To Achieve Significant Profits, 'Market Share Over 50%'

Platform Industry with 7 Million Subscribers Secured

Competition among card companies is intensifying in the overseas travel-specialized card market, so-called ‘Travel Cards.’ Although overseas payment amounts have increased in line with rising demand for overseas travel, it is evaluated that this has not contributed to performance.

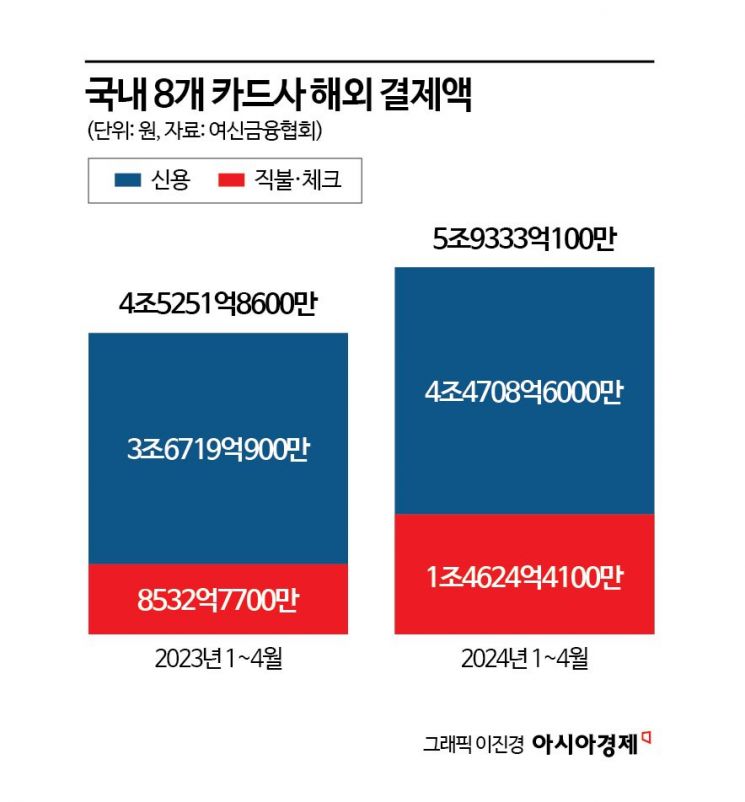

According to the Credit Finance Association on the 28th, the cumulative personal overseas usage amount of credit cards (lump-sum) and debit/check cards from eight domestic full-service card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Hana, BC, and Woori Card) as of the end of last month was 5.9333 trillion KRW, up 31.1% compared to the same period last year (4.5251 trillion KRW). Credit card usage increased by 21.8% to 4.4708 trillion KRW, and debit/check card payments rose by 71.4% to 1.4624 trillion KRW.

By card company, from January to April this year, Hana Card showed the highest sales amount at 1.1694 trillion KRW, with Shinhan Card (1.1127 trillion KRW) and Hyundai Card (1.0689 trillion KRW) also entering the trillion KRW payment range. Following them were Kookmin Card with 877.5 billion KRW, Samsung Card with 797.2 billion KRW, Woori Card with 543.5 billion KRW, Lotte Card with 346.4 billion KRW, and BC Card with 17.3 billion KRW.

The increase in overseas payment amounts is due to the surge in overseas travel demand, prompting card companies to competitively launch travel-specialized cards. In particular, after Toss Bank launched the ‘Lifetime Free Currency Exchange’ service in January, competition in travel cards intensified. The pioneer was Hana Card, which launched ‘Travelog’ in June 2022. It is a service that allows free currency exchange and withdrawal without fees. Shinhan Card closely followed by launching ‘SOL Travel’ in February. Despite being a no-annual-fee check card, it offers free airport lounge access twice a year. In addition, card companies have successively introduced products targeting travelers, such as ‘American Express’ (Hyundai Card), ‘Travelers’ (Kookmin Card), and ‘iD Global’ (Samsung Card).

On the morning of January 5th, passengers lined up for check-in at the Departure Hall of Terminal 1, Incheon International Airport. [Image source=Yonhap News]

On the morning of January 5th, passengers lined up for check-in at the Departure Hall of Terminal 1, Incheon International Airport. [Image source=Yonhap News]

However, profitability remains a challenge. With intensified competition in the card industry continuing for about half a year, it remains to be seen whether travel cards will establish themselves as a new source of revenue. A card industry insider said, “Simple sales may increase, but benefits such as fee discounts are costs for card companies,” adding, “It is still unknown in which direction the performance considering net profit will go.” Another insider said, “Our product has a small margin,” but added, “If we capture about 50% market share, we will achieve meaningful profits through economies of scale.” From January to April this year, Hyundai Card holds the highest market share in credit cards (23.8%), and Hana Card leads in debit/check cards (53%).

There is also an opinion that 7 million cumulative subscribers are needed to create added value beyond card fee revenue with travel cards. It is explained that gathering 7 million users can enable the card to function as a travel platform. Travel-related partners such as airlines, accommodations, and tourism can be brought onto the platform, securing affiliate fee revenue as well. The number of subscribers to Hana Card’s Travelog, now in its third year since launch, remains at the 4 million range (as of the 27th).

The immediate problem is that the scale of overseas installment and cash services has significantly decreased. Since overseas merchant payment fees are similar to domestic levels (0.5~2.3%), it is difficult to generate large profits from lump-sum payments. On the other hand, overseas installment and cash services have relatively high fee rates. From January to April this year, overseas installment usage amounted to 150.3 billion KRW, down 68.9% compared to the same period last year, and overseas cash service usage decreased by 67.4% to 41.1 billion KRW during the same period. A card industry official explained, “The decrease in overseas installment and cash service scale seems to be because overseas travel usage increased more than overseas direct purchase (direct import) amounts,” adding, “Since overseas installment and cash service usage has decreased, it may have some (negative) impact on performance.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.