Loan balance decreased by 11 trillion won... Declining trend since 3Q 2022

Plan for business recovery with mid- and high-credit borrower loans in the second half

The scale of loans and deposits at savings banks has decreased by more than 10 trillion won over the past year. As the industry continued to post losses last year, attention is focused on this year’s performance outlook.

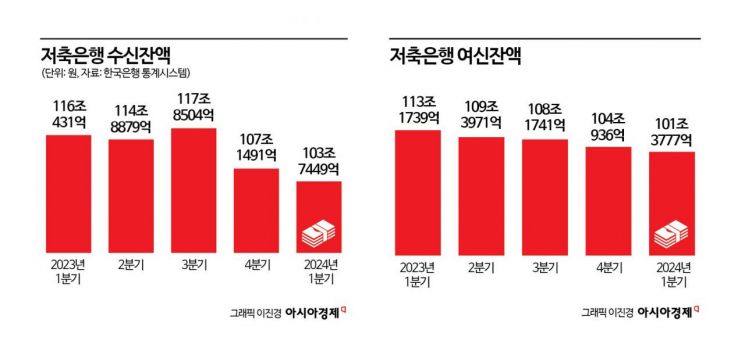

According to the Bank of Korea’s Economic Statistics System on the 21st, the deposit balance of mutual savings banks was recorded at 103.7449 trillion won as of the end of the first quarter of this year. This amount decreased by 3.4042 trillion won compared to the previous quarter and by 12.2982 trillion won compared to the same period last year. The deposit balance of savings banks has decreased for two consecutive quarters from 117.8504 trillion won in the third quarter of last year, marking the lowest level in nine quarters since the fourth quarter of 2021 (102.4435 trillion won).

Loans also declined. The loan balance stood at 101.3777 trillion won as of the end of the first quarter this year, down 2.7159 trillion won from the fourth quarter of last year and 11.7962 trillion won from the first quarter of last year. On a quarterly basis, this was the lowest since the fourth quarter of 2021 (100.5883 trillion won), and the downward trend has continued since the third quarter of 2022 (116.2769 trillion won).

The savings bank industry is shrinking due to concerns over “negative margins.” While the legal maximum interest rate is fixed, prolonged high interest rates have increased funding costs, making it unprofitable to issue loans. As they reduce loan assets, they also lose the incentive to attract deposits by offering high interest rates on savings and time deposits. An industry insider explained, “If deposit balances accumulate when loans cannot be aggressively issued, the cost burden increases. Since loans are being handled conservatively, deposit interest rates have been lowered to reduce the interest burden on savings and time deposits.”

The decline in loans and deposits in the savings bank sector is expected to continue into the second quarter of this year. The timing of the base interest rate cut has been delayed, and the financial authorities’ recent restructuring plan for real estate project financing (PF) has increased the burden of provisioning for bad debts. As the burden of provisions for non-performing projects such as land-secured loans and bridge loans grows, savings banks have no choice but to downsize.

In fact, savings banks are lowering deposit interest rates. SBI Savings Bank, ranked first in assets, lowered the interest rate on its parking account “Cider Deposit Account” from 3.1% per annum to 2.9% per annum on the 29th of last month, a 0.2 percentage point decrease. Aequan Savings Bank lowered the interest rate on its parking account “Plus Free Deposit” from 3.9% per annum to 3.5% per annum on February 1st, and further adjusted it to 3.3% per annum on the 11th of last month.

There were cases where savings bank fixed deposit interest rates were lower than those of commercial banks. According to the Bankers Association, as of the 17th, the representative fixed deposit products (12-month maturity) of the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?offered interest rates of 3.5% to 3.6%. The fixed deposit products (12-month maturity) of savings banks ranked high in assets?SBI, Aequan, and Welcome Savings Bank?offered rates of approximately 3.4%, 3.55%, and 3.6%, respectively. By lowering deposit interest rates to reduce interest expenses, the difference in rates compared to commercial banks has almost disappeared or even fallen below those of commercial banks.

However, in the second half of the year, the industry plans to revise its business strategy to accelerate the market recovery. An industry insider said, “We plan to shift the main target group from low-credit borrowers to medium- and high-credit borrowers.” He added, “Loans to medium- and high-credit borrowers have relatively smaller interest margins, so they need to be issued in a volume-driven, low-margin manner. Loan balances will increase mainly in savings banks targeting medium- and high-credit borrowers, and to fund these loans, the competitiveness of deposit interest rates in the savings bank sector will also improve.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)