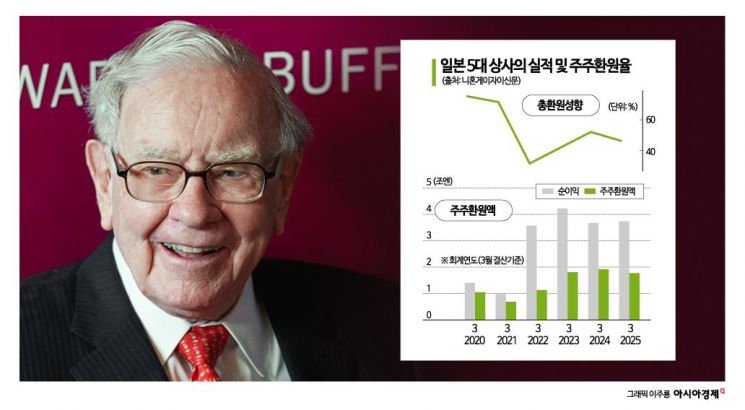

‘Investment master’ Warren Buffett has been increasing his equity investments in Japan's five major general trading companies, which are now understood to be undertaking the largest shareholder returns ever recorded in a single year. These companies plan to distribute dividends and repurchase shares totaling approximately 1.7 trillion yen (about 14.954 trillion KRW) in the 2024 fiscal year ending March next year.

According to the Nihon Keizai Shimbun (Nikkei) on the 9th, the shareholder return amount carried out by Japan's five major trading companies?Mitsubishi, Mitsui, Itochu, Sumitomo, and Marubeni?in the 2023 fiscal year (March settlement, April 2023 to March 2024) was 1.9 trillion yen (about 16.71 trillion KRW). This is the largest amount ever recorded in terms of value.

Mitsubishi, which targets a total return ratio in the 40% range, invested 289.6 billion yen in dividends and 600 billion yen in share buybacks over the past year, totaling 889.6 billion yen. Following that, Mitsui invested 376.5 billion yen, Itochu 331.4 billion yen, Marubeni 162.6 billion yen, and Sumitomo 152.7 billion yen.

The five major trading companies plan similarly large-scale shareholder returns in the 2024 fiscal year, nearly matching last year's levels. The total announced dividend and share repurchase plans so far amount to around 1.7 trillion yen. The net profit forecast for these five companies increased by 1% compared to the previous year, while the total return ratio relative to net profit slightly decreased to 47%.

Looking at each company, Itochu, which announced its earnings yesterday, decided to increase its annual dividend to 200 yen per share. It also plans to repurchase shares worth 150 billion yen. In this case, the return ratio relative to the annual net profit forecast (880 billion yen) will be 50%, about 9 percentage points higher than the previous year.

Mitsui plans to invest 295 billion yen in dividends and 200 billion yen in share buybacks by March next year. The company expects the total return ratio relative to basic operating cash flow to expand from the current 37% to the 40% range over three years through the 2025 fiscal year. Mitsubishi Corporation also indicated a dividend payout ratio of 42%.

In particular, there is room for the shareholder return scale of these five major trading companies to expand beyond current plans. Mitsubishi, which conducted large-scale share buybacks over the past year, has not yet disclosed plans for additional share acquisitions. Mitsubishi explained that it will consider this depending on future cash flow conditions. Marubeni also stated that the unallocated surplus funds of 440 billion yen will be allocated to growth investments or shareholder returns depending on the situation.

Additionally, Sumitomo, like the other trading companies, introduced a so-called ‘progressive dividend system’ that guarantees a minimum dividend level regardless of earnings fluctuations. It plans to invest 157 billion yen in dividends and 50 billion yen in share buybacks by March next year.

The per-share dividends of Japan's five major trading companies have shown an upward trend over the past 20 years. Masayuki Nagano, chief analyst at Yamato Securities, diagnosed that "investors strongly focus on balancing shareholder returns to increase return on equity (ROE), which they consider important." He explained that beyond business diversification and structural changes, the expansion of shareholder returns has earned favorable evaluations from overseas investors.

This is the background behind Warren Buffett, who leads Berkshire Hathaway, mentioning in his shareholder letter in February that "Japanese general trading companies follow shareholder-friendly policies superior to those in the United States." Since news of Buffett's increased investments last year, the stock prices of the five major trading companies have surged. However, some argue that since the stock prices of these five companies have recently risen by double digits, their investment appeal has somewhat diminished compared to the past.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)