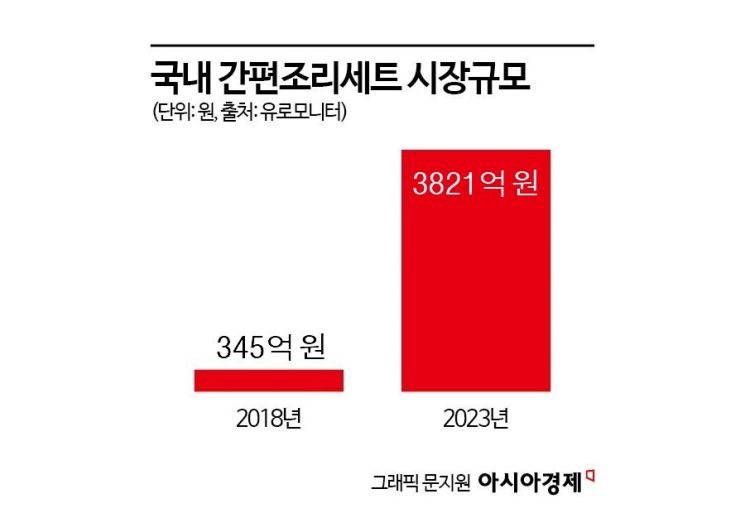

Last Year's Meal Kit Sales Reach 382.1 Billion KRW

Expanded 10 Times in 5 Years Since 2018

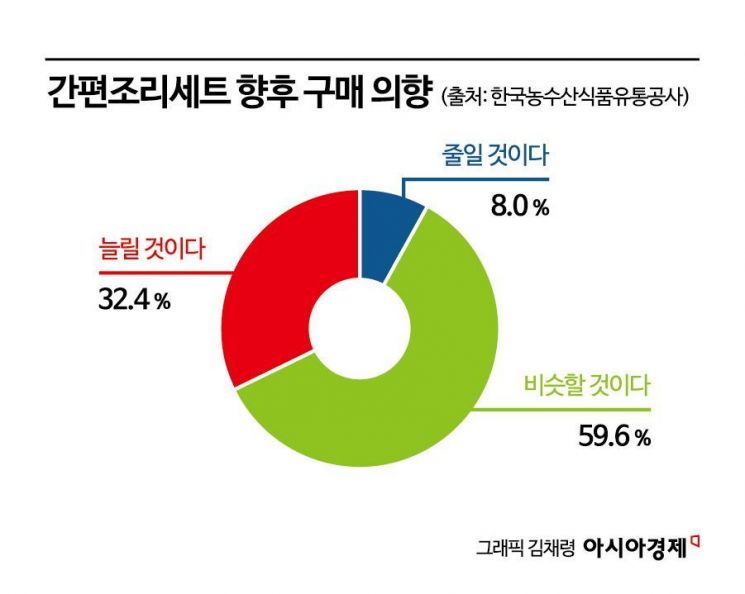

32% of Consumers Plan to Increase Meal Kit Purchases

The domestic meal kit market has grown more than tenfold in five years. The surge in meal kit demand, driven by the increase in dual-income and single-person households, has accelerated recently as dining-out demand declined due to persistent high inflation over the past few years. Meal kits reduce the time, effort, and cost required for meal preparation and are easily purchasable through large supermarkets and dawn delivery services, leading to forecasts of continued market growth.

According to global market research firm Euromonitor on the 10th, last year the domestic ready-to-cook set (meal kit) market size was recorded at 382.1 billion KRW. This marks a growth of more than ten times from 34.5 billion KRW in 2018 over five years. The meal kit market has continued its growth trend with ▲101.7 billion KRW in 2019 ▲188.2 billion KRW in 2020 ▲300.3 billion KRW in 2021 ▲340.8 billion KRW in 2022.

Dining-out prices soaring... Home meal demand shifts to meal kits

The expansion of the meal kit market is closely linked to the increase in one- to two-person households and dual-income families. Meal kits consist of unprocessed, prepped ingredients and processed foods with the exact quantities of ingredients and seasonings needed for cooking, attracting those who find it difficult to spend time, effort, and money on meal preparation.

