Significant Increase Since COVID-19 Period Maintained

Delinquency Rate Also Rising

Concerns Over High Interest Rates, High Exchange Rates, and Real Estate PF Defaults

Potential Link to Real Economy Contraction

"Repayment Ability↓ Expect Expansion of Defaults Centered on Vulnerable Companies"

Corporate loans by banks have been continuously increasing since the COVID-19 pandemic, and delinquency rates have also risen accordingly. There is an analysis that risks arising from the deterioration of financial soundness in real estate project financing (PF) could spill over into other financial sectors, necessitating market monitoring and preparation for such scenarios.

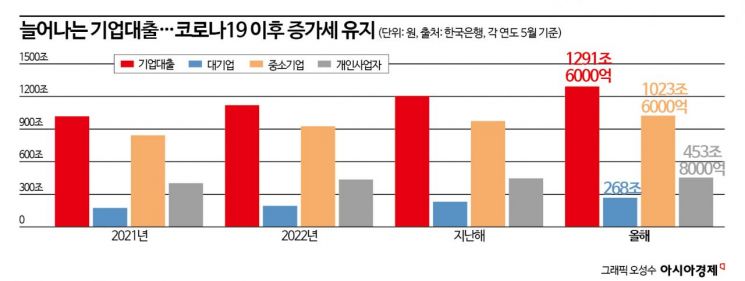

According to statistics from the Bank of Korea, the balance of corporate loans (based on deposit banks) in May this year was 1,291.6 trillion KRW. This is an increase of 87.1 trillion KRW compared to last year. Loans to large corporations amounted to 268 trillion KRW, while loans to small and medium-sized enterprises (SMEs) reached 1,023.6 trillion KRW. These figures represent increases of 37 trillion KRW and 50.1 trillion KRW respectively compared to the previous year. Among SME loans, loans to individual business owners increased by 7.8 trillion KRW from last year to 453.8 trillion KRW.

Corporate loans have increased significantly since the COVID-19 pandemic. From May 2021 to May 2022, corporate loans increased by 102.1 trillion KRW, the largest increase over a six-year period (from 2018 to this year). The growth trend has not significantly slowed since the increase in 2022. Looking at the statistics from May 2018 to May this year, the annual increase, which had remained around 42.5 trillion KRW during 2018-2019, rose to 87.1 trillion KRW from last year to this year. By industry, the average increase was largest in loans to large corporations (approximately 80 trillion KRW), followed by individual business owners, who increased by an average of 62 trillion KRW annually.

Delinquency rates are also rising. According to the Financial Supervisory Service, the lowest delinquency rate for won-denominated loans since 2019 was in December 2021 (0.21%). The delinquency rate in April this year was 0.48%, up 0.27 percentage points. The delinquency rate for corporate loans (as of December 2021) has increased more sharply, rising from 0.26% to 0.54%, an increase of 0.28 percentage points. In particular, delinquency rates for SMEs (0.66%) and individual business owners (0.61%) rose by 0.39 percentage points and 0.45 percentage points, respectively.

Despite the rapid increase in corporate loans, economic conditions have deteriorated, increasing vulnerabilities in the financial market. According to the “Analysis of Recent Corporate Financial Market Characteristics and Risk Factors” published by the KDB Future Strategy Research Institute, while other countries have seen a slowdown in corporate credit growth due to monetary tightening, Korea’s growth has continued. The global corporate credit growth in 2019 was 4.8 trillion USD (approximately 6,635.52 trillion KRW), while Korea’s growth was 45 trillion KRW. Globally, the increase slowed from 8.1 trillion USD between 2020 and 2021 to 1.8 trillion USD after monetary tightening. However, Korea’s corporate credit increased from 93 trillion KRW to 99 trillion KRW during the same period, even after monetary tightening.

The research institute analyzed that during the COVID-19 period, various financial policies supporting companies led to increased borrowing from banks. Subsequently, as conditions for issuing corporate bonds worsened, companies found it difficult to raise funds directly from financial markets, resulting in increased corporate loans. Additionally, unfavorable conditions such as high interest rates, high exchange rates, delayed economic recovery, and concerns over real estate PF defaults have persisted, increasing corporate financial risks. The institute emphasized, “With domestic companies’ growth and profitability not yet recovered, the burden of financial costs is likely to lead to contraction in the real economy, including private consumption and investment.” It warned, “Especially, a deterioration in corporate debt repayment ability is expected to expand defaults centered on vulnerable companies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.