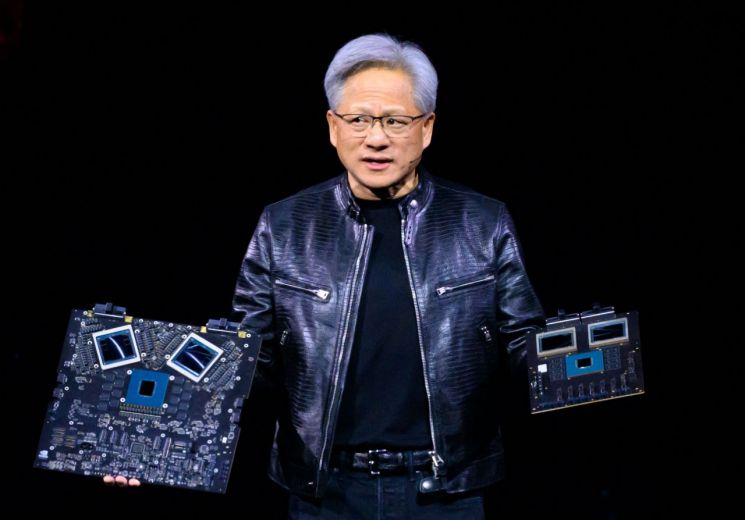

Jensen Huang, CEO of Nvidia, stated on the 22nd (local time) that demand for the company's semiconductors continues to outpace supply, and expressed confidence that growth will continue with the next-generation chip "Blackwell," scheduled for release at the end of this year. Nvidia, a leader in artificial intelligence (AI), saw its stock price surpass $1,000 per share in after-hours trading, boosted by better-than-expected earnings and news of a 10-for-1 stock split.

During an earnings conference call with analysts, CEO Jensen Huang said, "We are ready to ride the next wave of growth," adding, "We expect to generate a significant portion of this year's revenue from the Blackwell chip, which is scheduled for release at the end of the year." He predicted that the current situation, where demand for Nvidia products exceeds supply, will continue into next year.

Nvidia's first-quarter (February to April) revenue, released shortly after the New York Stock Exchange closed, rose 262% year-over-year to $26 billion, with adjusted earnings per share (EPS) increasing 461% to $6.12. These figures exceeded market expectations. The company also forecasted $28 billion in revenue for the current quarter, again surpassing Wall Street estimates. Additionally, Nvidia decided to implement a 10-for-1 stock split for its common shares. The quarterly cash dividend was also increased to $0.10 per share, up from $0.04 in the previous quarter.

Nvidia's strong performance is seen as an indication that demand for AI chips remains robust. Colette Kress, Nvidia's Chief Financial Officer (CFO), explained, "This was driven by increased shipments of our flagship AI chip, the H100, and other Hopper graphics processors," adding, "The biggest highlight of this quarter was Meta Platforms announcing the large language model LLaMA 3, which uses 24,000 H100 GPUs."

Regarding concerns that a lull might occur during the transition to the next-generation Blackwell chip as customers hold off on purchasing the existing Hopper model, CEO Huang dismissed these worries, saying, "Everyone wants to build out their infrastructure as quickly as possible." Earlier reports suggested that Amazon had halted orders for existing semiconductors from Nvidia in preparation for Blackwell's launch, but the company promptly denied these claims.

Furthermore, CEO Huang announced that Nvidia is developing the next-generation chip following Blackwell and plans to shift from the usual two-year release cycle for new chip architectures to an annual schedule. He stated, "We can confirm that there is another chip after Blackwell," and explained, "We are now operating on a one-year cycle."

Buoyed by strong growth expectations, Nvidia's after-hours stock price surged. Although the stock closed the regular trading session on the New York Stock Exchange down 0.46% at $949.50, it surpassed the $1,000 mark in after-hours trading. This is the first time Nvidia's stock price has exceeded $1,000 outside of regular trading hours.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.