High-Value and Special Line Orders and MRO Business Expansion

Structural Growth Phase "Strong Performance to Continue in Second Half"

Shipbuilding stocks that recorded an earnings surprise in the first quarter of this year are expected to continue their upward trend in the second half. Securities firms predict that the shipbuilding industry will maintain solid performance, supported by orders for high value-added eco-friendly ships and special vessels, as well as the expansion of maintenance, repair, and overhaul (MRO) businesses.

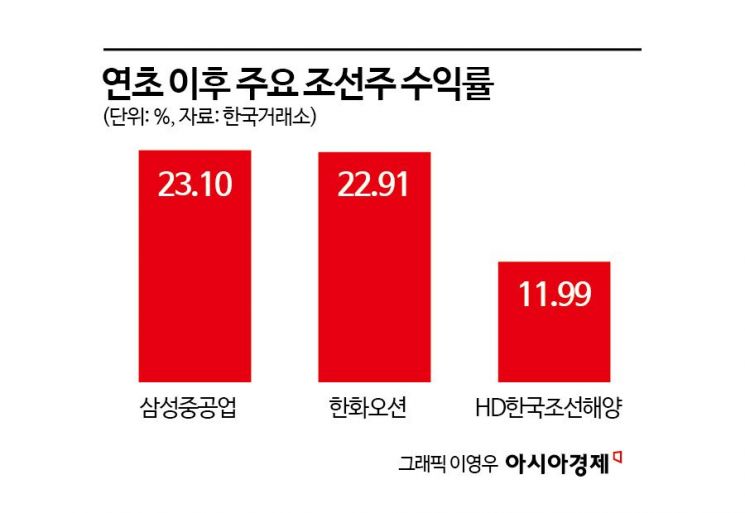

According to the Korea Exchange on the 29th, Samsung Heavy Industries rose 23.10% since the beginning of the year, closing at 9,540 KRW on the 28th. During the same period, Hanwha Ocean and HD Hyundai Heavy Industries also jumped 22.91% and 11.99%, respectively, showing a consistent upward trend among the three major shipbuilders.

The strong earnings improvement supports the ongoing rise in shipbuilding stocks since the start of the year. The industry expects the three major shipbuilders to post simultaneous annual profits for the first time in 13 years since 2011. HD Hyundai Heavy Industries has already achieved about 84% of its $13.5 billion order target for this year.

Securities firms forecast that shipbuilding stocks will continue to deliver solid earnings in the second half following the first half. Han Seung-han, a researcher at SK Securities, said, "With the construction volume in the order backlog and rising ship prices already confirmed, the only remaining variable is costs. Prices of raw materials such as iron ore and imported steel plates are on a downward trend," adding, "Labor cost increases and provision settings were implemented last year, and due to continuous foreign labor supply, outsourcing unit costs will only rise slightly." He further noted, "Hanwha Ocean and HD Hyundai Heavy Industries have secured special vessel construction and maintenance capabilities through domestic Defense Acquisition Program Administration (DAPA) warship projects, and orders for U.S. military ship MRO projects are becoming visible," emphasizing, "It is necessary to consider additional valuation through orders in various businesses beyond just merchant ships and offshore plants."

In particular, HD Hyundai Heavy Industries is praised for its abundant net cash and undervalued subsidiary assets. Yang Hyung-mo, a researcher at DS Investment & Securities, said, "While net cash holdings reach 1.8 trillion KRW, liabilities are only about 12.8 billion KRW," adding, "Based on its financial strength, mergers and acquisitions (M&A) are also possible." He analyzed, "The corporate value of its subsidiary Hyundai Samho is conservatively estimated to be up to 5 trillion KRW," and "As the subsidiary's value rises, a revaluation of the stock price is expected."

Samsung Heavy Industries, having turned around the fastest among the three major shipbuilders, is expected to maintain a solid profitability improvement trend. Wi Kyung-jae, a researcher at Hana Securities, said, "The high proportion of floating liquefied natural gas production facilities (FLNG) and liquefied natural gas (LNG) carriers, which are more profitable than container ships and tankers, is positive," forecasting, "The sales growth trend that will begin in earnest in the second half is expected to continue into 2025." He also added, "When constructing container ships, which are not highly profitable, blocks are procured from China, securing profitability and limiting margin erosion," and "As the world expands the trade volume of natural gas for carbon neutrality, Samsung Heavy Industries is preparing for ultra-large ammonia carriers (VLAC), which will also benefit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)