Amendments to Protect and Support Small Business Owners

Multiple Bills Proposed in the Past Month

Concerns Raised Over 'Temporary Fix' Measures

As one in five restaurant operators in Seoul go bankrupt and the delinquency rate among sole proprietors soars, raising concerns about a crisis among self-employed individuals, the National Assembly is moving to ease their loan burdens. However, there are criticisms that extending loan repayment periods or deferring loan repayments without fundamental solutions is a short-sighted measure.

According to the National Assembly's legislative information system on the 19th, Song Ki-heon, a member of the Democratic Party of Korea, recently introduced the "Partial Amendment to the Act on the Protection and Support of Small Business Owners." The bill aims to allow small business owners who have difficulty repaying loans received from the Small Enterprise and Market Service to repay in "long-term installments" and to defer lump-sum repayments for closed small business owners.

A similar amendment was proposed by Min Byung-duk of the same party on the 7th. The core of this amendment is to allow the extension of repayment periods and deferral of repayments under Article 22-2 of the Act on the Protection and Support of Small Business Owners to be done through "long-term installment repayment." If a borrower requests an extension of the repayment period, they can repay in long-term installments over a period determined by presidential decree, which can be 10 years or more.

Oh Se-hee, a former president of the Korea Federation of Small and Medium Business and a Democratic Party lawmaker, even introduced a special act for small business owners. The "Special Financial Support Act for Debt Reduction of Small Business Owners," proposed by Oh on the 13th, focuses on reducing the financial burden of small business owners, including debt restructuring by financial institutions. The current Act on the Protection and Support of Small Business Owners limits extensions and deferrals to policy funds. This bill explicitly states that, in addition to long-term installment repayment of policy funds, loans from commercial banks and other financial companies to small business owners can also be subject to debt restructuring measures such as extension of repayment periods, deferral, long-term installment repayment, and interest reduction.

Similar voices have emerged from the ruling party. On the 17th, Hwang Woo-yeo, emergency committee chairman of the People Power Party, urged at a committee meeting, "The government should consider measures to partially defer interest payments under the current high-interest rate situation so that when interest rates fall later, the interest can be repaid then, or to allow deferral of principal repayment even if the system requires lump-sum repayment of principal and interest."

These calls are backed by the recent surge in self-employed business closures and delinquency rates. According to OpenUp, a big data commercial district analysis platform by fintech company Finda, the restaurant closure rate in Seoul last year was 18.99%. This is a 3 percentage point increase from the previous year (15.99%). Last year's closure rate was even higher than the 2020 rate (18.89%), when the COVID-19 pandemic began. (▶Refer to our June 5 front-page article)

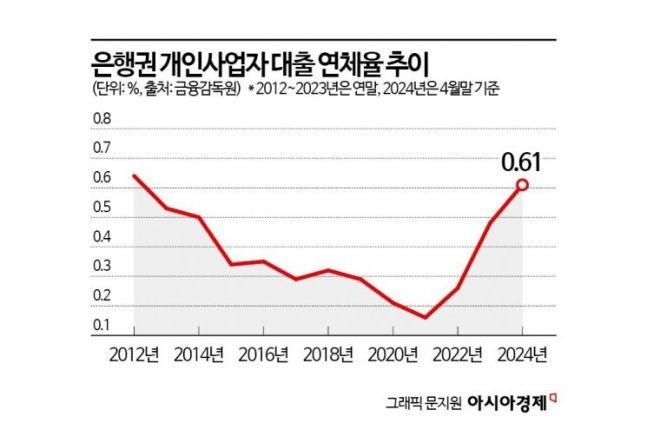

The delinquency rate among self-employed individuals also reached its highest level in 11 years. According to the Financial Supervisory Service, as of the end of April, the delinquency rate on personal business loans at domestic banks was 0.61%, up 0.07 percentage points from the previous month (0.54%) and surged 0.2 percentage points year-on-year. The delinquency rate exceeding 0.6% was last seen in late 2012 (0.64%), 11 years and 4 months ago. The rise in delinquency rates is due to an increasing number of sole proprietors unable to repay debts on time amid high interest rates and inflation.

However, some voices express concern that deferring loan repayments without fundamental solutions is a "stopgap" measure that could lead to moral hazard. They advise that it is necessary to prepare measures that enable self-employed individuals to sustain themselves through practical effect analyses. Seo Ji-yong, a professor in the Department of Business Administration at Sangmyung University, said, "Simply deferring repayments and extending loans is a short-sighted measure. Support should not be extended unconditionally with government funds; an effect analysis is necessary." He added, "The government could also consider lowering interest rates by linking with private finance through government guarantees."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)