Continued Large-Scale Investment Since 2021

Sales Increased but Profit Declined Due to Worsening Profitability

Capital Raised Through Stock Increase Amid Unavoidable Additional Investment Situation

Hanamicron, which succeeded in turnkey orders for memory semiconductors such as DRAM and NAND from SK Hynix in 2021, is currently struggling to cope with increasing interest expenses. Accordingly, Hanamicron plans to use part of the funds raised through a paid-in capital increase to repay debt. Financial soundness and profitability are expected to improve thereafter.

According to the Financial Supervisory Service's electronic disclosure system on the 27th, Hanamicron will issue 0.096 new shares per existing share to raise 112.5 billion KRW. The planned issue price is 22,500 KRW, and the final issue price will be confirmed on July 24. The raised funds will be used for facility investment, debt repayment, and operating expenses.

Previously, Hanamicron made a large-scale expansion investment in its Vietnam subsidiary, Hanamicron Vina, to supply the volume turnkey-ordered from SK Hynix in 2021. In 2022, short-term borrowings increased by 114.3 billion KRW, and 50 billion KRW worth of private bonds were issued. Total borrowings reached 414.4 billion KRW. The debt ratio rose by 54.2 percentage points (p) to 188.6% compared to the previous year. As the expansion was completed, Hanamicron Vina's sales increased from 21.6 billion KRW in 2021 to 337.5 billion KRW last year.

Hanamaterials, a subsidiary producing consumable parts necessary for semiconductor etching processes, also increased investments to expand production capacity. Since 2021, borrowings from financial institutions have increased, with Hanamaterials' borrowings rising from 159.5 billion KRW in 2021 to 241.7 billion KRW last year.

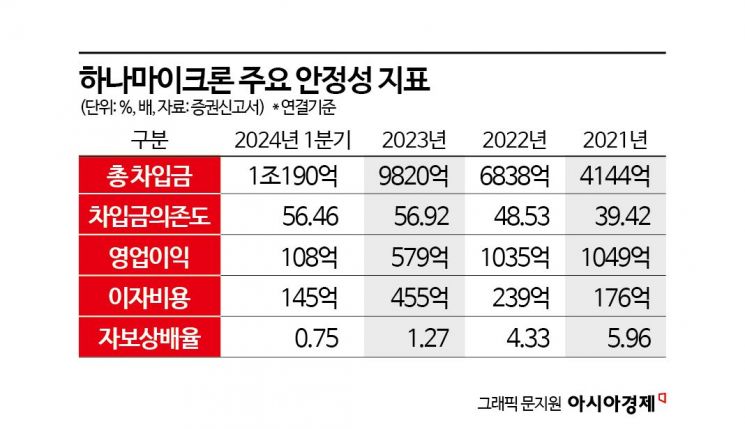

As expansion investments continued in the main affiliates, Hanamicron's consolidated financial stability deteriorated. Total borrowings increased from 414.3 billion KRW in 2021 to 982 billion KRW in 2023, and during the same period, the debt ratio soared from 134.4% to 216.9%. Interest expenses rose from 17.6 billion KRW to 45.5 billion KRW. The interest coverage ratio dropped from 5.96 times to 1.27 times.

Consolidated sales increased from 669.5 billion KRW in 2021 to 968 billion KRW in 2023, but operating profit decreased from 104.9 billion KRW to 57.9 billion KRW. Profitability declined. The company explained that this was due to a decrease in orders caused by inventory adjustments among domestic memory semiconductor companies, leading to a drop in operating rates. Although production capacity was expanded, the lower operating rate caused profit growth to lag behind sales growth.

Even in the first quarter of this year, when expectations for semiconductor industry recovery were high, operating rates fell short of expectations. The operating rate in the semiconductor manufacturing sector was 70.8%, not reaching the 80% range of 2022. The operating rate in the semiconductor materials sector was only 51.4%.

As large-scale investments continued to respond to the rapidly changing semiconductor business environment, interest expenses increased and profitability declined. Although Hanamicron's sales are increasing with the semiconductor industry recovery, profitability recovery is still distant. To improve profitability, the company is expanding its business area into the non-memory sector. From 2019 to last year, it invested 200 billion KRW to respond to the non-memory test market. Hanamicron also plans an additional investment of 69 billion KRW. This investment is for equipment that tests semiconductors (AP) that act as the brain in smartphones and tablets, performing commands, interpretation, computation, and control.

In a situation where additional investment is inevitable, if borrowings increase further, liquidity and financial stability could deteriorate, making a paid-in capital increase unavoidable. During the planning of the capital increase scale, not only facility investment funds but also debt repayment funds were included in the plan. The maturity date of the 25 billion KRW 10th series private bonds issued in November 2021 is approaching. 250 billion KRW of the paid-in capital increase proceeds will be used to pay principal and interest. It is expected that the debt ratio will decrease to 199.0% through capital expansion and debt repayment via the paid-in capital increase.

Industry insiders recently expected that Hanamicron's large-scale investments would bear fruit with the semiconductor industry's recovery. An industry official said, "The product portfolio will expand from server DRAM products to mobile DRAM and NAND," adding, "We expect a trickle-down effect from increased investments by upstream companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.