The loan balance of Saemaeul Geumgo has decreased by more than 16 trillion won in one year. This was influenced by the Saemaeul Geumgo Central Association tightening loan regulations due to rising delinquency rates, which almost halted new corporate loans.

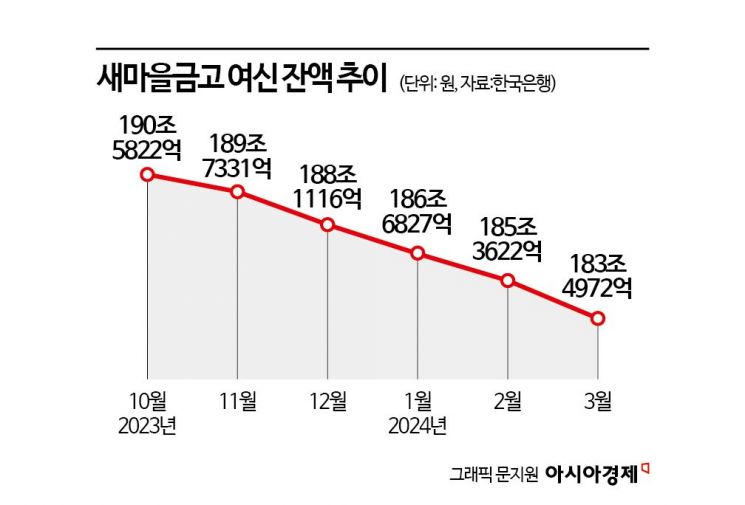

According to the Bank of Korea's Economic Statistics System on the 21st, as of the end of March, Saemaeul Geumgo's credit balance was recorded at 183.4972 trillion won. This is a decrease of 1.865 trillion won compared to the previous month. Compared to the previous year, it decreased by 16.5274 trillion won. Looking at the credit balance over the past two years, this is the lowest since April 2022 (185.8117 trillion won).

Saemaeul Geumgo's loans have been decreasing every month since January last year. Since the related statistics were first compiled in October 1993, Saemaeul Geumgo's loans steadily increased except for some years such as during the foreign exchange crisis. During 2021 and 2022, when real estate project financing (PF) was active, the credit balance increased significantly by 33.8221 trillion won and 24.5043 trillion won respectively compared to the previous year.

However, the situation completely changed starting last year. The rise in Saemaeul Geumgo's delinquency rates combined with the downturn in the real estate market caused loans to gradually decrease. As of last year, Saemaeul Geumgo's overall delinquency rate was 5.07%, up 1.48 percentage points from the previous year. For corporate loans, it rose 2.13 percentage points to 7.74%, approaching 8%.

As the delinquency rate increased, the Saemaeul Geumgo Central Association recently issued guidelines to all nationwide branches, in principle restricting joint loans and unsold collateral loans except for household loans. A representative from the Saemaeul Geumgo Central Association said, "Currently, new corporate loans are almost completely blocked," adding, "As large corporate loans decrease, the credit balance is likely to decline further."

The deposit balance has recovered to average levels. As of the end of March, Saemaeul Geumgo's deposit balance was 260.0811 trillion won, an increase of 1.7351 trillion won compared to the previous month, and 18.2252 trillion won more than in July last year, when it experienced a bank run (massive deposit withdrawal) crisis. However, the launch of high-interest deposit products is being avoided. Since loan operations are almost halted, it is difficult for each branch to manage funds properly. A Saemaeul Geumgo official conveyed the atmosphere, saying, "Both credit and deposits are being managed at the level of maintaining existing operations, and active business is not possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.