Analysis of the Impact of Subsidies on Cost Competitiveness

As major countries around the world compete to introduce support policies for building domestic semiconductor production bases, opinions have emerged that investment in facility expansion is essential for South Korea to maintain its semiconductor supply capacity and market dominance. There are also claims that government subsidies are necessary for this purpose.

On the 13th, the Korea Chamber of Commerce and Industry and Deloitte Anjin Accounting Firm analyzed data from Korea Credit Rating and released a report titled "Policy Tasks for Enhancing Semiconductor Supply Capacity and Cost Competitiveness" containing these findings.

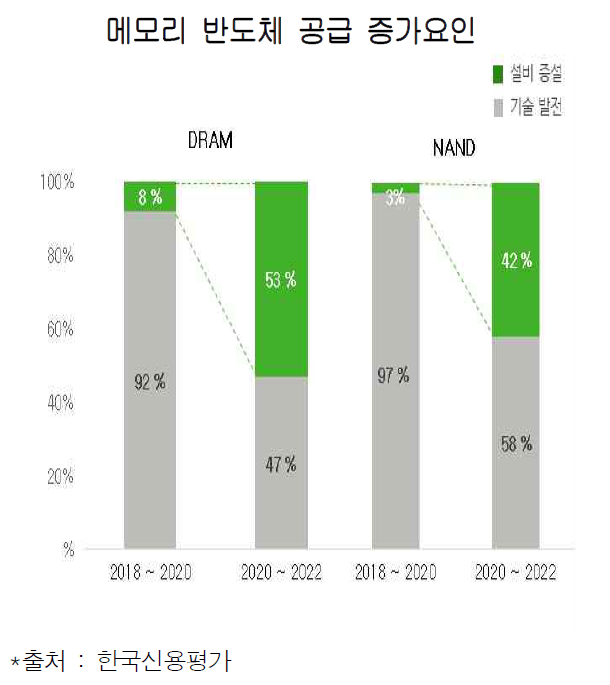

According to the report, among the three major memory semiconductor companies?Samsung Electronics, SK Hynix, and US-based Micron?the share of 'facility expansion' as a factor in DRAM supply growth increased from 8% (2018?2020) to 53% (2020?2022). In contrast, the share of 'technological advancement' during the same period decreased from 92% to 47%. The same trend was observed in NAND flash. The share of facility expansion in supply growth rose from 3% to 42%, while the contribution of technological advancement declined from 97% to 58%.

Based on these results, the report explained, "Due to the increasing difficulty of miniaturization in advanced processes and approaching physical limits, expanding supply capacity through facility expansion has become a more critical factor than technological advancement in securing semiconductor production capabilities," adding that "ultimately, large-scale capital investment and securing funding for line expansion will become increasingly important." It further analyzed, "This is also the reason why major countries worldwide are pouring astronomical subsidies and why discussions about the necessity of subsidies are emerging domestically."

The report also included an analysis of the impact of semiconductor subsidies on cost competitiveness. It found that if semiconductor facility investment subsidies are provided at 30% of the total investment amount, there could be up to a 10% cost reduction in semiconductor production. This effect arises from a decrease in depreciation expenses, which account for a significant portion (around the mid-40% range) of operating costs due to the characteristics of the equipment industry.

For example, the operating cost to produce one wafer in the 3-nanometer foundry process is $11,459. If a subsidy amounting to 30% of the facility investment is received, the depreciation expense?which accounts for 46% of operating costs?would decrease from $5,271 before the subsidy to $3,690 after the subsidy. In this case, the company’s operating profit increases by the amount of the depreciation reduction ($1,581), resulting in an additional corporate tax payment of $417. Due to the subsidy, the company’s operating costs decrease, and the government collects additional corporate tax revenue.

The report emphasized, "Ultimately, the core of the semiconductor industry is production capacity and cost competitiveness," and stressed that "helping to realize 'economies of scale' early through facility investment subsidies is most important." In fact, major countries are already providing astronomical subsidies. The United States provides $39 billion, the European Union (EU) €43 billion, and Japan ?2 trillion in subsidies for production facilities, but there is no related subsidy system domestically.

Kim Mun-tae, head of the Industrial Policy Team at the Korea Chamber of Commerce and Industry, said, "To accelerate the achievement of 'economies of scale' within semiconductor production companies, expand global market dominance, and achieve technological innovation in the value chain, it is necessary to strengthen more direct support measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.