Bank Management Status Disclosure Report...Top 5 Banks' Employee Salaries Exceed 110 Million KRW

Despite Lost KakaoBank IPO Effect, Internet Bank Employees Earn Over 100 Million KRW

Average Executive Compensation: Top 5 Banks 310 Million KRW > Internet Banks 270 Million KRW

High Interest Rate Trend Expands 'Loan-Deposit Interest Rate Spread'...Bank Profits Increase → Employee Compensation Rises

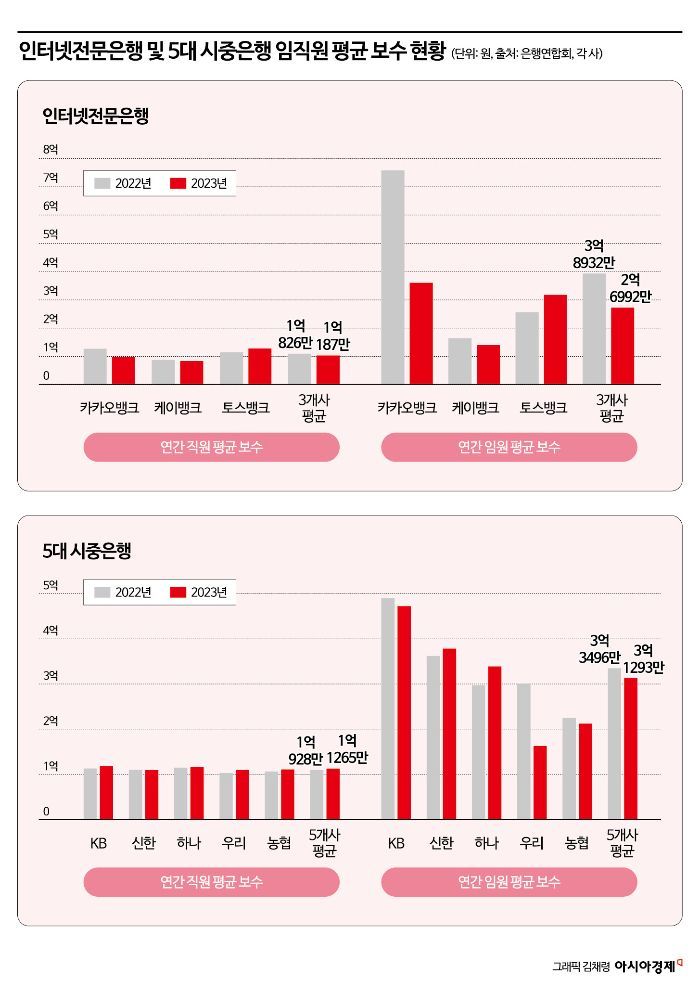

Last year, the annual average compensation (earned income) of employees at major commercial banks and internet-only banks exceeded 110 million KRW and 100 million KRW respectively. Additionally, the average compensation for executives, including salary, bonuses, and performance incentives, was found to be significantly higher at internet-only banks at 200 million KRW, and at major commercial banks at 300 million KRW. By sector, the average employee compensation at major commercial banks was more than 10% higher than that of internet-only banks, and the average executive compensation, which has a large proportion of performance bonuses, was 16% higher at commercial banks than at internet-only banks. However, with a clear increase in employee compensation confirmed due to the widening interest rate spread during the period of rising interest rates, it is expected that criticism of 'interest business' will be difficult to avoid this time as well.

According to the 'Management Status Disclosure Report' disclosed to the Korea Federation of Banks on the 3rd by the five major domestic banks?KB Kookmin, Shinhan, Hana, Woori, and NongHyup Banks?and internet-only banks such as KakaoBank, K Bank, and Toss Bank, the annual average compensation of employees at the five major commercial banks reached 112.65 million KRW, surpassing 110 million KRW for the first time. This report was prepared following last year's recommendation by the Financial Supervisory Service's 'Banking Sector Management, Business Practices, and System Improvement Task Force (TF)' that each bank voluntarily disclose management status such as revenue, expenses, and dividends in easy-to-understand terms annually.

Following commercial banks, the average employee compensation at the three internet-only banks again exceeded 100 million KRW last year. Although the IPO-related effect of KakaoBank disappeared, the average compensation of the three companies reached 101.87 million KRW due to a significant increase in Toss Bank's compensation.

