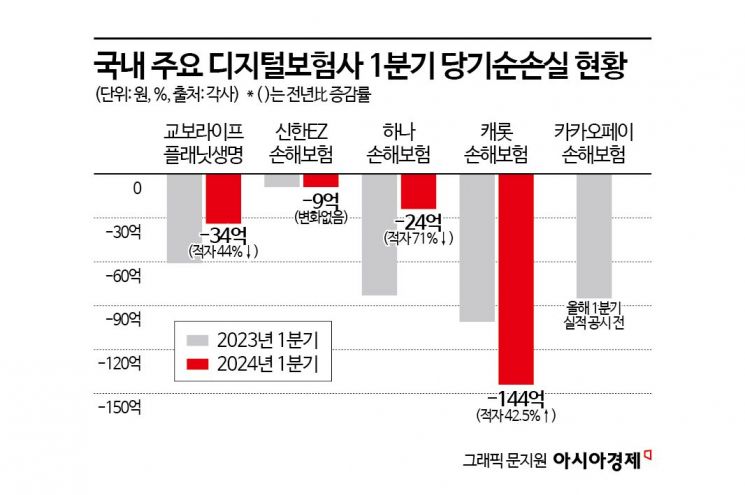

Kyobo Lifeplanet Improves Deficit by 44.2%·Hana Insurance by 71%

Shinhan EZ Insurance Records 900 Million KRW Loss, Same as Last Year

Organizational Restructuring and Product Diversification Underway to Improve Profitability

In the first quarter of this year, digital insurance companies are reducing their losses and striving to secure profitability. To expand the 'catfish effect' sparked in the automobile and travel insurance markets to other insurance sectors, they are personalizing and diversifying product lines and coverage to attract subscribers.

According to the Financial Supervisory Service on the 21st, Kyobo Lifeplanet Life Insurance recorded a net loss of 3.4 billion KRW in the first quarter of this year. This nearly halved the loss from 6.1 billion KRW in the first quarter of last year. Lifeplanet, which has been operating at a loss for 11 years since its establishment in 2013, is putting all efforts into improving profitability this year. On the 12th of last month, organizational restructuring was carried out, including the appointment of Shin Jung-hyun, the second son of Kyobo Life Chairman Shin Chang-jae and head of Lifeplanet's digital team, as head of the Digital Strategy Office. Under the slogan 'Reboot,' the company is undertaking comprehensive innovation of products and strengthening its insurtech (insurance + technology) business. Lifeplanet's new protection insurance contracts increased by 41% year-on-year last month, indicating gradual improvement in profitability.

Hana General Insurance posted a net loss of 2.4 billion KRW in the first quarter of this year. The deficit decreased by 71% compared to 8.3 billion KRW in the same period last year. Hana General Insurance, launched in 2020 after Hana Financial Group acquired The-K Non-Life Insurance, is focusing on health and life insurance while reducing dependence on automobile insurance to escape chronic losses this year. In January, they recruited CEO Bae Sung-wan, who worked at Samsung Fire & Marine Insurance for about 30 years. He is the first external CEO of Hana General Insurance. Although there was a temporary quarterly profit after CEO Bae's appointment, losses continued due to increased costs for IT infrastructure to diversify the portfolio.

Shinhan EZ Non-Life Insurance, a digital insurer established by Shinhan Financial Group in 2021, posted a net loss of 900 million KRW in the first quarter of this year, the same as the previous year. Shinhan EZ Non-Life is currently focusing on developing indemnity insurance as its main product to escape losses. They plan to launch the 4th generation indemnity medical insurance in the second half of this year. Although indemnity insurance has a high loss ratio, it is advantageous for customer acquisition due to high demand. With the introduction of 'simplified indemnity insurance claims' in the insurance industry this October, non-reimbursed medical treatment details will be digitized and pricing rationalized, which is expected to significantly improve the loss ratio of indemnity insurance. They also plan to focus on developing six lifestyle-oriented insurance products including health, mobility, pets, housing, electronic devices, and small and medium-sized enterprises (SMEs).

Carrot General Insurance, Korea's first digital non-life insurer, recorded a net loss of 14.4 billion KRW in the first quarter of this year. So far, it is the only digital insurer whose performance worsened compared to the same period last year (-10.1 billion KRW). Carrot General Insurance is pursuing a strategy to further enhance benefits for its main product, automobile insurance. Recently, Carrot introduced a service that offers up to a 20% discount on premiums based on safe driving levels, causing a stir in the industry. In March, they also strengthened consumer protection by providing points equivalent to 10% of the paid premium for travel insurance.

Kakao Pay General Insurance has not yet disclosed its first-quarter results for this year. It recorded a net loss of 8.5 billion KRW in the first quarter of last year. Kakao Pay, the parent company of Kakao Pay General Insurance, succeeded in turning a profit in the first quarter of this year. Kakao Pay General Insurance attracted attention by launching an overseas travel insurance product in June last year that refunds 10% of the premium if the insured returns safely without accidents. This insurance surpassed one million subscribers within 10 months of launch. In March, Kakao Pay General Insurance also launched a driver insurance product that refunds 10% of the paid premium if no accidents occur. In June, they plan to diversify life-related insurance services by introducing pet insurance through Kakao Pay's insurance comparison and recommendation service.

There are also voices calling for regulatory improvements for digital insurers to turn profitable. A representative from a digital insurance company said, "Due to government regulations, digital insurers must recruit over 90% of contracts through non-face-to-face channels such as the internet and mobile, making them vulnerable to long-term insurance with complicated riders or coverage details. Unless the structure that forces reliance on mini-insurance is fundamentally improved, it will take considerable time to escape chronic losses." Another digital insurer representative said, "Operating telemarketing (TM) channels overlapping with the parent company's channels is not allowed, limiting sales activities. To enhance consumer convenience, it is necessary to partially relax telecommunication sales regulations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.