China's Solar Power Restructuring Signals

US Tariff Policy Also Advantageous

Inventory Reduction Effect Expected in Second Half

Hanwha Solutions, which had been nicknamed 'Hwanasolushion' among individual investors due to sluggish stock performance, surged more than 8% on expectations of an improvement in the solar power market. Although inventory issues caused by oversupply remain a short-term problem, the long-term outlook for market improvement has brightened. Consequently, securities firms have unanimously raised their target prices for Hanwha Solutions.

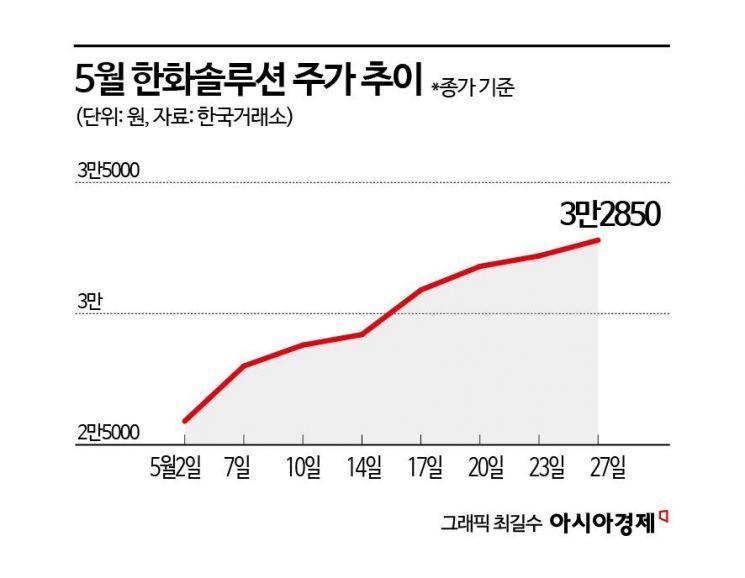

According to the Korea Exchange on the 27th, Hanwha Solutions closed at 32,850 KRW, up 8.60% (2,600 KRW) from the previous session. This is the highest closing price since January 17 (34,150 KRW).

Foreign and institutional investors jointly drove the stock price up. On the day, foreign investors and institutions purchased stocks worth 10.492 billion KRW and 18.481 billion KRW, respectively. Institutional buying intensified in the afternoon.

The expansion of investor sentiment was due to growing expectations of an improvement in the solar power market. On the 17th, the China Photovoltaic Industry Association held a symposium to discuss solutions to resolve oversupply. Major Chinese solar companies and government officials attended the event.

Yujin Jeon, a researcher at Hi Investment & Securities, explained, "If restructuring movements are actually detected, it could serve as a meaningful trigger to significantly change the direction of the solar industry, which is currently struggling due to aggressive price competition and excess inventory."

Moreover, the U.S. solar market is expected to rebound from the second half of the year. This is because the U.S. has decided to increase tariffs on Chinese solar cells. Starting in August, tariffs on Chinese solar cells will rise sharply from the current 25% to 50%. The two-year temporary tariff exemption on solar panels produced in four Southeast Asian countries will also end on June 6. All these policies are positive for Hanwha Solutions. Accordingly, the market is raising earnings forecasts for Hanwha Solutions.

Jinho Lee, a researcher at Mirae Asset Securities, analyzed, "The biggest concern in the market is the inventory accumulated in the U.S., but this concern is excessive. The likelihood of new Chinese supply being imported into the U.S. is significantly low, and the price of Chinese inventory in the U.S. is likely to decouple from Hanwha Solutions' product prices."

However, there is also a view that it will be difficult to reduce excess inventory in the short term. Yujin Jeon of Hi Investment & Securities said, "The modules imported indiscriminately from Southeast Asia for about two years since June 2022 and the resulting excess inventory are burdensome. As of the end of June, module inventory is estimated to be around 40 GW, which is similar in scale to the annual U.S. demand in 2024. Therefore, full-scale inventory reduction and price rebound are expected around late Q3 to early Q4."

Younggwang Choi, a researcher at NH Investment & Securities, pointed out, "The global oversupply of solar power, accumulated inventory in the U.S., and declining prices create a challenging business environment," adding, "it is difficult for fundamental improvements to appear in the short term."

Meanwhile, on the same day, NH Investment & Securities raised Hanwha Solutions' target price to 32,000 KRW. Hi Investment & Securities raised it to 40,000 KRW, Hyundai Motor Securities to 43,000 KRW, and Mirae Asset Securities to 45,000 KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.