More than Two-Thirds of Last Year's Investment

Impact of US and European Hydrogen Subsidy Execution

Expecting Effects of 'Hanil Hydrogen Cooperation Dialogue'

Signs of Full-Scale Overseas Project Launch

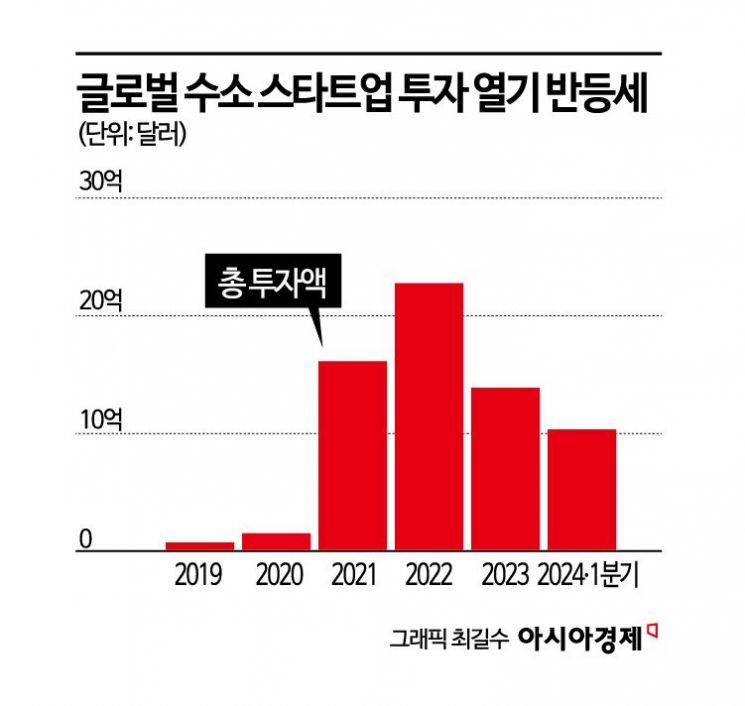

Funding is pouring into hydrogen startups. In just four months this year, the total investment exceeded $1 billion (about 1.368 trillion KRW). This is interpreted as reflecting expectations for industry growth as advanced countries such as the United States implement hydrogen policy subsidies.

According to Crunchbase, a global company information platform, on the 27th, Coloma, a natural hydrogen exploration company, raised $240 million (about 328.3 billion KRW), and global water electrolysis (a technology that produces hydrogen by electrolyzing water) company Hysata received $110 million (about 150.4 billion KRW) in investment. The investment raised by these two companies alone approaches 500 billion KRW, and more than $1 billion has been poured into hydrogen startups worldwide.

The amount of funding gathered in four months exceeds two-thirds of last year's investment of $1.4 billion (about 1.9152 trillion KRW). If this trend continues, it is expected to surpass the record high of $2.3 billion (about 3.1464 trillion KRW) in 2022.

The rebound in hydrogen industry investment is analyzed to be due to the full-scale implementation of hydrogen policy subsidies by the United States and the European Union (EU). Last year, the U.S. government announced the selection of seven hydrogen hubs and revealed plans to invest a total of $7 billion (9.4 trillion KRW) in federal government budgets. They aim for the "Hydrogen Shot," which targets reducing the production cost of clean hydrogen by 80% within 10 years to $1 per kilogram. The U.S. also plans to provide clean hydrogen production subsidies of up to $3 per kilogram through the Inflation Reduction Act (IRA).

The EU is focusing on building infrastructure for clean hydrogen adoption. Clean hydrogen storage terminals are being constructed at the three major ports in the region: Rotterdam, Antwerp, and Hamburg. Rotterdam Port, which began construction of a storage terminal last year, plans to build an additional 10 to 15 terminals. Antwerp Port is planning to build an ammonia terminal aiming for operation in 2027. Hamburg Port also plans to operate ammonia terminals sourced from Saudi Arabia and the United Arab Emirates starting in 2026. Through this, the EU plans to secure 6 GW of water electrolysis capacity this year and 80 GW (40 GW domestic and 40 GW foreign) by 2030, increasing hydrogen’s share of energy from the current 2% to over 23% by 2050 with green hydrogen (hydrogen produced from renewable energy). Additionally, investments amounting to 1.3 billion euros (about 1.9292 trillion KRW), twice the funding for clean hydrogen research, are expected to continue, and an additional 10 billion euros (about 14.8401 trillion KRW) will be invested over the next decade for joint financing.

The global enthusiasm for hydrogen investment is expected to extend to South Korea. Although no domestic hydrogen startup has yet received large-scale investments exceeding $100 million (about 136.8 billion KRW) this year, momentum is expected to build as the South Korean and Japanese leaders plan to launch the "Korea-Japan Hydrogen Cooperation Dialogue" next month. Cross-national and continental projects producing and exporting hydrogen from regions with favorable renewable energy generation such as the Middle East, Australia, and Canada are also beginning in earnest.

According to the "Deloitte 2023 Global Green Hydrogen Outlook Report" published by Deloitte, the clean hydrogen market, including green hydrogen and blue hydrogen (hydrogen produced with carbon capture and storage technology), is expected to grow from $642 billion (830 trillion KRW) in 2030 to $1.4 trillion (1,810 trillion KRW) by 2050, driven by net-zero (carbon neutrality) goals. Production volume is projected to increase from 170 million tons to 600 million tons.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.