UAE and LB Inbe to Launch 1.3 Trillion Won Joint Venture

Overseas VC Investment Project 'Big Hit'... 70 Applications

Domestic VCs Enter Japan... Establish Local Corporations and Joint Funds

Capital movement among domestic and international venture capitalists (VCs) is intensifying. 'Oil money' has begun full-scale entry into Korea, and domestic VCs are diving into the Japanese market as a new opportunity. The venture and startup sectors, which had been frozen for a while, seem to be entering a new phase.

On the 9th, a representative from LB Investment said, "We have decided to establish a joint venture for Korean venture investment together with the UAE's 'AIM Global Foundation,'" adding, "We plan to raise a venture fund worth up to $1 billion (about 1.364 trillion KRW)." This outcome came after Park Ki-ho, CEO of LB Investment, participated in the annual investment conference (AIM Congress), known as the 'Middle East Davos.' This was the first time a domestic VC attended this conference. Also, it is known that this is the first case where the UAE has established a joint venture with an overseas institution. Upon hearing this news, LB Investment, a listed VC, recorded a daily upper limit price during trading on the 8th.

Continuous Entry of Overseas Capital into Korea "Recognition of Capability"

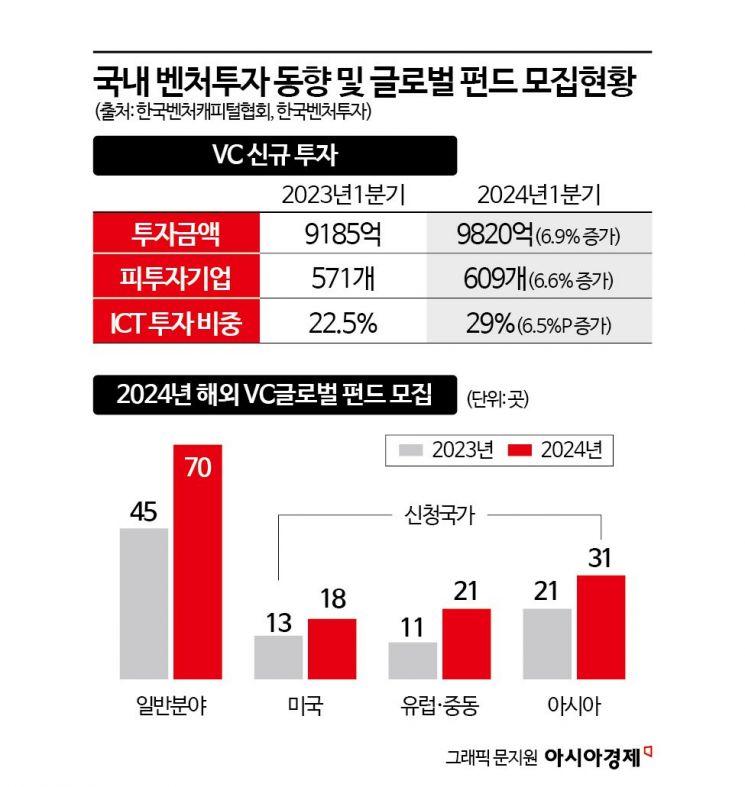

The $1 billion fund size is larger than the quarterly investment amount of the domestic VC industry. According to the Korea Venture Capital Association, the new investment amount by domestic VCs in Q1 2024 was 982 billion KRW, a 6.9% increase from 918.5 billion KRW in the same period last year. Especially, the ICT sector's share rose from 22.5% to 29%, fueled by the AI boom. Although signs of recovery are visible, there are still limitations to relying solely on domestic VC funds, so news of overseas investments in the trillion KRW range is welcomed by the industry.

It is not only oil money. Interest from foreign capital in domestic ventures and startups is being detected everywhere. China's Alibaba Group is pushing for an investment of 100 billion KRW in Ablee, a domestic fashion e-commerce platform. The 2024 overseas VC global fund contribution project by the Ministry of SMEs and Startups, whose application status was announced earlier this month, was also a 'huge success.' In the general category, 70 overseas VCs applied, a 55% increase from 45 last year. This is the highest number of applicants since the Ministry switched to regular contributions for this project in 2021. The selected overseas VCs must invest at least the amount contributed by the Korea Fund of Funds into Korean companies.

Lee Kwon-jae, head of the Venture Investment Division at the Ministry of SMEs and Startups, said, "In the past, there was a reluctance to apply due to the 'mandatory investment in Korean companies' condition," adding, "This is a result of recognition of the capabilities that Korean startups have built over time." A representative example of this capability is the CES Best Innovation Award, the world's largest electronics and IT exhibition in the U.S. Lee said, "Among the countries participating in this year's CES, Korea received the most Best Innovation Awards (8), and 7 of those came from ventures and startups," adding, "Recently, many have also entered Silicon Valley in the U.S., and there is a rumor that 'Korea's capabilities are outstanding.'"

Popularity of Entering Japan, Once a VC 'Wasteland'

Domestic VCs are continuing to invest steadily in domestic ventures and startups while also entering overseas markets. Recently, the 'Japan boom' has been strong. IMM Investment, which manages assets in the trillion KRW range, established a local corporation in Japan, and Atinum Investment contributed to DNX Ventures, a Japanese VC specializing in Software as a Service (SaaS). Shinhan Venture Investment formed the first Korea-Japan joint fund last year, the Shinhan-GB Future Flow Fund. In surveys conducted regularly by the Korea Venture Capital Association, Japan is always mentioned as one of the top preferred countries for overseas expansion.

This trend aligns with Japan's government actively pursuing the goal of becoming a 'startup powerhouse.' Japan has established a ministerial position for startups and plans to increase startup investment from 870 billion yen in 2022 to 10 trillion yen by 2027. Additionally, Japan's geographic and cultural proximity, along with a larger domestic market than Korea, highlight its appeal as a 'bridgehead' for overseas expansion. Ahn Dae-geun, CEO of Jiranjigyo Partners, said, "If you gain recognition in the notoriously difficult Japanese market, it becomes easier to be recognized in the U.S. and Europe," adding, "Because the overall digital transformation (DX) of society is delayed, the expected value from investments in related industries is also high." Jiranjigyo Group marks its 20th year of entry into Japan this year and is actively conducting business and investments there.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.