SKIET Sale 'Tapping'... The Key Issue is the 86% Internal Transaction Ratio

SK Battery Needs Future Investment Funds... If Successful, Financing Will Be Eased

"There are too many internal transactions to perform a proper valuation."

Recently, a subsidiary of SK Group was put up for sale in the market but received a "valuation impossible" judgment from the mergers and acquisitions (M&A) industry. Although the company has rapidly grown alongside the electric vehicle and battery markets and is even listed on the KOSPI, it relies excessively on sales to affiliated companies and has not been recognized for independent market competitiveness. This is not just an issue for SK Group alone but is raising concerns as a problem faced by the entire domestic large conglomerate sector, which urgently needs business restructuring and future investments.

Urgent Need for Battery Investment Funding... Market Judges 'Valuation Impossible' Due to Excessive Internal Transactions

According to the investment banking (IB) industry on the 22nd, SK Group’s battery separator manufacturer SK IE Technology (SKIET), which is pursuing share sales for business restructuring and fundraising, has an internal transaction ratio of 86%.

Out of the total sales of 649.6 billion KRW in 2023, transactions with related parties such as SK On, SK On Hungary, and SK Battery America amount to 559.3 billion KRW.

A senior official from the IB industry explained, "In the case of SKIET, the internal transaction ratio with the battery affiliate SK On is so high that it is difficult to evaluate the corporate value itself. When it is within the family, even if the quality is somewhat lower, confidentiality is maintained and sales or margins are guaranteed due to the convenience of transactions. However, when a third party takes over, it is difficult to maintain past sales or profits."

Since most of SKIET’s sales occur with SK battery affiliates, its competitiveness after the sale cannot be guaranteed. Of course, negotiation terms can be adjusted, such as promising stable volume for a certain period.

A senior official from the financial industry familiar with M&A stated, "For such M&As, additional negotiation terms should be added, such as guaranteeing contracts between existing affiliates for a certain period to enable independent survival."

Currently, SK Group urgently needs additional funds for overseas factory expansions, including in the United States, to expand its global battery market share. SK On’s planned facility investment funding for this year amounts to approximately 7.5 trillion KRW.

There were expectations that if the SKIET sale is completed, the group could overcome the immediate funding shortage, but market reactions have been cold.

SKIET, which went public in 2021, attracted record-breaking subscription deposits at the time of its IPO due to the influx of investment funds into secondary battery-related companies, drawing attention as a major public offering.

SKIET’s current stock price is in the 50,000 KRW range, down to a quarter of its initial price of 210,000 KRW.

Top 10 Largest Conglomerates’ Internal Transactions Approaching 200 Trillion KRW... An Obstacle to Corporate Competitiveness and M&A

The decline in competitiveness and flexibility caused by excessively high internal transaction ratios among affiliates is not just a problem for SK Group.

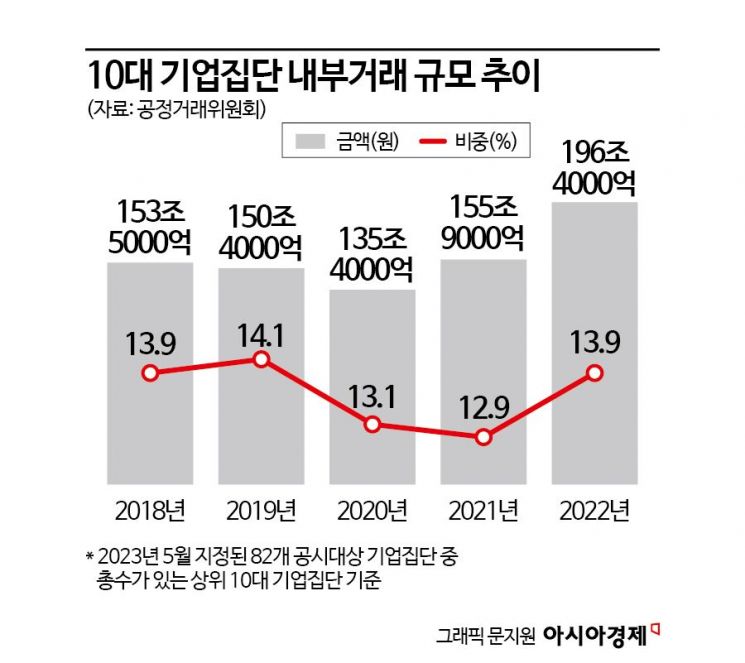

As of the end of 2022, the most recent data, the total internal transaction amount among domestic affiliates of the top 10 conglomerates with controlling shareholders (Samsung, SK, Hyundai Motor, LG, Lotte, Hanwha, GS, HD Hyundai, Shinsegae, CJ) reached 196.4 trillion KRW. Compared to 155.9 trillion KRW in 2021, this is an increase of 40.5 trillion KRW (26%) in just one year, the largest increase in the past five years.

By company, SK showed the largest increase in internal transaction ratio over one year. Extending the period to five years, Hyundai Motor Group showed the largest increase in internal transaction ratio.

Most large conglomerates are in urgent need of business restructuring, and internal transactions are identified as a strong obstacle to M&A or investment attraction.

A private equity fund official said, "If the internal transaction ratio is high, the sales pipeline is not diverse, which lowers the attractiveness of the company to acquirers. If business contracts with large corporations or affiliates are terminated, it immediately impacts performance."

Looking at past cases, in 2011 Samsung Group sold its maintenance, repair, and operations (MRO) company iMarketKorea to Interpark. At that time, iMarketKorea faced criticism for 'preferential treatment' due to its high internal transaction ratio. Samsung had to maintain transactions with iMarketKorea for a considerable period even after selling its shares.

There is also a view that the SKIET case has become an opportunity for the previously overvalued large conglomerate affiliates to be evaluated more objectively in the M&A market.

Professor Yoon Kyung-soo of Gachon University’s Department of Economics said, "The parts that were previously overvalued are now being accurately evaluated in the M&A market. Excessive internal transactions not only infringe on minority shareholders’ interests but also hinder the flexibility of corporate restructuring. This is a price to pay for the abnormal ways in which performance was previously demonstrated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)