Korea's No.1 Children's Clothing Company Seoyang Networks

100% Stake in Li & Fung Group in 2020

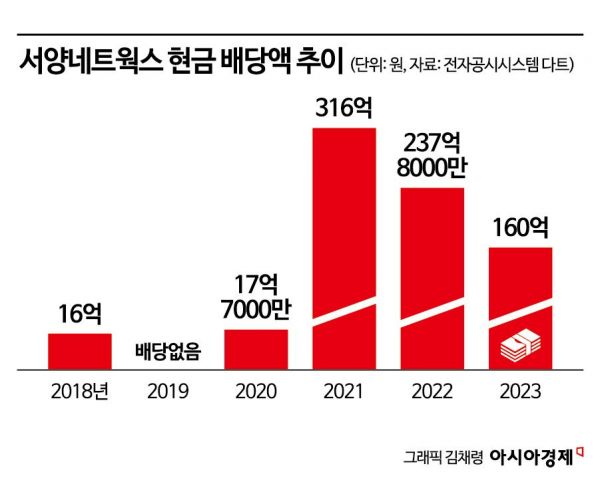

Dividends from 1.7 Billion KRW to 20-30 Billion KRW Range

It has been revealed that Western Networks, a children's clothing company embroiled in the Park Geun-hye administration's state affairs manipulation scandal, paid hundreds of billions of won in dividends to overseas investors after the Choi Soon-sil family divested their shares. Western Networks operates brands such as Blue Dog, Minkmu, and Little Ground, and is considered the number one company in the domestic children's clothing market based on sales.

According to the Financial Supervisory Service's electronic disclosure system on the 21st, Western Networks paid 16 billion won in dividends last year to Perfect Investment, which owns 100% of the company's shares. The cash dividends received by the largest shareholder amounted to 31.6 billion won in 2021, 23.78 billion won in 2022, totaling 71.38 billion won over the past three years.

Last year's cash dividends were about ten times higher than the 1.7 billion won dividends paid by Western Networks in 2020. In particular, compared to the 3.3 billion won in cash dividends paid from 2018 to 2020 before the sharp increase in high-value dividends, the dividends paid over the past three years exceed 20 times that amount.

Western Networks, established in 1991, is a children's clothing manufacturing and sales company managed by Seo Dong-beom, the husband of Choi Soon-cheon, the younger brother of Choi Soon-sil. Seo and related parties held 100% of the shares as the largest shareholders until 2013, when they handed over more than 70% of the shares to Perfect Investment B.V., a subsidiary of the Hong Kong-based distribution company Lianfeng Group, relinquishing their position as the largest shareholder. Seo Dong-beom secured the remaining 30% of the shares and management rights. Subsequently, all shares held by Perfect Investment B.V. were transferred to Perfect Investment.

Perfect Investment was suspected of being a 'slush fund channel' for the Choi Soon-sil family during the Park Geun-hye administration's state affairs manipulation scandal in 2016. Because of this, Western Networks' children's clothing brands, including Blue Dog, became targets of boycotts.

The sharp increase in dividends occurred after CEO Seo sold his 30% stake to Perfect Investment in November 2020 and left the company. Western Networks had a no-dividend policy after paying 2 billion won in dividends in 2012 but paid an interim dividend of 1.6 billion won for the first time in 2017, followed by 16 billion won in 2018 and 1.7 billion won in 2020. However, dividends sharply increased immediately after CEO Seo stepped down.

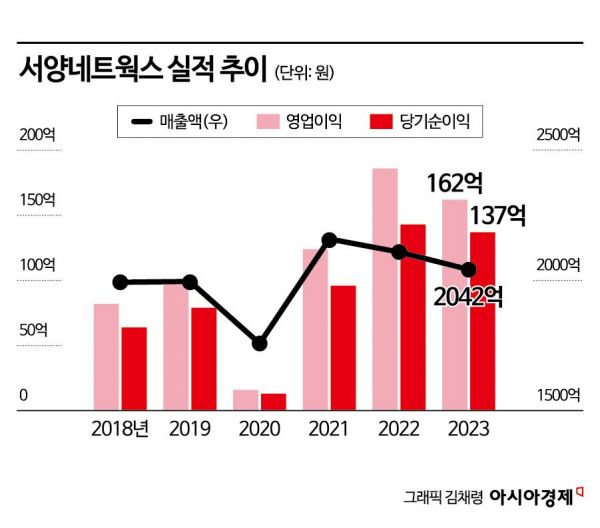

During this period, sales essentially remained flat. Although sales dropped by 10% to 175.8 billion won in 2020 when the COVID-19 pandemic began, the company recorded sales around 200 billion won in recent years.

However, dividends over the past three years far exceed the company's annual profits. While dividends can increase if net income accumulates and cash increases, Western Networks' net income only slightly increased. For example, the 31.6 billion won dividend in 2021 far exceeded the operating profit of 12.4 billion won and was more than three times the net income of 9.3 billion won that year.

In the distribution industry, it is believed that Perfect Investment is taking massive dividends to recover its investment. The acquisition price of Western Networks by Perfect Investment is known to be around 200 billion won. Currently, the domestic children's clothing market has significantly shrunk due to low birth rates, and with the luxury children's clothing market growing, the value of Western Networks' shares is estimated at around 120 billion won. Previously, Lianfeng Group attempted to sell Western Networks in 2020 but reportedly halted due to the impact of COVID-19 and other factors. An industry insider said, "Considering that the Hong Kong company sought investors in 2020, it seems they are focusing on securing investment returns through company operations and appear to be trying to recover their investment before selling."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.