Ecopro and Ecopro BM Both Hit 52-Week Lows

Group Market Cap Down 20 Trillion Won Since Year-End

Sell Report on Ecopro BM Dampens Investor Sentiment Across Group Companies

As the sluggishness of secondary battery stocks continues this year, the market capitalization of the EcoPro Group, one of the leading secondary battery stocks, has evaporated by more than 20 trillion won. With concerns over the industry outlook combined with poor earnings, and even sell reports from securities firms emerging, it seems unlikely that the stock price will easily recover from its short-term slump.

According to the Korea Exchange on the 30th, all EcoPro Group stocks recorded declines of 4-5% the previous day. EcoPro and EcoPro BM both closed at 52-week lows. EcoPro closed the session at 90,300 won, down 4.65% from the previous day, marking a 52-week low again just two days after the 27th. Since the stock split last month, EcoPro started in the 100,000 won range but is now struggling to hold the 90,000 won level. EcoPro BM, the leading stock on KOSDAQ, fell sharply for two consecutive days, dropping below 200,000 won and hitting a new 52-week low of 187,500 won. Among the group companies, EcoPro Mety, the only one listed on the KOSPI market, has shrunk to about one-third of its 52-week high of 244,000 won recorded intraday on January 11. EcoPro Mety’s stock price fell nearly 4% the previous day, breaking below the 80,000 won level. EcoPro HN also dropped more than 6%.

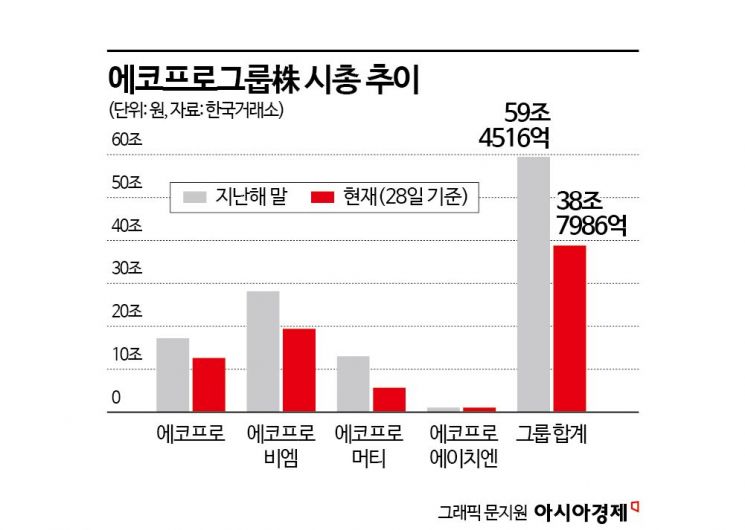

With the group stocks generally showing weakness this year, the group’s market capitalization has shrunk from 59.4516 trillion won at the end of last year to 38.7986 trillion won as of the 28th, a decrease of about 20 trillion won.

The sell report on EcoPro BM by a securities firm is interpreted as having triggered the overall price weakness of the group stocks. On the 28th, Hi Investment & Securities downgraded EcoPro BM’s investment rating from 'Hold' to 'Sell,' citing the need for valuation normalization. The target price was also lowered from 200,000 won to 150,000 won. Researcher Jeong Won-seok of Hi Investment & Securities explained, "Despite the continuous decline in stock price since the peak in July last year, the valuation burden remains significant. While I agree with the forecast that EcoPro BM’s earnings will bottom out in the first half of this year and gradually increase, it is difficult to reasonably justify the valuation of a price-to-earnings ratio (PER) of 26.1 times based on the expected 2027 earnings, considering adjusted mid- to long-term earnings forecasts due to weak electric vehicle demand in North America and Europe, falling cathode material prices, and declining market share of domestic companies in the European and emerging market EV battery sectors." He added, "The rapid price surge caused by last year’s FOMO (Fear Of Missing Out) has had side effects, and now a process of valuation normalization is necessary."

Following poor first-quarter earnings, the outlook for the second quarter is also negative. Hi Investment & Securities estimates EcoPro BM’s second-quarter sales to be 860 billion won, down 55% year-on-year, with an operating loss of 6.5 billion won, turning to a deficit.

EcoPro BM’s poor performance is expected to lead to weak earnings for EcoPro Mety. NH Investment & Securities researcher Joo Min-woo said, "Due to inventory adjustments by the main client EcoPro BM, the first half earnings will be weak. Short-term demand weakness, inventory adjustments, and price declines are occurring simultaneously, causing a sharp deterioration in earnings, but a turnaround is expected in 2025." About 90% of EcoPro Mety’s sales come from EcoPro BM. Due to the poor performance of affiliates, the holding company EcoPro is also expected to face earnings declines. Most of EcoPro’s sales are generated from EcoPro BM.

Due to vertical integration, the earnings slump is spreading across the group stocks, but there are opinions that synergy effects are expected in the future. EcoPro is building a closed-loop system value chain that extends from recycling to precursors and cathode materials. DS Investment & Securities researcher Choi Tae-yong said, "EcoPro Group’s closed-loop eco system consists of EcoPro BM (cathode materials), EcoPro EM (NCA), EcoPro Mety (precursors), EcoPro Innovation (lithium processing), EcoPro CnG (used battery recycling), EcoPro AP (high-purity oxygen and nitrogen), and EcoPro HN (fine dust reduction solutions). Since the group has proactively led upstream value chain internalization, synergy among affiliates is expected." He added about EcoPro BM, "As a leader in the industry, it is expected to benefit greatly when the industry improves. This is why a long-term approach to earnings is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.