Toss Bank Preliminary Q1 Net Profit 14.8 Billion KRW

All Three Banks Surpass 10 Million Customers, Sustaining External Growth

Emergence of 4th Internet Bank and Digital Transformation of Commercial Banks

Concerns Over Growth Slowdown, Calls for Profitability Assurance

"Need to Explore Overseas Expansion Through Japanese Cases"

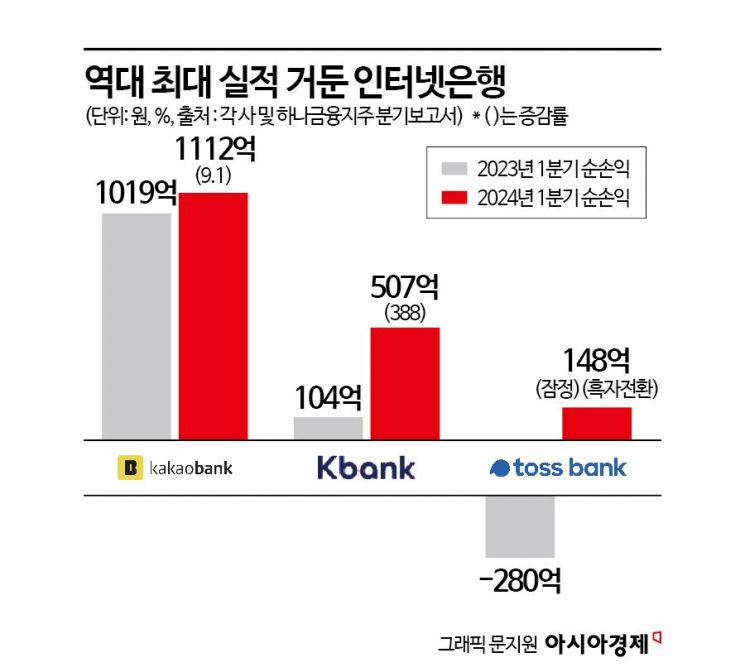

All internet banks achieved record-breaking performance in the first quarter. They have shown external growth not only in net profit but also in the number of customers and loan/deposit balances. However, concerns are rising that competition may intensify due to the emergence of a fourth internet bank and the digital transformation of commercial banks, leading to opinions that business strategies focusing on profitability rather than growth are necessary.

According to the first quarter report from Hana Financial Group on the 23rd, Toss Bank recorded a net profit of 14.813 billion KRW in the first quarter of this year. It turned profitable from a net loss of 28 billion KRW in the first quarter of last year. Although this is a preliminary figure before the official earnings announcement, the industry expects a net profit of at least 14 billion KRW. If so, Toss Bank will have posted net profits for three consecutive quarters, following 8.6 billion KRW in the third quarter and 12.4 billion KRW in the fourth quarter of last year. This is also the highest quarterly performance to date. Prior to this, the internet bank "seniors," Kakao Bank and K Bank, also announced record-breaking performances in the first quarter of this year. Kakao Bank and K Bank recorded net profits of 111.2 billion KRW and 50.7 billion KRW, respectively, in the first quarter. These figures represent increases of 9.1% and 388% compared to the first quarter of last year (101.9 billion KRW and 10.4 billion KRW).

The number of customers is also continuously expanding. Kakao Bank announced that more than 700,000 new customers joined during the first quarter. The monthly active users (MAU) exceeded 18 million for the first time. As of the first quarter, the number of customers reached 23.56 million, meaning about 46% of South Korea's population (51,751,065 as of this year) use Kakao Bank. K Bank also secured 10.33 million subscribers, an increase of 800,000 during the first quarter. Toss Bank surpassed 10 million customers last month.

The scale of loans and deposits is steadily increasing as well. As of the first quarter, the loan balances of Kakao Bank and K Bank amounted to 56.06 trillion KRW, an increase of about 36% (14.82 trillion KRW) compared to the same period last year. The increase is greater than the household loan growth of the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Banks), which was 12.8023 trillion KRW during the same period. Regarding deposit balances, Kakao Bank recorded 53 trillion KRW, up about 12% (5.8 trillion KRW) compared to the same period last year. This is about 82% of DGB Daegu Bank's 64.4084 trillion KRW, which has transitioned into a commercial bank. K Bank's deposit balance increased by 25.7% to 23.97 trillion KRW.

However, it is uncertain whether such external growth will continue in the long term. As discussions on the fourth internet bank become more active and the digital transformation of commercial banks accelerates, the advantages held by the existing three internet banks will gradually diminish. Based on the case of Japan, which introduced internet-only banks 17 years ahead of Korea, there are opinions that focusing on improving profitability in preparation for growth slowdown is necessary.

In a recent report titled “Development and Implications of Japanese Internet-Only Banks,” senior research fellow Lee Yoon-seok of the Korea Institute of Finance stated, “Compared to Japanese internet banks, Korean internet banks have higher growth potential but lower profitability, so improving profitability is very important.” He explained that Korean internet banks have succeeded in aggressive external expansion by increasing total assets based on low-interest loan supply and platform revenue, but their ROA (Return on Assets) is lower than that of Japanese internet banks. From 2019 to last year, the ROA of the three Korean internet banks ranged from -0.5% to 0%. In contrast, Rakuten Bank, Japan’s largest internet bank by total assets, approaches 0.5%, and Seven Bank, which has the highest profitability, recorded 1.4% last year.

Lee diagnosed that competition in the Korean banking industry is intensifying, and the previous growth trend may hit a wall. This is because the increase in internet banks is accompanied by fierce pursuit from commercial banks. He said, “In Japan, traditional banks have expanded their operations through digital financial products and sales channels, gradually narrowing the unique domain of internet banks,” and added, “In Korea, discussions on the fourth internet bank are actively underway, and if traditional banks accelerate digital transformation, the differences with internet banks will gradually diminish.” Furthermore, he predicted that demand for commercial banks to acquire ownership of internet banks with strategic partnerships or future potential will also decrease.

Lee emphasized that to improve profitability, Korea should refer to the cases of Japan’s Seven Bank, Sony Bank, and Rakuten Bank. Representative examples include overseas expansion through ATM location modeling using artificial intelligence (AI) big data (Seven Bank), real estate-secured loans using digital platforms (Sony Bank), and creating synergy effects among affiliates (Rakuten Bank). He also suggested that active overseas business is necessary. Especially since competitive applications and financial services provided through open banking are strengths, cooperation with public financial institutions (such as the Korea Financial Telecommunications & Clearings Institute and the Credit Information Center) should be sought for overseas expansion. This is because infrastructure environments based on high-speed internet such as 5G and IT systems must also be established in other countries to provide services similar to those in Korea.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.