Linking Non-Covered Medical Usage to Premium Renewal

'Discount' if No Non-Covered Insurance Claims in Past Year

'Surcharge' Applied Proportionally to Non-Covered Claim Amounts

Starting from the 1st of next month, subscribers of the 4th generation indemnity health insurance who have signed the non-reimbursed coverage special contract will have their non-reimbursed insurance premiums discounted or surcharged based on their usage of non-reimbursed medical services at the time of premium renewal.

According to the Financial Services Commission and the Financial Supervisory Service on the 6th, those eligible for discounts under the system are subscribers who have not received any non-reimbursed insurance claims in the past year. This is estimated to be about 62.1% of 4th generation indemnity subscribers. The discount rate will be determined using the surcharge funds from those subject to surcharges.

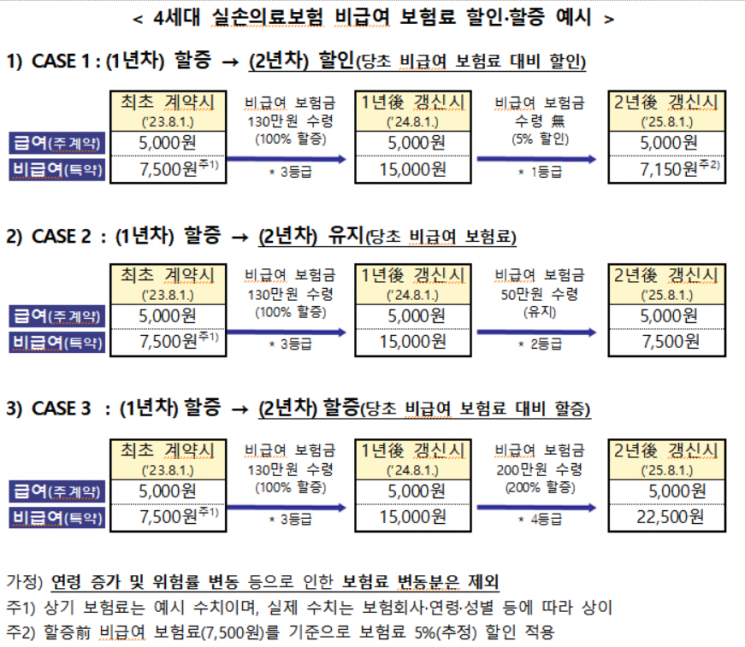

Those subject to surcharges are subscribers who have received non-reimbursed insurance claims of 1 million KRW or more in the past year, estimated to be about 1.3%. The surcharge rate ranges from 100% to 300%. Even if non-reimbursed insurance claims were received, if the amount is less than 1 million KRW, no surcharge will be applied and the premium will remain unchanged.

To protect medically vulnerable groups, medical expenses due to diseases subject to special calculation exceptions or for those rated as long-term care grade 1 or 2 are excluded from discount and surcharge targets.

The discount and surcharge grades are maintained only for one year immediately after the premium renewal. After one year, the non-reimbursed usage will be recalculated from scratch to reassess the discount or surcharge grade.

In July 2021, the 4th generation indemnity insurance was newly launched to maintain its role as a social safety net complementing health insurance while improving fairness in premium burdens among subscribers. Since its launch, the number of subscribers has steadily increased, reaching 3.76 million contracts by the end of last year, accounting for about 10.5% of all indemnity health insurance policies.

The 4th generation indemnity classifies its product structure into 'reimbursed' and 'non-reimbursed' categories, adjusting premiums annually according to the loss ratio of each. Unlike reimbursed premiums, which are uniformly adjusted for all policyholders, non-reimbursed premiums are differentially applied (discounted or surcharged) based on non-reimbursed insurance claims. The differential application of non-reimbursed premiums was deferred for three years after product launch to secure sufficient statistics and will be applied from the premium renewal date starting next month.

Subscribers of the 4th generation indemnity are classified into five tiers (grades 1 to 5) based on the amount of non-reimbursed insurance claims received in the year before premium renewal. Those with no non-reimbursed claims are eligible for discounts, and those with claims under 1 million KRW are not subject to discounts or surcharges. Conversely, those with claims of 1 million KRW or more will have their non-reimbursed premiums surcharged by 100% to 300%. The surcharge amounts collected from surcharge targets will be used to discount the premiums of discount targets, with the discount rate expected to be around 5%. This varies by insurance company.

Each insurance company will establish and operate a 'Non-Reimbursed Insurance Claim Inquiry System' so that consumers can reasonably manage their non-reimbursed medical usage and avoid inconvenience from premium surcharges. Subscribers of the 4th generation indemnity can check their non-reimbursed claim amounts, premium discount or surcharge levels, remaining non-reimbursed claim amounts until the next surcharge level, and necessary documents for applying for discount or surcharge exemptions through the individual insurer’s website or application (app).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.