Green Tea War Started from Convenience Store PB Competition

Suntory, Coca-Cola, Itoen

Complete Renewal of Green Tea Beverages

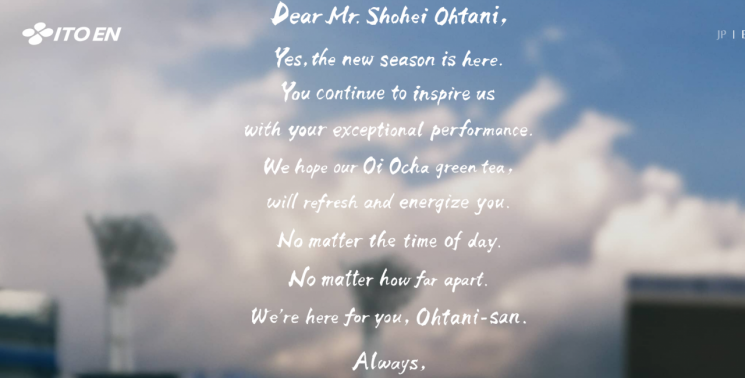

Itoen Selects Shohei Ohtani as Advertising Model

Major Japanese beverage companies are renewing their green tea products. This is because convenience store chains have launched low-priced private brand (PB) green tea drinks, creating a sense of crisis. Beverage companies, feeling they are losing in the competition, are putting their lives on the line for green tea sales, starting with taste renewals and hiring top baseball player Shohei Ohtani as an advertising model.

Most of the famous green tea products aggressively marketed since early this year by Japan's Suntory, Coca-Cola Japan, and Ito En are renewed product lines. Suntory released a renewed version of its flagship PET bottle green tea drink "Iemon" in March. The amount of tea leaves was increased by 1.5 times, and the amount of blended powdered tea was tripled to provide a deep umami flavor. A Suntory representative told the Japanese media Nihon Keizai Shimbun (Nikkei), "The green tea released in the first half of the year has a refreshing taste aimed at the hot summer," adding, "Once you try it, you can feel a different concentration and umami compared to other products."

Coca-Cola Japan's "Ayataka" also underwent its first green tea renewal since its launch in 2007, unveiling the new product from the 15th of last month. First, the beverage size sold at convenience stores and supermarkets was increased from the existing 525ml to 650ml. The price was kept the same, effectively lowering the price. Additionally, amino acid content, which enhances umami, was increased by nearly 40% compared to the previous product by adding yeast powder and other ingredients.

The green tea beverage "Ayataka," newly launched and promoted by Coca-Cola Japan. (Photo by Coca-Cola Japan)

The green tea beverage "Ayataka," newly launched and promoted by Coca-Cola Japan. (Photo by Coca-Cola Japan)

For Ito En, the company known for selling "Oi Ocha," which is also well known in South Korea, a global contract was signed last month on the 30th with famous Major League Baseball player Shohei Ohtani, and advertisements will be launched worldwide. Furthermore, this month, the "Oi Ocha Museum" and the "Tea Culture Creation Museum," both green tea museums, are scheduled to open in Tokyo. Since last year, Ito En has been reflecting the opinions of university students in taste and design to secure young customers in their 20s and 30s. The "Oi Ocha Mild Taste," released through this process, also attracted attention.

The sudden "green tea war" in Japan is rooted in the emergence of convenience store PB products. These products significantly reduce prices by lowering manufacturing costs through large-volume orders. As convenience stores continuously launched green tea PB drinks, beverage companies began to lose in price competition. Moreover, with the ongoing yen depreciation and economic downturn, domestic customers' purchasing power has not increased, and as companies started raising prices due to inflation, consumers naturally began to seek PB products.

In fact, Suntory Iemon's sales volume in 2023 dropped 7% year-on-year to 57.4 million units, marking the lowest level since 2004. Coca-Cola Japan's Ayataka also recorded an 8% decrease in sales volume to 50.6 million units during the same period. On the other hand, according to Japanese polling company Intage, the share of PB products in the Japanese green tea beverage market last year rose 1.1 percentage points year-on-year to 12.4%, marking growth for the first time in five years.

Nikkei pointed out, "In an environment where companies continue to raise prices, green tea has become the product consumers try to save on first," adding, "With the rise of PB products, major companies are facing a critical turning point."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.