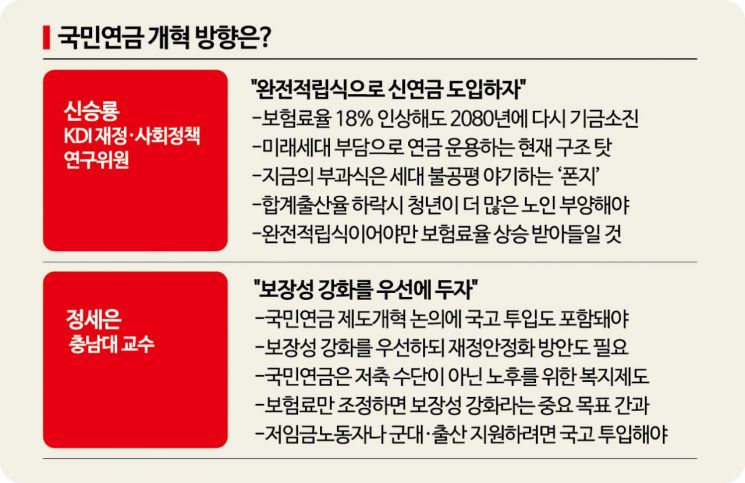

Desirable Directions for National Pension Reform Policy Debate

Concerns Raised Over "Increase Returns by Issuing Bonds" Proposal

Government Funding Seen as a 'Trick'... Burdening Future Generations

Regarding the reform direction of the National Pension Service, opinions clashed between those advocating for a shift to a 'fully funded' system and those insisting on raising the income replacement rate. Shin Seung-ryong, a fiscal and social policy research fellow at the Korea Development Institute (KDI), argued that the burden should not be passed on to future generations, while Professor Jeong Se-eun of Chungnam National University emphasized the need to strengthen benefit adequacy. Among the experts participating in the discussion, voices were divided over government budget injections, with some agreeing and others warning against misleading the public.

These arguments emerged at a policy forum titled "Desirable Directions for National Pension Reform," held on the 23rd at the Korea Press Center in Jung-gu, Seoul. The forum was jointly hosted by KDI and the Korean Economic Association.

Research fellow Shin, who was the first presenter that day, proposed, "In South Korea, which has the world's lowest fertility rate, pension fund depletion and significant intergenerational inequity cannot be resolved by mere parameter reforms of the National Pension. Therefore, we should operate a fully funded new pension separately from the existing pension, which is unaffected by fertility rates." Shin had previously released a "National Pension Structural Reform Plan" on February 21, calling for reform toward a fully funded system.

A fully funded system means that the insurance premiums one pays are returned to oneself as pension benefits. Currently, the National Pension partially reflects a pay-as-you-go system, where future generations' premiums fund current pensions, making it a 'partially funded' system. When workers pay premiums, some are accumulated in the fund, and some are used to pay benefits to the elderly. Due to the low fertility and aging population trend, the burden on each worker inevitably increases. Shin argues that to reduce the burden on future generations, the system must transition to a fully funded model.

Shin Seung-ryong, Associate Research Fellow of the Fiscal and Social Policy Research Department at KDI, is giving a presentation on the topic "Complete Funded National Pension Structural Reform Plan" at the "National Pension Reform Direction Forum" hosted by KDI and the Korean Economic Association on the 23rd at the Press Center in Jung-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

Shin Seung-ryong, Associate Research Fellow of the Fiscal and Social Policy Research Department at KDI, is giving a presentation on the topic "Complete Funded National Pension Structural Reform Plan" at the "National Pension Reform Direction Forum" hosted by KDI and the Korean Economic Association on the 23rd at the Press Center in Jung-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

Shin explained that the fully funded system imposes the least pension burden. He stated, "The current National Pension, based on intergenerational solidarity through a pay-as-you-go method, has a long-term expected return ratio of less than one, as proven mathematically. If, in the long term, the fund's investment return rate exceeds the nominal growth rate, it is possible to maximize fund and investment returns through a fully funded pension, thereby minimizing the national burden."

Once reform toward a fully funded system begins, the National Pension will be divided into the new pension and the old pension. From the start of the reform, all premiums paid will be accumulated in the new pension and managed under the fully funded system. The old pension will pay benefits based on the expected return ratio before the reform, according to the benefit formula.

However, advancing toward a fully funded pension requires further discussion on fiscal management methods. Shin analyzed, "The fiscal burden of the old pension will reach about 3-4% of GDP from the 2040s and will disappear to within 0.1% of GDP by the 2090s. By utilizing the spread between fund investment returns and government bond interest rates before the fund is depleted, fiscal input can be made more efficient."

Shin emphasized, "Any increase in premium rates that is not fully funded is perceived as a continuation of a Ponzi scheme. Despite having a fund exceeding 1,000 trillion won, persuading additional fiscal input requires the philosophy of a fully funded fund." He added, "We must not shift the responsibility for optimistic pension reform onto future generations."

