Hankyungyeop-Affiliated Hankyung Research Institute Report Released

'Inheritance Tax Reform Measures to Revitalize Public Interest Corporations'

"Significant Social Costs Feared if Public Interest Corporations Shrink"

There has been a call to improve regulations on inheritance and gift taxes applied to public interest corporations affiliated with companies in order to promote donations and public interest activities.

The Korea Economic Research Institute (KERI), under the Korea Economic Association, included this in its report titled "Inheritance Tax Improvement Measures for Revitalizing Public Interest Corporations," released on the 20th.

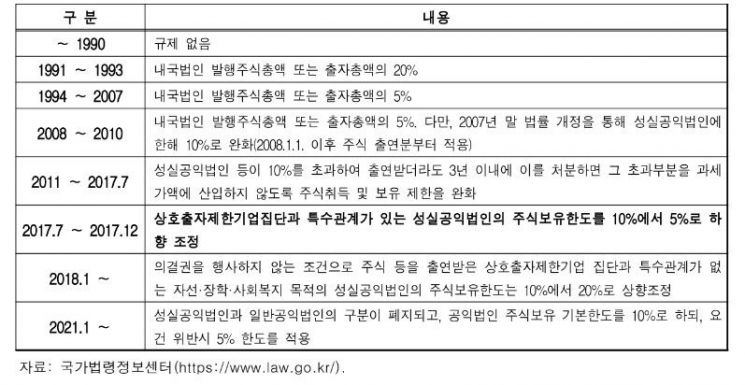

History of Restrictions on Stock Contributions to Public Interest Corporations. Photo by National Law Information Center, Korea Economic Research Institute under the Korea Employers Federation provided

History of Restrictions on Stock Contributions to Public Interest Corporations. Photo by National Law Information Center, Korea Economic Research Institute under the Korea Employers Federation provided

KERI cited data compiled by the Fair Trade Commission, noting that the number of public interest corporations affiliated with domestic publicly disclosed business groups (with total assets of 5 trillion won or more) slightly increased from 66 in 2018 to 79 in 2022, but the average shareholding ratio of affiliates by public interest corporations actually decreased from 1.25% to 1.10%. It analyzed that the current tax regulations on stock donations to public interest corporations are hindering their activities. The burden of inheritance and gift taxes is causing corporate social activities such as stock donations to public interest corporations to shrink.

KERI stated that with the recent emphasis on ESG (Environmental, Social, and Governance) management, the role of companies in discovering and solving social issues through public interest foundations is being highlighted, but in Korea, it is difficult to perform this role due to tax regulations on stock donations to public interest corporations.

Furthermore, KERI suggested that stock donations by companies to public interest corporations should be recognized as a key means for the smooth execution of public interest projects, and related inheritance and gift tax regulations should be improved. In particular, it argued that public interest corporations affiliated with mutual investment-restricted business groups whose asset size exceeds 0.5% of nominal domestic GDP generally have sound financial conditions, so the exemption limit for inheritance and gift taxes should be reviewed to induce the social return of funds they hold.

Lim Dong-won, a senior research fellow at KERI, said, "The contraction of public interest corporation activities could lead to a reduction in public interest projects that benefit society as a whole, causing significant social costs," adding, "If excessive tax burdens are improved, the establishment of public interest corporations will increase, and donations and public interest activities will become more active."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.