Q1 Order Backlog Hits 61 Billion, 'All-Time High'

Samsung SDS, Emro Collaborate on SRM SaaS Solution Development

Solution Unveiled to Address Supply Chain Issues

Investments to minimize supply chain risks have continued since the COVID-19 pandemic. Recently, various risk factors such as geopolitical risks, strengthened protectionism, and climate change have been affecting supply chains. This is why Emro, the nation's top supply chain management (SCM) software developer, continues to grow. About a year after Samsung SDS acquired management rights of Emro, overseas expansion results are also expected to emerge.

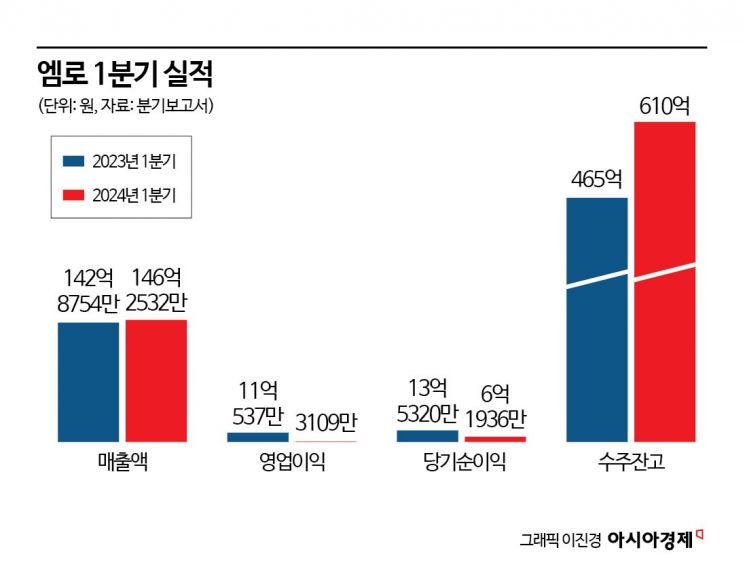

According to the financial investment industry and Emro on the 24th, Emro's order backlog as of March stood at 61 billion KRW, a 31.2% increase compared to a year ago. This is the largest order backlog in history.

Emro recorded sales of 14.6 billion KRW in the first quarter based on consolidated financial statements this year, a 2.4% increase compared to the same period last year. Investments to build stable supply chains have increased due to rising geopolitical instability from the Middle East and the global inflation impact, achieving the highest first-quarter sales ever.

SCM is subdivided into planning, execution, logistics, purchasing, and supply chain management. The supply chain management software developed by Emro enhances corporate purchasing transparency and maximizes cost reduction effects. Emro provides solutions in all purchasing areas including cost management, procurement purchasing, electronic contracts, and partner management.

Yoon Cheol-hwan, a researcher at Korea Investment & Securities, explained, "Performance will improve this year through the next-generation supply chain management (SRM) project with the largest domestic company," adding, "Emro was selected as the final project through competition with global companies." He continued, "The next-generation project will deploy Emro's supply chain management software, cloud services, and AI functions as a full package." Furthermore, he analyzed, "It is expected to be the largest contract since the company's founding," and "Due to the nature of the next-generation project, the proportion of license sales will be high and profitability will be good."

Emro expects this year to be the inaugural year for overseas expansion together with Samsung SDS. Samsung SDS, which acquired Emro in May last year, developed the SRM SaaS solution together with Emro and Onine Solutions. They plan to begin full-scale overseas sales and marketing activities starting with the United States. Samsung SDS and Emro participated in the 'Gartner Supply Chain Symposium·Expo 2024,' held over four days from the 6th to the 8th. They attracted attention by introducing the SRM SaaS solution and various application cases to global customers.

Samsung SDS proposed supply chain risk response measures using AI and launched a full-scale market attack. Emro's opportunities for overseas expansion are expected to increase. Earlier, Samsung SDS held the 'Cello Square Media Day' on the 20th. Oh Gu-il, Vice President and Head of Samsung SDS Logistics Division, introduced, "Supply chain risks cannot be solved by IT or digital transformation alone," but added, "We will provide sustainable logistics services without interruption despite global supply chain changes by utilizing digital technology and AI."

Emro increased its R&D expenses and strengthened investments in the overseas SRM SaaS solution business. Emro plans to continue growth through ▲a rich sales pipeline ▲launch of a new version of supply chain management software ▲strengthening AI business ▲expanding sales through overseas market entry. An Emro official said, "While preparing for overseas expansion, we confirmed the competitiveness of Emro's supply chain management software and AI software," adding, "We will open the era of 'Emro 2.0,' advancing as a global leading software company."

Meanwhile, Emro's stock price has been rebounding since the 17th of last month. The stock price rose about 27% from 56,400 KRW on the 16th of last month to 71,500 KRW the day before. During the same period, the KOSDAQ index fell by 1.7%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)