled as early as next week. In line with the implementation of the 'Virtual Asset User Protection Act (Virtual Asset Act),' the first comprehensive law for the virtual asset industry, on the 19th of next month, unqualified 'bad coins' will be removed through self-regulation. Rumors of mass delisting have circulated on online communities and social networking services (SNS), temporarily increasing the price volatility of altcoins (virtual assets excluding Bitcoin).

According to the virtual asset industry on the 19th, the Digital Asset Exchange Joint Council (DAXA), together with the virtual asset industry and the Financial Supervisory Service, plans to announce the 'Best Practices for Virtual Asset Trading Support' as early as next week, and no later than early July.

This best practice was prepared with the support of financial authorities. Currently, virtual asset exchanges do not apply unified listing standards, causing confusion among investors. For example, 'Wemix,' which was delisted from major exchanges in December 2022 due to violations of circulation disclosure, was quietly relisted within just one year. However, contrary to some reports, the authorities will not act as the decision-maker for trading support. Trading support matters are not specified in the Virtual Asset Act, which is a primary law, so the authorities have no regulatory authority over them. The 'Report on the Implementation of Supplementary Opinions on the Virtual Asset User Protection Act' submitted to the National Assembly's Political Affairs Committee in May also includes that 'the financial authorities will support exchanges in establishing unified listing standards and internal control standards.'

After the Virtual Asset Act takes effect next month, 29 exchanges registered with the financial authorities, including five won-denominated market exchanges, must review whether to support trading of listed assets. Initially, the maintenance of trading support will be reviewed over six months, and thereafter, reviews will be conducted every three months. Currently, major exchanges have separate review and resolution bodies for support. Through monitoring based on the common criteria for designation of cautionary assets and termination of trading support established by DAXA, decisions are made on designating cautionary assets or terminating trading support (delisting). Upbit, the leading exchange in the domestic market, specifies 15 items as reasons for designation of cautionary assets or termination of trading support, including compliance with laws and regulations, security vulnerabilities, and the credibility of the issuer.

The market expects that unqualified assets will be gradually removed from exchanges due to strengthened regulations. According to the Financial Intelligence Unit (FIU) under the Financial Services Commission, the total number of virtual asset items listed on 22 domestic virtual asset exchanges in the second half of 2023 is about 600 (excluding duplicate listings). This is a decrease of 22 items (3.5%) compared to the first half of last year. Since the best practices have not yet been announced, it is expected that a 'sorting of wheat from chaff' will be possible after the announcement. A DAXA official stated, "We are finalizing the best practices for trading support prepared with the support of the authorities and will announce them soon."

It is observed that the recent increase in volatility of altcoins reflects such anxiety. This is a learning effect from some assets being delisted before the enforcement of the 'Specific Financial Information Act (Special Act)' in 2021. In fact, on major online communities, unverified anonymous posts such as 'Upbit's 40 cautionary assets will be disclosed' have been posted with specific asset names. The price volatility of altcoins has also increased. As of 5 p.m. on the 18th, among digital assets listed on Upbit, only two virtual assets have risen in the past week. More than 50 assets are recording declines of 20-30%. An Upbit official responded, "There is no verified information regarding this matter, so it is difficult to provide specific guidance." Some investors have posted verified messages stating, "I have filed complaints with the authorities regarding posts falsely listing delisting candidates."

A virtual asset industry insider said, "Before the enforcement of the first virtual asset regulation law, the Special Act, some coins were delisted," adding, "However, since the authorities are not directly involved in trading support and have announced a six-month review period, it is unlikely that a large number will be delisted all at once." Another industry insider said, "Altcoins are light and thus inherently volatile," but added, "Given the uncertainty of U.S. benchmark interest rates and the lack of positive factors to offset the implementation of the Virtual Asset Act in July, caution is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.