Q1 Coffee Franchise Usage Rate Down 5.4% Compared to 2022

Low-Cost Coffee Emphasizing Cost-Effectiveness Increases by 21.3%

Recently, amid the impact of high inflation, the usage rate of coffee franchises has been declining. However, so-called 'low-priced coffee' franchise companies are expanding their influence in the market based on price competitiveness, boosting both their performance and usage rates.

According to market research firm Embrain on the 14th, the usage rate of coffee franchises in the first quarter of this year decreased by 5.4% compared to the same period in 2022. As the high inflation trend continues, the burden of dining out has increased, and the rise in raw material costs has led coffee franchise companies to raise prices, which is believed to have contributed to the decline in usage rates. In fact, international coffee bean prices have tripled over the past four years, raising concerns that the trend of food and beverage price increases is shifting to coffee specialty stores.

Although the usage rate of coffee franchises is decreasing, there are clear differences in usage patterns depending on the franchise characteristics. High-priced franchises, where coffee prices are relatively expensive, show a marked decrease in usage rates, whereas coffee franchises known as low-priced brands increased by 21.3% compared to the same period in 2022. With the recent impact of high inflation, consumers who prioritize cost-effectiveness are increasing, making low-priced coffee a reasonable choice. Generally, brands that sell their signature menu item, Americano, for under 2,000 KRW are considered low-priced coffee.

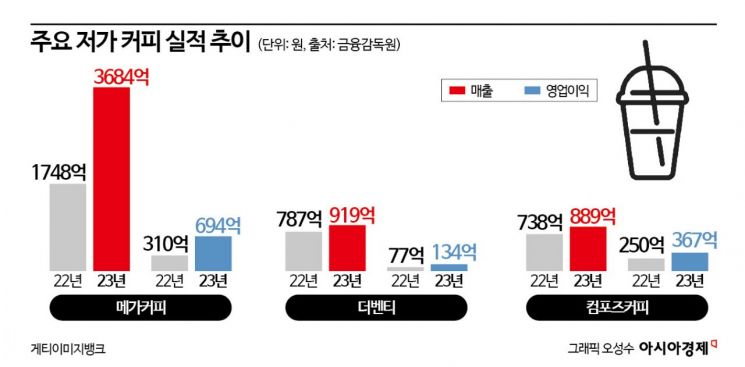

In fact, low-priced coffee franchises have recently produced positive results in terms of performance through aggressive store expansion. Mega MGC Coffee (Mega Coffee), which recently surpassed 3,000 stores, is a representative example. Mega Coffee, which started by opening its Hongdae branch in 2015, increased its number of stores to 3,038 as of the 5th of this month. According to the Financial Supervisory Service, the operating company of Mega Coffee, Anhouse, recorded sales of 368.4 billion KRW last year, a 110.7% increase from 174.8 billion KRW the previous year. Operating profit also rose 124.1%, from 31 billion KRW to 69.4 billion KRW during the same period.

Besides Mega Coffee, Compose Coffee's sales last year reached 88.9 billion KRW, up 20.5% year-on-year, and operating profit increased 46.8% to 36.7 billion KRW, resulting in an operating profit margin of 41.3%. Compose Coffee, which opened its first store in 2014, surpassed 2,500 stores in March after 10 years. Additionally, S&C Sain, which operates The Venti, showed a sharp upward trend with sales of 91.9 billion KRW and operating profit of 13.4 billion KRW last year, increasing 16.8% and 74.0% respectively compared to the previous year.

On the other hand, Starbucks Korea (SCK Company) has seen sales increase every year, earning it the nickname of a profitable subsidiary of E-Mart, but its operating profit has not significantly improved. Starbucks Korea posted sales of 2.9295 trillion KRW and operating profit of 139.8 billion KRW last year, up 12.9% and 14.2% respectively from the previous year. Although these results show improvement compared to the previous year, they are somewhat disappointing compared to expectations of surpassing 3 trillion KRW. In particular, the operating profit margin was 4.8%, a 0.1 percentage point increase from the previous year, but this is about half of the levels during the pandemic years of 2020 (8.5%) and 2021 (10.0%).

KG Hallis F&B, which operates Hollys Coffee, recorded sales of 143.7 billion KRW and operating profit of 9 billion KRW last year, increasing 5.7% and 5.4% respectively from the previous year, but these figures still fall short of the pre-COVID-19 levels in 2019, when sales were 164.9 billion KRW and operating profit was 15.4 billion KRW. Coffee Bean Korea also saw a slight increase in sales to 158 billion KRW last year from 153.5 billion KRW the previous year, but operating profit declined to 1.5 billion KRW from 2.5 billion KRW a year earlier. However, Twosome Place's sales rose 12.1% to 480.1 billion KRW last year, and operating profit increased 19.3% to 26.1 billion KRW. This is attributed to CEO Moon Young-joo's specialized stores and unique menu enhancement strategies implemented since last year.

Meanwhile, reports have emerged that Starbucks is being shunned by consumers worldwide due to price increases and other factors. According to the British BBC, Starbucks' global sales in early this year decreased by 1.8% compared to the same period last year. In particular, in its largest market, the United States, sales at stores operating for at least one year dropped by 3%, marking the largest decline since the COVID-19 pandemic and the 2009 financial crisis. Among the customers who left Starbucks were its most loyal customers, the Starbucks Rewards members, who decreased by 4% compared to the previous quarter. BBC described this as a rare phenomenon.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)