American consumers' expected inflation rate over the next five years has jumped back into the 3% range. However, the one-year expected inflation rate slightly eased from the low 3% range. Optimism that the U.S. New York stock market will rise further in one year reached its highest level in three years.

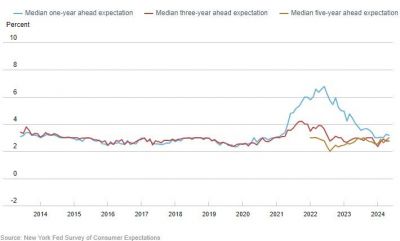

According to the May consumer outlook survey released on the 10th (local time) by the New York Federal Reserve Bank, the median five-year expected inflation rate, which indicates long-term inflation expectations, was 3.0%. This is a 0.2 percentage point increase from the previous month (2.8%). Following a rising trend from 2.6% in March, this reflects consumers' concerns about entrenched high inflation. This is the first time since August last year that the five-year expected inflation rate has recorded a figure in the 3% range in the monthly survey.

In this survey, the three-year expected inflation rate was 2.8%, unchanged from the previous month. The one-year expected inflation rate slightly decreased from 3.3% to 3.2%. Fox Business News reported, "It still far exceeds the inflation target of 2%," adding, "Consumers expect high inflation to persist." Previously, the Fed had forecasted through economic outlooks that inflation would fall to 2.1% by 2025 and stabilize around 2% in 2026.

Notably, the survey results drew attention as they were released ahead of the U.S. Federal Reserve's monetary policy decision. At the June Federal Open Market Committee (FOMC) meeting scheduled for June 11-12, the Fed is expected to keep the current interest rate at 5.25-5.5% while raising the dot plot, which reflects officials' rate cut projections. Since the end of last year, the Fed has hinted at three rate cuts this year through the dot plot, but recent concerns about a rebound in inflation may lead to a downgrade to one or two cuts, or even zero cuts.

In this survey, American consumers were also optimistic about the labor market. The average probability of losing a job within the next 12 months dropped by 2.7 percentage points to 12.4% compared to the previous month. This is below the 12-month trailing average of 13.2%. The probability of voluntarily leaving a current job within the next 12 months rose slightly from 19.4% to 19.6%. The probability of finding a new job if one loses their current job increased by 1.3 percentage points to an average of 52.5% compared to the previous month.

Perceptions of household financial conditions also improved. The number of respondents who said they were better off than a year ago increased. Expectations compared to the previous year also improved. The proportion of respondents who expected their financial situation to remain the same or improve over the next 12 months rose to 78.1%, the highest since June 2021.

Along with this, optimism about the U.S. stock market reached its highest level since May 2021. The expectation that stock prices will rise in one year averaged 40.5%, up 1.8 percentage points from the previous month. Bloomberg reported that this optimism "was broadly seen across most age groups, education levels, and regions," adding that "the major indices of the U.S. New York stock market hitting record highs helped household net worth reach an all-time high in the first quarter, and stock prices continued their rally thereafter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.