Recently, as dining-out prices have soared, the demand for home-cooked meals to reduce food expenses continues to rise. According to the National Statistical Portal of Statistics Korea, last month’s dining-out price inflation rate was 2.8%, 0.1 percentage points higher than the overall consumer price inflation average of 2.7%. This marks 36 consecutive months since June 2021 where dining-out price inflation has exceeded the average consumer price inflation rate.

An official from the Korea Agro-Fisheries & Food Trade Corporation explained, "The relatively affordable price compared to dining out, simple cooking methods, and fresh ingredients provide various advantages, leading to a continuous increase in demand."

One in three plans to increase meal kit purchases... Market set to grow further

A consumer survey conducted by the Korea Agro-Fisheries & Food Trade Corporation found that the most common reason for purchasing meal kits was "more convenient than cooking from scratch (19.8%)." This was followed by "time-saving (18.2%)," "ability to have a high-quality meal relative to the time, effort, and cost of preparation (15.7%)," "to eat dishes difficult to prepare at home (12.4%)," and "to replace dining out (8.8%)."

Regarding purchase frequency, "once a week" was the highest at 27.8%, followed by "once every 2-3 weeks (25.9%)," "once a month (16.3%)," and "once every 4-6 days (11%)."

Looking ahead, 32.4% of consumers responded that they plan to increase their meal kit purchase frequency. The majority, 59.6%, intend to maintain a similar frequency, while only 8% said they would reduce purchases.

Consumers who plan to reduce meal kit purchases cited reasons such as "too expensive (19.5%)," "insufficient nutritional content (19.5%)," and "excessive packaging leading to food and packaging waste (9.8%)."

Peacock leads market share... 'Famous restaurant collaborations' ignite meal kit competition amid soaring dining prices

Currently, the top seller in the domestic meal kit market is Emart’s private brand Peacock. Peacock’s sales last year increased by 5% from the previous year to 420 billion KRW, more than 12 times its first-year sales of 34 billion KRW in 2013. Peacock’s market share is estimated at 30%. Including Peacock, retailer private brands such as Homeplus’s 'Signature,' Lotte Mart’s 'Yorihada,' and GS25’s 'Simply Cook' account for 60% of the total market. Following these are Fresh Easy with 11.9%, hy’s 'It’s On' with 8%, and CJ CheilJedang’s 'Cookit' with 4.5% market shares.

The recent competitive keyword is "famous restaurants." As high inflation shifts dining-out demand to home dining, companies are launching meal kits in collaboration with well-known restaurants to compete.

Homeplus sells over 120 ready meals in collaboration with famous restaurants. ‘Chaesundang Shabu-Shabu,’ launched in February last year, saw sales grow approximately 21% year-on-year as of March this year. ‘Hakoya Whole Cheese Pork Cutlet,’ introduced in May last year by the renowned pork cutlet brand Hakoya, surpassed cumulative sales of 260,000 units as of April 30. Emart partnered with ‘Kaden’ in Yeonhui-dong, a popular Japanese restaurant run by Chef Jeong Ho-young, favored by younger customers, to offer two popular menu items (Nagasaki Jjamppong Soup, Maze Udon) as meal kits.

Fresh Easy expanded collaborations beyond Korea, partnering with overseas famous restaurants. They launched two types of 'Nishimuramen Meal Kits' with 'Nishimuramen,' a famous fusion ramen restaurant in Japan. Nishimuramen is a well-known ramen spot in Fukuoka, Japan, beloved by locals and international travelers alike. The first branch in Korea opened in Yeonnam-dong, Seoul, in November last year.

An industry insider said, "With continuous price increases, the costs of dining out and purchasing ingredients are rising. Accordingly, the market for meal kits collaborating with famous restaurants, which guarantee verified restaurant-level taste, reasonable prices, and easy cooking methods, is expected to gradually expand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)