National Pension Regular Investment Hits First Trillion-Won Scale

Government Employees Pension Makes Blind Fund Investment After 5 Years

'Relief' Amid Liquidity Squeeze... Active Participation by Public Institutions

Major pension funds and mutual aid associations are making 'record-breaking' investments in private equity funds (PEFs). This is seen as a 'godsend' for PEF managers who have recently been struggling with fundraising (fund raising).

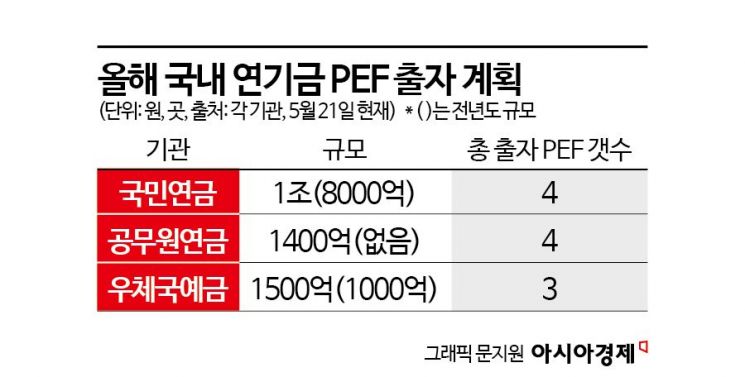

According to the investment banking (IB) industry on the 22nd, the National Pension Service and the Government Employees Pension Service are currently selecting entrusted managers for PEF blind funds (funds that select investment targets after raising capital). The Postal Savings has already selected PEF managers for its mezzanine (subordinated) strategy investment project. The total planned investment amount by these institutional investors this year reaches 1.29 trillion KRW.

The annual PEF investment scale by pension funds and mutual aid associations was 1.58 trillion KRW in 2022 and 2.29 trillion KRW last year. Considering other major players such as the Private School Teachers’ Pension and several mutual aid associations expected to invest in the second half of the year, the total capital flowing into PEFs by the end of the year is expected to surpass last year’s scale. Pension funds and mutual aid associations are steadily increasing alternative investments that can expect high returns, with private equity being one of the representative investment targets.

National Pension Service’s First Regular Investment Hits 1 Trillion KRW... Government Employees Pension Service Returns After 5 Years

The investment scale of each institution is at an all-time high. The National Pension Service will invest 1 trillion KRW in PEFs through its regular investment project this year, a 25% increase from last year’s 800 billion KRW. Compared to 500 billion KRW in 2022, it has doubled in two years. The number of managers to be finally selected also increased from three last year to four this year. Around 15 firms, including MBK Partners, have applied, signaling fierce competition. A shortlist of qualified candidates is expected to be drawn up next month.

The Government Employees Pension Service is recruiting entrusted managers for blind funds for the first time in five years since its 120 billion KRW investment in 2019. Proposals will be accepted until the 3rd of next month. The investment scale is 140 billion KRW, and four managers will be selected in total: two for the large league with 40 billion KRW each, and two for the medium league with 30 billion KRW each. The Postal Savings increased the scale of its mezzanine strategy investment project from 100 billion KRW last year to 150 billion KRW this year. Last month, SG Private Equity, Dominus Investment, and J&Private Equity were selected as preferred negotiation candidates for entrusted managers.

Prolonged Fund Raising 'Drought'... Busy PEFs

From the managers’ perspective, the investment moves by domestic institutions are nothing short of a 'godsend.' The ongoing 'three highs' (high interest rates, high exchange rates, and high inflation) have made fundraising a challenging environment. Globally, the situation remains tough, and domestically, liquidity has shrunk as Saemaeul Geumgo, which was active in PEF investments, has effectively stopped investing following a corruption scandal.

The same applies to large PEF managers. MBK Partners even applied for a PEF investment project by the Radioactive Waste Management Fund under the Korea Radioactive Waste Agency. The project was to select up to four managers with a total scale of 100 billion KRW. Considering MBK Partners’ 'weight class,' some found this surprising amid participation by small and medium-sized PEF managers. Han & Company, which had previously raised funds solely through overseas institutional investors, participated in the National Pension Service’s regular investment project for the first time last year. It was selected as an entrusted manager along with IMM Private Equity and Macquarie Asset Management.

Not only pension funds and mutual aid associations but also government financial institutions are actively investing. KDB Industrial Bank will invest 489 billion KRW in the first phase of the Innovation Growth Fund this year. The Export-Import Bank is selecting managers to invest 150 billion KRW in funds focused on advanced strategic industries such as semiconductors, batteries, and bio. PEF managers are competing fiercely. Fourteen firms have applied, and three will be finally selected (competition ratio of 4.6 to 1).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.