Most Facility Investments Are for New Factory Expansion

Performance and Order Backlog Also Increase in a 'Virtuous Cycle'

As the demand for electricity from companies increases due to the artificial intelligence (AI) boom, the top three power equipment manufacturers (LS Electric, HD Hyundai Electric, and Hyosung Heavy Industries) are making aggressive investments. Their facility investment in the first quarter reached twice the amount of the same period last year.

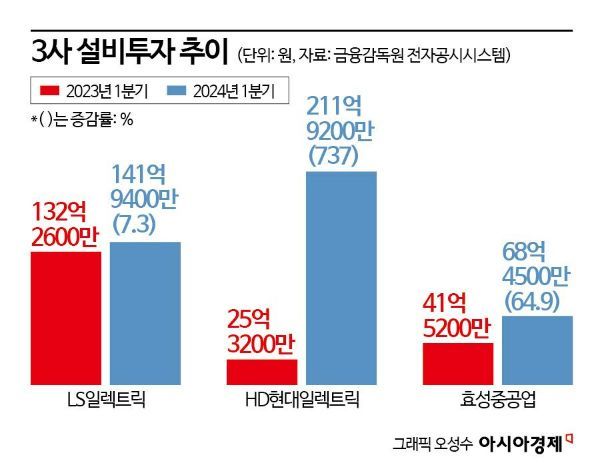

According to the first-quarter reports of these 'Big 3' on the 21st, the total facility investment of the three power equipment companies during this period was 42.231 billion KRW, an increase of 112.1% compared to 19.91 billion KRW in the same period last year. LS Electric invested 14.194 billion KRW, a 7.3% increase over the same period, while HD Hyundai Electric invested 21.192 billion KRW, a staggering 737% increase from 2.532 billion KRW in the previous year. Hyosung Heavy Industries invested 6.845 billion KRW, up 64.9% from 4.152 billion KRW in the same period last year.

Most of the facility investments were for new and expanded factories. HD Hyundai Electric invested 14.4 billion KRW to purchase land for a smart factory for medium- and low-voltage circuit breakers, and 2.214 billion KRW in a transformer iron core factory. Additionally, HD Hyundai Power Transformers spent 4.572 billion KRW to expand the transformer storage yard and material warehouse at its North American subsidiary. LS Electric invested 1.457 billion KRW in new facilities such as buildings, machinery, and molds in the first quarter, while Hyosung Heavy Industries spent 1.826 billion KRW on new and expanded factories, a 52% increase compared to 1.21 billion KRW in the same period last year.

The increase in investment is due to the surge in transformer demand, which also led to strong performance. LS Electric's operating profit rose 14.6% year-on-year to 93.7 billion KRW. HD Hyundai Electric and Hyosung Heavy Industries recorded operating profits of 128.8 billion KRW (up 178.1%) and 56.2 billion KRW (up 298.2%), respectively.

Considering the increase in facility investment and the nature of the investments, there is an analysis that the long-term boom potential is high. The securities industry expects that since power grid investments will take at least five years, there will be growth momentum factors for more than three years ahead. Choi Moon-sun, a researcher at Korea Investment & Securities, said, "More Korean companies are expected to build more local factories in the U.S., and U.S. power grid investments are expected to become more active in the future."

LS Electric stated in its quarterly report, "Global power grid investments are expected to increase from $235 billion (approximately 327 trillion KRW) in 2020 to $636 billion (approximately 886 trillion KRW) by 2050." It added, "The U.S. announced the 'Low Carbon and Clean Infrastructure Investment Plan' in March 2022, which is expected to increase market potential, and Korea also announced a power system innovation plan, planning to invest about 75 trillion KRW by 2030 to expand the power grid, so substation construction projects will continue to expand."

In fact, the order backlogs of these companies were 2.6 trillion KRW for LS Electric (up 13% year-on-year), 6.9 trillion KRW for HD Hyundai Electric (up 66.4%), and 4.1 trillion KRW for Hyosung Heavy Industries (up 17.1%).

Meanwhile, on the same day, LS Electric announced plans to double the production capacity of ultra-high-voltage transformers at its Busan plant to accelerate its global transmission and distribution market strategy. It plans to invest 80.3 billion KRW to expand the factory by next year. The Busan plant is LS Electric's core production base for ultra-high-voltage power equipment. The annual production capacity of ultra-high-voltage transformers, currently worth 200 billion KRW, will be increased to about 400 billion KRW by October next year. The factory expansion will be completed by September next year.

An LS Electric official said, "We have already secured orders exceeding the increased production capacity from this expansion and will actively respond to the surging overseas demand for ultra-high-voltage transformers in the North American investor-owned utilities (IOU) and renewable energy markets." He added, "This investment is not aimed at short-term profits based on the boom but is a sustainable future growth investment." He further stated, "We will continue to expand our power infrastructure business through various methods such as mergers and acquisitions (M&A) and joint ventures both domestically and internationally."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.