HD Hyundai Marine Solution, the Biggest IPO of the First Half, Sailing Smoothly After Listing

Reached 199,200 KRW Intraday on the 13th, Approaching 200,000 KRW

High Possibility of Special Inclusion in KOSPI 200 Next Month

HD Hyundai Marine Solutions, the biggest IPO of the first half of this year, is sailing smoothly after its listing. It entered the top 50 in market capitalization within just four trading days of joining the KOSPI market, raising expectations for its special inclusion in the KOSPI 200 index scheduled for next month.

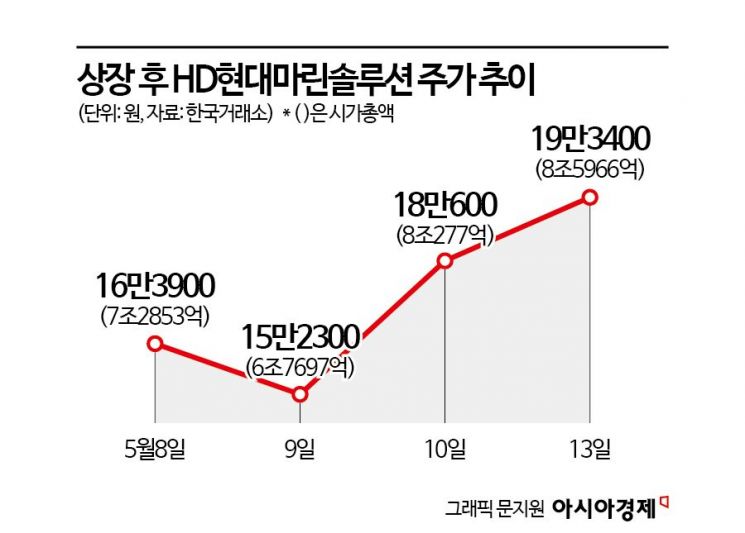

According to the Korea Exchange on the 14th, HD Hyundai Marine Solutions has risen for two consecutive days recently and is on the verge of surpassing 200,000 KRW. It closed at 193,400 KRW, up 7.09% from the previous day. This marks an increase of over 14% compared to the closing price on the first day of listing. HD Hyundai Marine Solutions, which was listed on the 8th, surged more than 96% on its first day, reaching the 160,000 KRW range. Although the stock price fell the next day, it rose for two consecutive days afterward, settling in the 190,000 KRW range. During the previous trading session, it even reached 199,200 KRW intraday.

The market capitalization, which was 7.2853 trillion KRW on the first day of listing, has exceeded 8.5 trillion KRW, and its market cap ranking rose to 48th, entering the top 50.

As the stock price continues to perform well, attention is focused on whether HD Hyundai Marine Solutions will be specially included in the KOSPI 200. To be specially included in the KOSPI 200 index, the average daily market capitalization within 15 trading days from the listing date must be within the top 50. The securities industry views the possibility of HD Hyundai Marine Solutions’ special inclusion as high.

According to Shinhan Investment Corp., an analysis of the stock prices of seven IPO stocks that were specially included in the KOSPI 200 since 2020 (Ecopro BM, LG Energy Solution, Kakao Pay, Krafton, Kakao Bank, SK IE Technology, SK Biopharmaceuticals) shows that their average returns over 15 trading days after IPO exceeded the KOSPI by 26 percentage points. Jin-hyuk Kang, a researcher at Shinhan Investment Corp., explained, "Considering that the average 15-day increase rate of large IPOs is 26 percentage points higher than the KOSPI, it can be said that HD Hyundai Marine Solutions has a sufficient possibility of special inclusion in the KOSPI 200."

Kyung-beom Ko, a researcher at Yuanta Securities, said, "HD Hyundai Marine Solutions has a low float as the second-largest shareholder KKR’s 24.2% stake is under a six-month lock-up." He added, "Ecopro BM also experienced repeated stock price increases due to a low float in the second half of last year and was included in the KOSPI 200." He further noted, "If the market capitalization remains within the top 50 during the 15 trading days from the listing date, it can be specially included on the next regular rebalancing date on the 13th of next month."

However, inclusion in the MSCI Korea Index this year seems unlikely due to the low free float ratio. Researcher Kang said, "HD Hyundai Marine Solutions’ inclusion in the MSCI Korea Index this year is expected to fail due to the low free float ratio." He explained, "The current free float ratio is 16%, and the free float market capitalization calculated based on this is 1.1 trillion KRW, which is significantly below the free float market cap cut-off of 1.8 trillion KRW for index inclusion/exclusion." Inclusion in the MSCI Korea Index is expected around February next year. Kang predicted, "Assuming the current stock price level is maintained, inclusion in the MSCI February review next year will be possible after the six-month lock-up period ends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)