From July, Stress Interest Rate Reflection Ratio Increases from 25% to 50%

Household Debt Rises by 11 Trillion Won in April-May Ahead of System Strengthening

Financial Authorities Hold Consecutive Meetings and Face-to-Face Engagements with Financial Sector

Kwon Dae-young, Financial Services Commission Secretary-General, Urges "Establishment of Stable Lending Practices"

Lee Bok-hyun, Financial Supervisory Service Chief, Warns of Potential Acceleration in Household Debt Growth

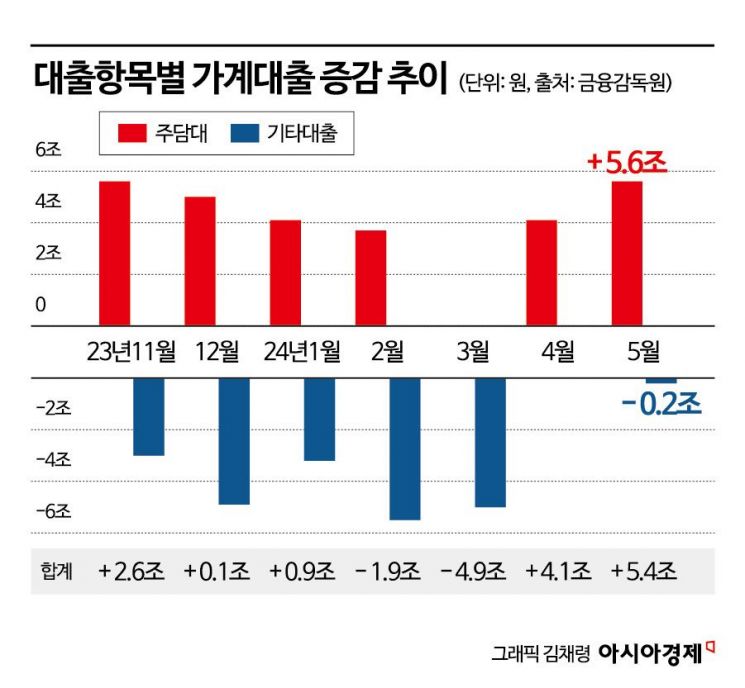

With the application of the second phase of the stress Debt Service Ratio (DSR) scheduled for July, financial authorities are continuing face-to-face engagements such as inspection meetings and briefings with the financial sector. Household loans saw a significant increase in May following a sharp rise in April, and the outstanding balance of household loans in the banking sector is approaching a record high of 1,110 trillion won, raising renewed concerns about household debt management.

According to financial authorities and the financial sector on the 14th, from July, the stress interest rate reflection ratio for household loans will increase from the current 25% to 50%, raising the loan threshold further. The application, which was previously limited to mortgage loans in the banking sector, will be expanded next month to include bank credit loans and second-tier financial sector mortgage loans. The DSR refers to the ratio of loan principal and interest payments to annual income. When limiting the ratio of loan principal and interest payments to annual income, the higher the interest rate, the lower the amount that can be borrowed. The stress DSR system raises the loan threshold by applying an additional interest rate called the 'stress interest rate' on top of the existing rate.

The stress interest rate is determined by comparing the highest weighted average monthly household loan interest rate over the past five years (based on Bank of Korea data) with the current interest rate. A minimum of 1.5% and a maximum of 3% cap are applied: if the difference between past and current rates is less than 1.5 percentage points, the stress interest rate is set at 1.5 percentage points; if the difference is between 1.5 and 3 points, the stress interest rate equals that difference; if the difference exceeds 3 percentage points, the stress interest rate is capped at 3%. Currently, the stress interest rate is 1.5 percentage points. In the first half of this year, when the first phase of the stress DSR system was implemented, 0.38 percentage points, which is 25% of the 1.5% stress interest rate, was added to the loan interest.

From July, this additional interest rate will be raised to 0.75% (tentative), which is 50% of the stress interest rate. For a borrower with an annual income of 100 million won using a variable-rate mortgage loan with a 30-year principal and interest repayment plan, the loanable amount will decrease to about 600 million won from 660 million won before the DSR introduction. Furthermore, with bank credit loans and second-tier financial sector mortgage loans included in the stress DSR application, the loan burden is expected to increase further.

Ahead of the implementation of the second phase of the stress DSR system, financial authorities plan to closely monitor household debt balances and continue face-to-face contact with the financial sector. Internally, they have ordered strengthened monitoring. This is because household loan demand, which began to increase from April amid growing expectations of a policy pivot by the European Central Bank (ECB), could fluctuate ahead of the expansion of the stress interest rate. Additionally, factors such as the easing of policy mortgage requirements, recovery in real estate transactions, and tax reform discussions in the second half of the year are expected to stimulate household debt.

According to the Bank of Korea’s financial market trends report for May, released on the 12th, the outstanding balance of bank household loans increased by 6 trillion won from April to 1,109.6 trillion won. The household loan balance, which had sharply increased due to seasonal effects and the upcoming full implementation of the stress DSR, seemed to decline in March compared to the previous month but returned to an upward trend with a 5 trillion won increase in April and another 6 trillion won increase in May. This is the highest increase in seven months.

Kwon Dae-young, Secretary General of the Financial Services Commission, is announcing the future policy direction for an orderly soft landing of real estate PF at the Government Seoul Office in Jongno-gu, Seoul on the 13th. Photo by Jo Yong-jun jun21@

Kwon Dae-young, Secretary General of the Financial Services Commission, is announcing the future policy direction for an orderly soft landing of real estate PF at the Government Seoul Office in Jongno-gu, Seoul on the 13th. Photo by Jo Yong-jun jun21@

In response, the Financial Services Commission convened the five major commercial banks on the day the Bank of Korea announced the household loan statistics to review household debt. It is reported that they thoroughly examined the recent household loan situation and risk factors for household debt in the second half of the year. Kwon Dae-young, the Secretary-General who chaired the meeting, evaluated that household loans have been managed stably this year but emphasized, "Since the household debt ratio remains high compared to major countries, household debt must be consistently and stably managed," and urged, "Borrow only what you can repay and establish a loan practice of repaying in installments from the start." He also added, "The financial sector should ensure that loans are handled at the frontline with consideration of the borrower's repayment ability."

The Financial Supervisory Service (FSS) also held a financial situation review meeting on the 13th, chaired by FSS Governor Lee Bok-hyun, ordering the implementation of tasks to improve household debt-related systems. Governor Lee stressed, "Since the previously stable increase in household debt may accelerate due to interest rate cuts and expectations of a housing market recovery, please ensure the smooth implementation of the announced system improvement tasks to manage the annual household debt growth rate within an appropriate range."

Governor Lee plans to hold an official briefing with the heads of 17 banks on the 18th at the Bankers Association building in Myeong-dong, Seoul. The agenda is expected to include key issues such as project-specific evaluations and strengthened post-management for real estate project financing (PF) restructuring, the introduction of accountability structures, and household debt management.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.