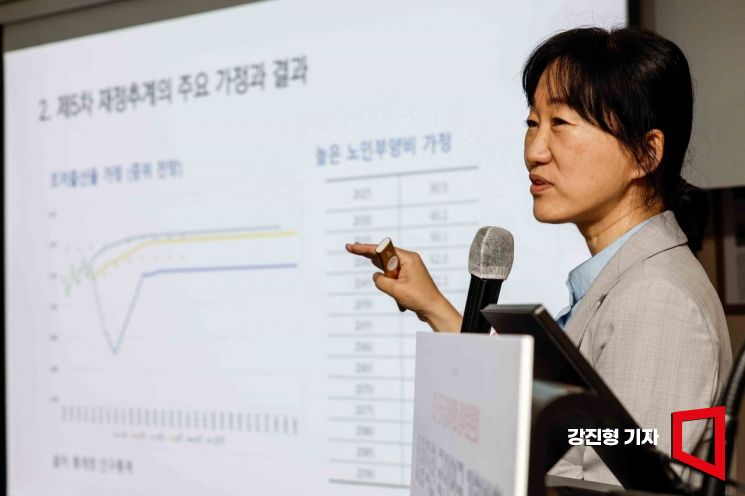

Professor Jeong Se-eun of Chungnam National University is attending the "National Pension Reform Direction Forum" hosted by KDI and the Korean Economic Association at the Press Center in Jung-gu, Seoul on the 23rd, presenting on the topic "The 5th National Pension Financial Projection and Rational Pension Reform Measures." Photo by Kang Jin-hyung aymsdream@

Professor Jeong Se-eun of Chungnam National University is attending the "National Pension Reform Direction Forum" hosted by KDI and the Korean Economic Association at the Press Center in Jung-gu, Seoul on the 23rd, presenting on the topic "The 5th National Pension Financial Projection and Rational Pension Reform Measures." Photo by Kang Jin-hyung aymsdream@

On the other hand, a completely opposite voice prioritized strengthening benefit adequacy. Professor Jeong stated, "With the current level of benefit adequacy in the National Pension, even combined with the basic pension, it is difficult to provide a minimum stable retirement income guarantee, so benefit adequacy needs to be enhanced. Strengthening the National Pension, rather than the basic pension?which is 100% tax-funded?is advantageous in terms of fiscal stability and public acceptance."

Professor Jeong argued, "We must recognize that the National Pension system is a welfare program for retirement income security, not a savings tool, and reform the system itself that relies solely on premiums for fiscal stability. The high-benefit structure, where one receives more than one pays over the long term, has already been largely resolved through pension reform."

She also proposed including government budget injections and their methods in discussions on current National Pension reforms. Professor Jeong said, "It is necessary to include government budget injections to provide generous benefits to early enrollees, support premiums for low-wage workers and small self-employed individuals, and cover premiums for military service and childbirth. Achieving fiscal stability solely through premium adjustments overlooks the important goal of strengthening benefit adequacy." She added, "Fair distribution of the National Pension burden should not be limited to intergenerational equity issues."

Shin and Professor Jeong also differed in their perspectives on the pension system's problems. Shin focused on the fact that even if the premium rate is raised to 18% and an income replacement rate of 40% is applied, the fund will be depleted by 2080, and the premium rate may have to rise to as high as 34.9%. In contrast, Professor Jeong expressed concern that without strengthening the National Pension's benefits, elderly poverty will not improve in the future, and the old-age dependency ratio (the number of elderly supported by 100 working-age people) will soar to 110.3 by 2080.

Jodongcheol (right), President of KDI, and Kim Honggi, President of the Korean Economic Association, are attending the "National Pension Reform Direction Forum" hosted by KDI and the Korean Economic Association at the Press Center in Jung-gu, Seoul on the 23rd, exchanging opinions. Photo by Kang Jinhyung aymsdream@

Jodongcheol (right), President of KDI, and Kim Honggi, President of the Korean Economic Association, are attending the "National Pension Reform Direction Forum" hosted by KDI and the Korean Economic Association at the Press Center in Jung-gu, Seoul on the 23rd, exchanging opinions. Photo by Kang Jinhyung aymsdream@

Experts participating in the discussion supported the 'fully funded new pension.' Oh Geon-ho, policy committee chairman of the Welfare State We Make, explained, "In the mid to late 20th century, when public pensions matured in the West, it was appropriate for younger generations to support the older generations to some extent, relying on them. However, in the 21st century, the economy and demographic structure have completely changed. The current intergenerational contract requires reducing the burden on future generations in advance." He added, "It is inevitable to accumulate the fund one will receive oneself while expecting the effect of fund investment returns."

Yoon Seok-myung, honorary research fellow at the Korea Institute for Health and Social Affairs, called both proposals "unrealizable hopeful tortures," but said, "I prefer Shin's plan because most OECD member countries have shifted their pension systems to a pay-as-you-contribute basis, which is the most necessary approach for our country." The unprecedented record low fertility rate worldwide continued, with the total fertility rate falling below 0.7 for the first time in the fourth quarter of last year.

However, Shin's proposal to utilize the spread between fund investment returns and government bond interest rates raised concerns. Won Jong-hyun, full-time expert committee member of the National Pension Fund Management Committee, said, "The expression of issuing bonds to increase fund investment returns is worrisome. It means borrowing to leverage investments, which is a frightening expression to me."

Opinions diverged on fiscal input. Expert Won emphasized, "I largely agree with both presenters mentioning government budget support." He added, "Since the National Pension's implementation in 1988 until the mid-2000s, over 90% of operating funds were controlled to be invested in bonds. If the fund had been managed as it is now back then, the average annual cumulative return would have been higher than 5.8%." He continued, "I want to emphasize that the low 5% return is the government's responsibility. This is why I agree with government budget support."

There was also a stance warning against the 'government budget omnipotence theory.' Research fellow Yoon said, "We must not mislead by government budget injections. No country injects fiscal resources just to reduce premiums. It is appropriate for the government to cover only past mistakes." Professor Park Kwang-yong of Sogang University's Graduate School of International Studies, who attended as an audience member, said, "If necessary, fiscal input should be made, but we must clearly assess whether our country has fiscal capacity. Mandatory expenditures increase due to aging. Since the welfare expenditure ratio to GDP will rise to 18% in the long term, fiscal capacity is not large." He also warned, "Fiscal input can become a 'trick.' Injecting fiscal resources instead of raising premiums imposes a tax burden on future generations, which I consider risky."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.