Vice Chairman Jeon Young-hyun Leading Samsung Electronics Semiconductor

Multiple Challenges in Memory and System Businesses Emerge

Accelerated HBM Cycle Speeds Up Technology Development

Foundry Requires Advanced Process Competitiveness

Jeon Young-hyun, the vice chairman credited with creating the Samsung semiconductor legend, has taken charge of the semiconductor (DS) division, drawing increased attention to the scale of changes ahead. Industry experts say that Samsung must regain its ‘super-gap’ competitiveness?a core part of its DNA?not only in memory but across all areas including system semiconductors to achieve results.

According to the semiconductor industry on the 22nd, Jeon Young-hyun, the newly appointed head of Samsung Electronics’ DS division (vice chairman), immediately began grasping internal operations and refining strategic points following the ‘one-point’ personnel reshuffle on the 21st. It is reported that he has not yet delivered any messages to DS division employees.

Within the industry, there is a consensus that Jeon faces numerous challenges as Samsung Electronics’ semiconductor savior. Beyond revitalizing the overall organizational atmosphere, issues have emerged across both memory and system semiconductor businesses. In the memory sector, which holds the largest business share, Samsung’s super-gap competitiveness has weakened, while in the system sector, expanding market share remains difficult.

In particular, in the memory sector, Samsung must reclaim the leading position in the high-bandwidth memory (HBM) market?AI products stacking multiple DRAM chips?that it lost to competitor SK Hynix. Samsung Electronics has already introduced not only the latest generation HBM3E 8-stack but also 12-stack products. Quality tests (qual tests) are underway to supply products to Nvidia, a major player in the HBM market in the U.S. Due to HBM demand exceeding supply, there are industry rumors that some products were supplied ahead of qual tests, but since there has been no official delivery announcement, market attention remains high.

Market research firm TrendForce estimates that HBM will account for 21% of DRAM market sales this year and could exceed 30% next year. Increasing market share in HBM is seen as essential to boosting company performance and enhancing competitiveness and market share in the DRAM market. Moreover, with both Samsung Electronics and SK Hynix targeting next year for mass production of next-generation HBM4 products, the product replacement cycle has accelerated, speeding up technology development.

An industry insider said, "To improve HBM yield (the ratio of good products among finished goods), efforts must be made not only in product development but also in manufacturing technology development. As the HBM replacement cycle accelerates, if Samsung Electronics can regain its previous super-gap capabilities, it is expected to achieve better market results."

In the system semiconductor sector, Samsung must increase market share in both design and foundry markets to achieve the ‘2030 System Semiconductor No. 1 Vision.’ Earlier, Samsung Electronics Chairman Lee Jae-yong presented this vision in 2019, aiming to grow the system semiconductor business alongside the company’s core memory business. However, industry evaluations suggest that achieving this vision under current circumstances will be challenging.

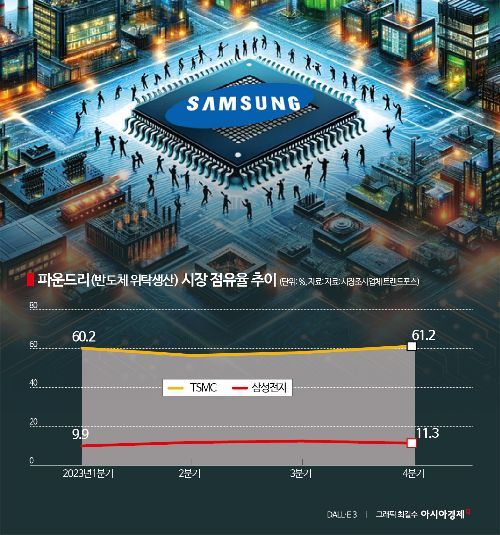

In particular, in the foundry sector, Taiwan’s TSMC, the market leader, holds over 60% market share, while Samsung Electronics’ share declined to the 11% range as of Q4 last year. Additionally, Intel, which announced its re-entry into the foundry market in 2021, is rapidly expanding its business, intensifying competition. Notably, Intel changed its accounting standards this year to include self-produced products in foundry sales, causing its sales figures to surpass Samsung Electronics, signaling rapid market changes.

Industry experts say that to enhance foundry competitiveness in this environment, Samsung must ultimately compete in advanced process technology. With the 2nm era anticipated next year, Samsung needs to leverage its advantage in gate-all-around (GAA) technology introduced earlier in the 3nm process and improve yields. Securing abundant design assets (IP) and semiconductor design automation (EDA) tools to increase Samsung foundry’s attractiveness is also a key task.

An industry insider said, "Vice Chairman Jeon Young-hyun is regarded as an expert who possesses a perfect combination of technology, experience, and know-how in the industry. He must reduce concerns inside and outside the company, swiftly address challenges, and devote all efforts to finding future growth engines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.