Since Surpassing 9% Last September, Exceeds 10% After 8 Months

Large Corporations' Loan Balance Increased by 18 Trillion This Year...More Than SME Loans

Large Corporations Prefer Bank Loans Over Corporate Bonds Amid Prolonged High Interest Rates

Financial Authorities' Soundness Pressure, Commercial Banks Compete in Large Corporate Loans

The proportion of large corporate won-denominated loans by the five major commercial banks has exceeded 10%. As the high-interest rate trend has prolonged, various soundness issues have emerged across the financial sector, and with financial authorities emphasizing risk management such as delinquency rates, this is interpreted as a result of continued business targeting large corporations. Large corporations also seem to prefer bank loans, which have started to fall below 5% interest rates, over unstable corporate bonds.

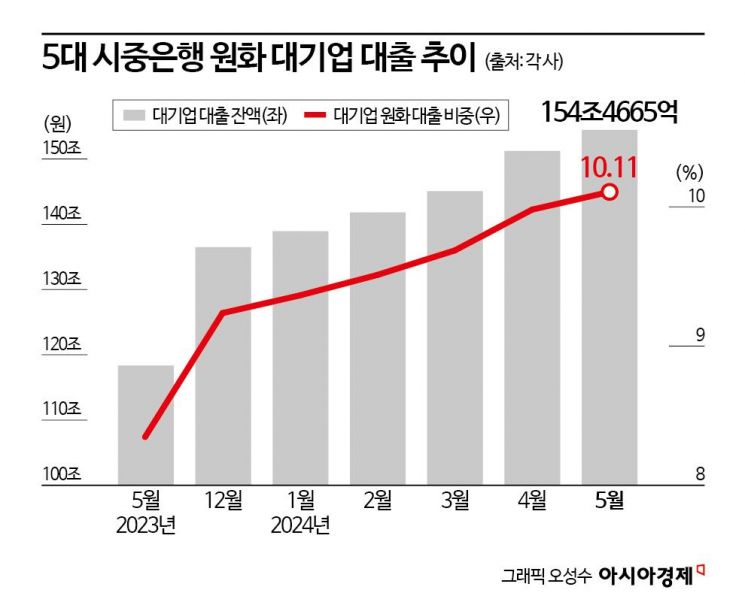

According to the financial sector on the 7th, as of the end of May this year, the proportion of large corporate loans to total won-denominated loans by the five major commercial banks?KB Kookmin Bank, Shinhan Bank, Hana Bank, Woori Bank, and NH Nonghyup Bank?stood at 10.1%. The proportion of large corporate loans by these banks was around 8% in April last year, exceeded 9% in September, and surpassed 10% after eight months.

On the other hand, these banks have limited loans to small and medium-sized enterprises (SMEs) and individual business owners, maintaining or lowering similar levels. The proportion of SME loans to total won-denominated loans by the five major banks was 42.5% at the end of May this year, down about 0.1 percentage points from 42.6% at the end of last year. During the same period, the proportion of loans to individual business owners also decreased by about 0.4 percentage points from 21.6% to 21.2%. Compared to May last year, these decreased by 0.2 percentage points and 0.9 percentage points, respectively.

The trend of concentration in large corporate loans is also confirmed by the overall loan amount trends. Since the beginning of this year, the increase in loans to large corporations, SMEs, and individual business owners by the five major banks totaled 40.6227 trillion won, of which the increase in large corporate loans was 18.0381 trillion won, SME loans increased by 17.9711 trillion won, with individual business owner loans amounting to only 4.4135 trillion won. Although the outstanding balances by loan category are SME loans (648.8566 trillion won), individual business owner loans (324.1071 trillion won), and large corporate loans (154.4665 trillion won), all five major banks appear to be focusing on increasing large corporate loans.

The reason major commercial banks are focusing on large corporate loans is that large corporations prefer bank loans over raising funds through corporate bond issuance. Banks also welcome this from the perspective of managing delinquency rates and strengthening soundness as emphasized by financial authorities. In fact, in April, the amount of newly issued general corporate bonds was 4.327 trillion won, falling short of the matured amount of 6.936 trillion won. As a result, the net issuance trend of general corporate bonds, which had continued since December last year, shifted to net redemption. The issuance volume of corporate bonds in May is likely to have further decreased.

A representative from a commercial bank said, "Since corporate bond market interest rates are unfavorable, companies are turning to bank corporate loans, and especially the demand for funds from large corporations is steadily flowing in," adding, "As commercial banks have strengthened loan operations targeting large corporations this year, the overall increase rate compared to SME and individual business owner loans has been steep."

There is also an analysis that commercial banks have no choice but to focus on large corporate loans to achieve two goals: profitability and soundness, while aligning with the financial authorities' policy to limit the increase in household loans. Since the liquidity coverage ratio (LCR) regulation limit for banks will normalize from July, alternatives are needed, and SME loans are unfavorable for improving soundness as their delinquency rates are on the rise. According to the Financial Supervisory Service, the non-performing loan ratio for corporate credit in the first quarter of this year was 0.61%, up 0.02 percentage points from 0.59% in the previous quarter. The non-performing loan ratios for SMEs rose from 0.64% to 0.69%, for small corporations from 0.85% to 0.89%, and for individual business owners from 0.34% to 0.41%.

Banks are also steadily lowering loan interest rates. The interest rate on new large corporate loans by deposit banks (Bank of Korea Economic Statistics System) was 5.16% in January, 5.11% in February, 5.01% in March, and dropped below 5% to 4.97% in April. SME loan rates have already fallen to the high 4% range since February and have continued to decline.

A financial sector official said, "It is true that competition among commercial banks for loans centered on large corporations has intensified," and predicted, "Since the increase in household loans needs to be more sensitively controlled from the second half of the year, movements to promote loans to large corporations will become more active than those for SMEs, and loans to SMEs more than individual business owners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)