Among commercial banks, Kookmin Bank had the highest average annual salary at 118.21 million KRW, while Shinhan Bank had the lowest at 108.98 million KRW. Hana Bank paid 115.66 million KRW, NongHyup Bank 110.69 million KRW, and Woori Bank 109.69 million KRW in employee compensation. In 2022, Hana Bank paid the highest at 114.77 million KRW, but its increase last year was lower than Kookmin Bank's, dropping it to second place.

Among internet-only banks, Toss Bank took the top spot with an outstanding average annual employee compensation. Toss Bank paid an average of 126.21 million KRW to its employees last year, surpassing the five major commercial banks. KakaoBank, which paid an average of 125.47 million KRW per employee in 2022, fell below 100 million KRW to 96.91 million KRW as the IPO effect disappeared, and K Bank paid 82.49 million KRW, a 4% decrease from the previous year due to a reduction in performance bonus payout rates.

Average Executive Compensation: Commercial Banks > Internet Banks… KB > Shinhan > KakaoBank Order

The annual average compensation of executives was also 16% higher at commercial banks compared to internet-only banks. Last year, the average executive compensation at commercial banks was 312.99 million KRW, about 43 million KRW more than the 269.92 million KRW at internet-only banks. In 2022, due to the expanded performance bonuses at KakaoBank and Toss Bank, internet-only banks had higher compensation than commercial banks, but this reversed within a year.

Kookmin Bank's average executive compensation per person was 472.48 million KRW, the highest among both commercial and internet-only banks. It was followed by Shinhan Bank at 378.45 million KRW and KakaoBank at 356.96 million KRW. KakaoBank's average executive compensation per person dropped in ranking as the IPO effect disappeared. Hana Bank's average executive compensation per person was 338.75 million KRW, and Toss Bank's was 314.58 million KRW, both exceeding 300 million KRW. Woori Bank and K Bank recorded average executive compensations in the mid-100 million KRW range, while NongHyup Bank paid in the 200 million KRW range.

Additionally, the average voluntary retirement pay (special retirement pay) at the five major commercial banks increased by 1.7% from 355.48 million KRW to 361.68 million KRW. Special retirement pay ranged from as little as three months to as much as 36 months of monthly salary.

The commercial bank with the highest special retirement pay was Hana Bank, reaching 409.15 million KRW, followed by Woori Bank at 402.65 million KRW. Next were Kookmin Bank at 381 million KRW, NongHyup Bank at 308.13 million KRW, and Shinhan Bank at 307.46 million KRW. Including basic retirement pay, the total retirement pay received by bank employees who took voluntary retirement at the five major banks last year is estimated to be around 600 million KRW on average. Last year, Hana Bank's statutory basic retirement pay per person was 187.36 million KRW, which combined with the average special voluntary retirement pay of 409.15 million KRW, amounts to 596.51 million KRW.

'Interest Rate Spread' Expansion Increases Bank Profits → Employee Compensation Rises

The background to the increase in employee compensation in the banking sector is the expansion of the interest rate spread during last year's rising interest rate period. In fact, the simple average KRW interest rate spread (based on new transactions) of the five major commercial banks was 1.38 percentage points, an increase of 0.22 percentage points from the previous year.

Among commercial banks, NongHyup Bank had the largest interest rate spread at 1.55 percentage points. It was followed by Hana Bank at 1.37 percentage points, Kookmin Bank at 1.35 percentage points, Woori Bank at 1.33 percentage points, and Shinhan Bank at 1.29 percentage points.

The household interest rate spread was also largest at NH NongHyup Bank. The household interest rate spreads by bank were 1.24 percentage points at NongHyup Bank, 0.94 percentage points at Kookmin Bank, 0.93 percentage points at Woori Bank, 0.92 percentage points at Hana Bank, and 0.91 percentage points at Shinhan Bank. Excluding policy products, the household interest rate spread was also highest at NongHyup Bank at 1.22 percentage points, the only bank exceeding 1 percentage point, followed by Kookmin Bank (0.93 percentage points), Woori Bank (0.90 percentage points), Hana Bank (0.86 percentage points), and Shinhan Bank (0.80 percentage points).

Despite financial authorities' warnings to refrain from excessive high-interest lending practices, the interest rate spread between loans and deposits is widening compared to the previous month. On the 21st, citizens are conducting transactions at a branch of a major commercial bank in Seoul. Photo by Dongju Yoon doso7@

Despite financial authorities' warnings to refrain from excessive high-interest lending practices, the interest rate spread between loans and deposits is widening compared to the previous month. On the 21st, citizens are conducting transactions at a branch of a major commercial bank in Seoul. Photo by Dongju Yoon doso7@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.