Brookings Institution Survey

34% of Respondents Say "Inflation Target Should Be Set as a Specific Range, Not a Number"

Three out of ten economic experts in the U.S. academic and private sectors believe that the Federal Reserve (Fed) should raise its inflation target from the current 2%. Despite the highest benchmark interest rate in 23 years, U.S. inflation has not been fully controlled, and some argue that the inflation target should be raised to secure flexibility in monetary policy amid concerns about economic slowdown.

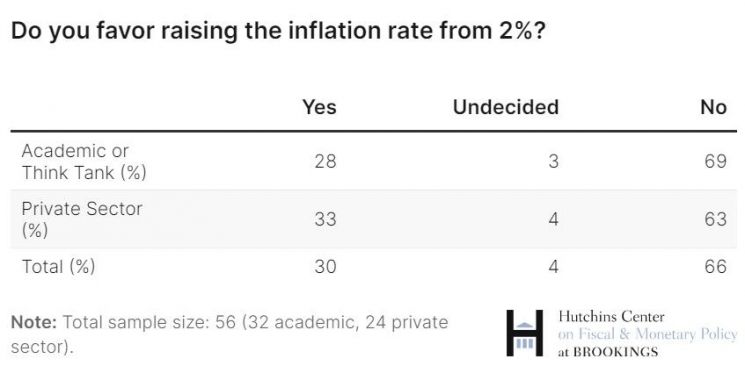

According to a recent "Fed Communication Evaluation" survey conducted by David Wessel, head of fiscal and monetary policy at the Hutchins Center under the Brookings Institution, a U.S. think tank, among 56 experts, 30% of respondents said the Fed should further raise its inflation target. The Hutchins Center's Fed Communication Evaluation, conducted every four years, included 32 scholars and researchers and 24 private sector experts this year.

The appropriate inflation target suggested by experts who supported raising the Fed's inflation target ranged from a minimum of 2.5% to a maximum of 4%.

On the other hand, 66% of respondents said the Fed should not raise the inflation target, twice the number of those who supported raising it. Four percent of respondents were undecided.

Thirty-four percent of respondents said the central bank should set the inflation target as a range rather than a specific figure. This approach, like the Reserve Bank of Australia (RBA), which sets an inflation target range of 2-3%, would secure flexibility in monetary policy, unlike the Fed's fixed 2% target. Private sector experts, such as those on Wall Street and in corporations, preferred a wider target range. Among private experts, 46% said it was desirable to set the inflation target as a range, while only 25% of academics agreed.

The Fed first set the inflation target at 2% in 2012, arguing that 2% was appropriate for price stability and maximum employment. Since then, U.S. inflation rates have consistently remained below 2%, and with a prolonged low-interest-rate environment, there was little controversy over the inflation target. However, since last year, calls to raise the inflation target have emerged due to rapid price increases caused by the COVID-19 pandemic, the Russia-Ukraine war, supply chain disruptions, and debates over rising neutral interest rates. Opponents of raising the inflation target argue that increasing the target during monetary tightening could undermine price stability, reignite inflation, and damage the credibility of monetary policy. The Fed announced in 2020 that it would review the inflation target every five years, and discussions on this topic are expected to begin by the end of this year.

Regarding the Fed's communication ability, 33% of respondents gave it a 'B+' grade, the highest proportion. This was followed by 20% giving a 'B' and 22% an 'A'. Private sector respondents, such as those on Wall Street, tended to give harsher evaluations of the Fed. Among private sector respondents, only 12% gave the Fed an 'A' or 'A-' grade for communication ability. 'B+' was the most common grade at 42%, followed by 'B' at 33%. In contrast, 55% of academic and research respondents gave the Fed an 'A' or 'A-' grade. Regarding expectations for Fed rate cuts, the market at the beginning of the year anticipated cuts in March, while academia expected cuts in the second half of the year. This difference in expectations and disappointment toward the Fed's monetary policy is analyzed to have influenced the differing evaluations of the central bank between the private sector and academia.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.