Party and government: "Ban on short selling resumption until blocking system is fully established"

Institutions limited to 90-day repayment period for short selling loan transactions

Extension allowed only within 12 months

The People Power Party and the government extended the current short-selling ban until the end of March next year on the 13th. They also decided to limit the repayment period for short-selling loan transactions by institutional investors to 90 days, the same as individuals, and even if extended, repayment must be made within 12 months.

Jung Jeom-sik, chairman of the People Power Party's Policy Committee, said at a press briefing held after the civil-party-government consultation meeting on "Improving the Short-Selling System to Establish Market Order" that "based on the direction for improving the short-selling system announced at the civil-party-government consultation meeting last November, we finalized the 'Short-Selling System Improvement Plan' after a public discussion process."

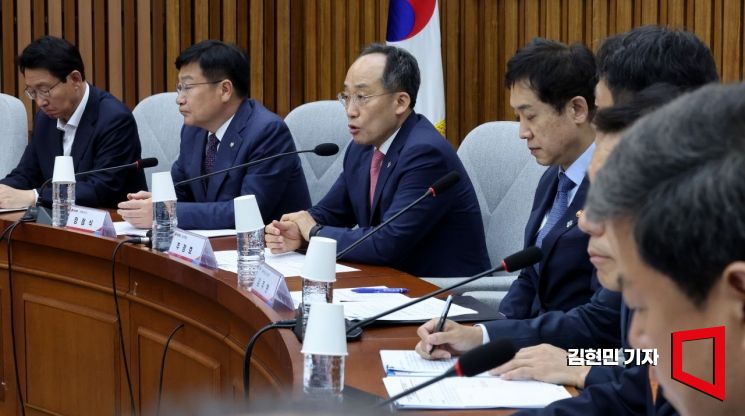

Chu Kyung-ho, floor leader of the People Power Party, is speaking at the 'Improvement of the Short Selling System for Market Order Establishment' public-private consultation held at the National Assembly on the 13th. Photo by Kim Hyun-min kimhyun81@

Chu Kyung-ho, floor leader of the People Power Party, is speaking at the 'Improvement of the Short Selling System for Market Order Establishment' public-private consultation held at the National Assembly on the 13th. Photo by Kim Hyun-min kimhyun81@

At the meeting, the civil-party-government agreed to fully lift the short-selling ban starting from the second quarter. This coincides with the completion of the Korea Exchange's Illegal Short-Selling Central Blocking System (NSDS) to prevent naked short-selling. Once the NSDS is established, it will conduct a full inspection of illegal short-selling by institutional investors within three days and verify the validity of the internal balance management system within institutions. Going forward, not only institutional investors but all corporate investors must establish and operate internal control standards to prevent naked short-selling. Securities firms will also be subject to the same rules, and only verified institutional and corporate investors will be allowed to place short-selling orders.

Additionally, the meeting decided to extend the repayment period for short-selling loan transactions by institutional investors to 90 days, the same as individuals, allowing extensions up to four times but limiting the maximum repayment period to 12 months. To improve individual investors' access to short-selling, the cash collateral ratio for lenders will also be uniformly applied at 105%, down from the current 120%.

The civil-party-government also significantly strengthened penalties and sanctions to strictly punish illegal short-selling. Fines for illegal short-selling will be increased from the current 3 to 5 times the amount of unfair profits to 4 to 6 times, and criminal penalties will be substantially enhanced to allow imprisonment depending on the scale of unfair profits. Furthermore, restrictions on trading financial investment products, limitations on executive appointments, and account suspension will be introduced for short-selling traders.

The civil-party-government agreed to actively promote the preparation and passage of related bills within this year. Chairman Jung emphasized, "We will introduce restrictions on trading financial investment products, limitations on executive appointments, and account suspension for illegal short-selling traders," adding, "Today's civil-party-government consultation will be the starting point for fundamentally improving the short-selling issue and establishing market order."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.