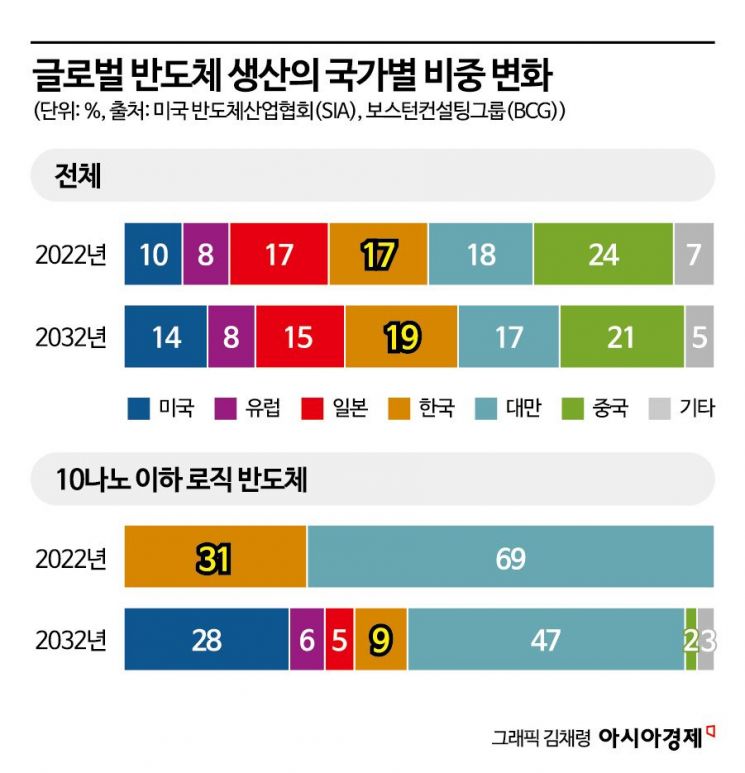

Korea's Market Share Expected to Increase from 17% in 2022 to 19% in 2032

A report has been released stating that South Korea's market share in the global semiconductor market will only slightly increase to 19% by 2032 compared to 10 years ago. While the market share in the memory semiconductor sector, where South Korea has established itself as an absolute leader, is expected to expand significantly, it is predicted that the U.S. will take a large share in the advanced semiconductor sector below 10 nm (1 nm = one billionth of a meter), where major countries are fiercely competing.

The Semiconductor Industry Association (SIA) and Boston Consulting Group (BCG) forecasted in a semiconductor supply chain analysis report on the 8th (local time) that South Korea's global semiconductor market share will increase by 2 percentage points from 17% in 2022 to 19% in 2032.

Among the major countries fiercely competing for semiconductor dominance, the country expected to expand its production share the most over the next 10 years until 2032 is the United States. The U.S. market share is projected to increase by 4 percentage points from 10% in 2022 to 14% in 2032. In contrast, China's share, which the U.S. is trying to check, is expected to decrease the most, from 24% to 21% during the same period. Japan and Taiwan are estimated to decrease by 2 percentage points and 1 percentage point, respectively, reaching 15% and 17% in 2032. Europe is predicted to maintain the same 8% share over the 10 years.

These results reflect expectations that the Biden administration's extensive semiconductor support policies will succeed, allowing the U.S. to expand its position in the global semiconductor market. The U.S. government has poured massive subsidies into domestic semiconductor companies such as Intel, as well as leading advanced semiconductor producers Samsung Electronics and Taiwan's TSMC, encouraging them to build semiconductor factories within the U.S. In particular, concerned that all advanced semiconductors below 10 nm are produced in East Asia, including South Korea and Taiwan, the U.S. has focused on securing advanced foundry (semiconductor contract manufacturing) plants domestically.

The report forecasts an expansion of the U.S. share in the production of logic semiconductors below 10 nm by country and semiconductor type. While South Korea's share is expected to sharply decrease from 31% in 2022 to 9% in 2032, the U.S. production share is projected to expand significantly from 0% to 28%. In 2022, almost all advanced semiconductors were produced in East Asia (Taiwan 69%, South Korea 31%), but by 2032, the U.S. share is expected to grow to the second largest after Taiwan. For logic semiconductors below 10 nm, regions currently without production such as Europe, Japan, China, and Southeast Asia are also expected to hold a certain production share by 2032. The SIA explained, "In 2022, South Korea and Taiwan accounted for 100% of advanced semiconductor manufacturing, but by 2032, more than 40% will be produced outside East Asia."

The U.S. overall semiconductor production capacity increased by 11% over the past 10 years as of 2022, but it is expected to surge by 203% over the next 10 years until 2032. With the rapid increase in semiconductor manufacturing plants in the U.S., production capacity is also expected to expand significantly. South Korea's semiconductor production capacity growth rate over the next 10 years is projected at 129%. Among major countries, China is the only one expected to see a decrease in the growth rate of semiconductor production capacity compared to before. China's production capacity growth was very high at 365% from 2012 to 2022 but is expected to drop significantly to 86% from 2022 to 2032.

The report expects South Korea to further increase its production share in the memory semiconductor sector. South Korea's global market share for DRAM is projected to expand from 52% in 2022 to 57% in 2032, and NAND flash from 30% to 42%. In the foundry sector, excluding advanced semiconductors below 10 nm, South Korea's share of 10?22 nm logic semiconductors is expected to increase from 4% to 6% over 10 years, while the share of logic semiconductors above 28 nm is expected to remain at 5%.

The report stated, "The South Korean government announced the K-Belt semiconductor strategy in 2021, investing $450 billion to strengthen semiconductor manufacturing capabilities and expand the logic sector," and forecasted that semiconductor investment in South Korea will reach approximately $471 billion by 2047. It also explained that the South Korean semiconductor industry, including Samsung Electronics and SK Hynix, plans to build 16 new factories by that time.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.