30 Japanese Affiliates...Global Business Hub

Concerns Over Overall Business Contraction Amid Line Yahoo Incident

Naver's involvement in the Line-Yahoo incident has drawn attention to the potential impact on its other businesses in Japan. Japan is not only the first market where the messenger Line succeeded overseas, but it is also considered a forward base for content and B2B (business-to-business) operations. There are concerns that if Naver's influence in Japan diminishes, its overall business could shrink.

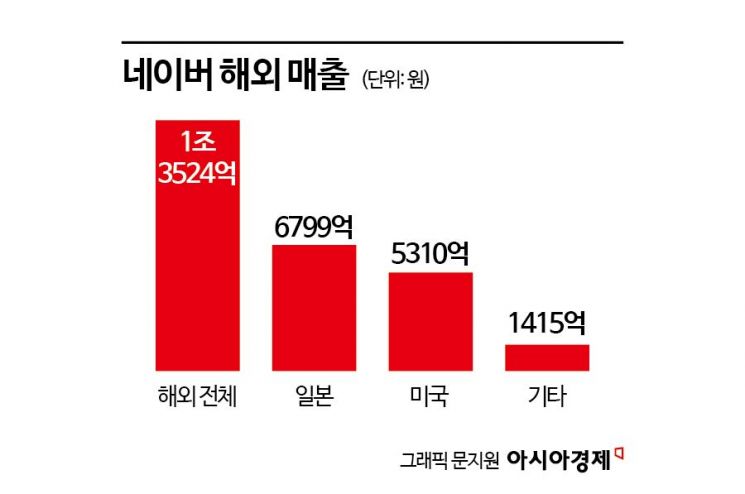

Japan accounts for half of overseas sales

According to industry sources and Naver's business report on the 21st, as of the end of last year, Naver has a total of 30 affiliates operating in Japan. This is the result of about 15 years since establishing its Japanese subsidiary, Naver Japan, in 2001 and entering the market.

Besides Line, which has become the national messenger, content and B2B businesses form the two main pillars of Naver's operations in Japan. Even excluding Line, which has been excluded from Naver's consolidated sales since the third quarter of 2020, Japan's sales?including content and B2B?account for the largest share of global sales. Last year, Naver earned 1.3524 trillion KRW overseas, about half of which, 679.9 billion KRW, came from Japan.

The content business is represented by webtoons. Naver Webtoon operates 'Line Manga' through its Japanese affiliate Line Digital Frontier. It also provides the e-book service 'eBook Japan' through eBook Initiative Japan, a subsidiary of Line Digital Frontier. Through this, it leads the Japanese digital comics market.

In the B2B sector, Naver Cloud Japan and Works Mobile Japan provide IT infrastructure and groupware services. Beyond infrastructure supporting Line-related services, they are expanding their market share in the Software as a Service (SaaS) market by bundling AI solutions, translation services, and more into their cloud offerings.

The Japanese market is important as a global forward base for these two businesses. Looking at the webtoon business alone, Japan has a large manga market and a rapidly growing digital comics sector. Capturing the Japanese market makes it easier to target other countries. As a strategic stronghold, Naver is strengthening its business in Japan. It is expanding its local intellectual property (IP) business by partnering with Japanese terrestrial broadcasters to establish webtoon studios and drama production studios.

The same applies to the B2B business. According to global market research firm IDC, Japan's software (SW) market size is $98.5 billion (about 135 trillion KRW), ranking fourth worldwide. It is more than six times the size of South Korea's market. Although digital transformation has accelerated rapidly since the COVID-19 pandemic, there is no dominant local cloud service provider (CSP), making it a promising market.

From job hunting to medical care... the lifestyle platform Line

Line, the core service, was developed by NHN Japan in 2011 and has evolved from a messenger into a comprehensive platform. Its related services are diverse. These include ▲news (Line News) ▲games (Line Games) ▲streaming (Line Music) ▲shopping (Line Shopping, Line Gift), as well as coupon services (Line Coupon), part-time job hunting (Line Arubaito), and non-face-to-face medical services (Line Doctor), deeply penetrating daily life.

Line has also established itself as a financial hub. In addition to easy payment and remittance (Line Pay), it offers securities trading (Line Securities), microloans (Line Pocket Money), cryptocurrency trading (Line Bitmax), and credit scoring services (Line Score).

The industry is paying close attention to the future impact of the Line incident. There is concern that anti-Korean sentiment in Japan could be stirred up, causing users to abandon the service or restricting business activities between companies. Especially in the B2B sector, where securing government projects and references through public-private cooperation is important, there are worries that this path could be blocked. Professor Changbeom Lee of Dongguk University's Graduate School of International Information Security said, "If the Japanese government engages in a public opinion campaign, users may react by rushing to withdraw, and partners or clients could be affected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.