1.91 Million Long-Term Foreign Residents in Q1

Only 4 out of 10 foreigners residing long-term in South Korea are enrolled in private insurance. It is analyzed that domestic insurance companies need to develop insurance products targeting this group.

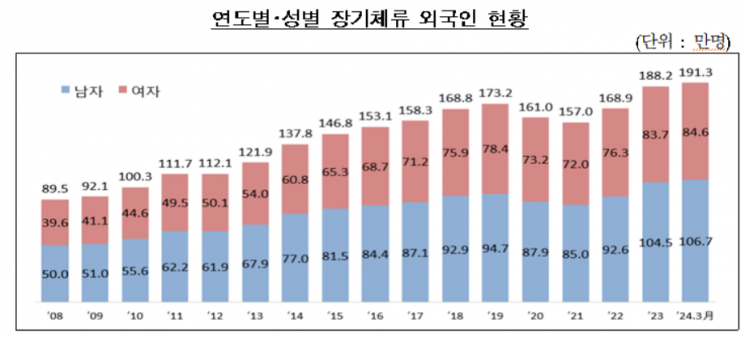

According to the Insurance Development Institute on the 17th, as of the first quarter of this year, the number of foreigners excluding short-term stays (such as travel within 90 days) was 1.91 million, a 13% increase compared to 1.69 million at the end of 2022.

The number of long-term foreign residents in their 20s and 30s has been steadily increasing. It rose from 850,000 in 2018 to 930,000 in the first quarter of this year. This means that the number of 'potential customers' expected to subscribe to insurance has increased accordingly.

As of the end of 2022, 690,000 long-term foreign residents were subscribed to at least one of life insurance, long-term casualty insurance, or automobile insurance, resulting in an insurance subscription rate of 41%. By insurance type, there were 310,000 in life insurance, 420,000 in long-term casualty insurance, and 220,000 in automobile insurance.

Excluding group insurance enrolled through workplaces, life insurance subscriptions were highest for health, cancer, and accident insurance in that order. For long-term casualty insurance, accident insurance had the highest subscription rate, and this tendency was similar to that of Koreans.

For both life and long-term casualty insurance, subscription rates by age group showed similar levels between men and women. However, the subscription rate among foreign men in their 30s and 40s was significantly lower compared to women of the same age group, suggesting a considerable possibility of coverage gaps.

In the case of automobile insurance, the proportion of foreigners choosing own vehicle damage coverage (62%) was lower than that of Koreans (83%), indicating a higher price sensitivity. Although the proportion of foreigners subscribing to automobile insurance online is increasing similarly to Koreans, face-to-face sales still account for a high 66%.

An official from the Insurance Development Institute stated, "The number of foreigners, which briefly slowed during the COVID-19 period, is steadily increasing again, so continuous interest in insurance for foreigners is necessary," adding, "Considering the diverse characteristics of foreigners, existing insurance products should be reorganized, and insurance products that meet the purpose of stay and coverage needs should be expanded."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)