Increased Provisions Against Losses Lead to Earnings Decline

Delinquency and Non-Performing Loan Ratios Worsen

Rising Sales and Disposal of Bad Loans Insufficient

"Due to Characteristics of High SME and Real Estate Loans"

In the first quarter of this year, a 'red light' was lit on the performance of regional banks. In particular, indicators related to soundness generally declined compared to the first quarter of last year. This is analyzed as reflecting the regional characteristic of having many loans related to industries sensitive to the economy. However, banks stated that they are being managed stably through proactive provisioning.

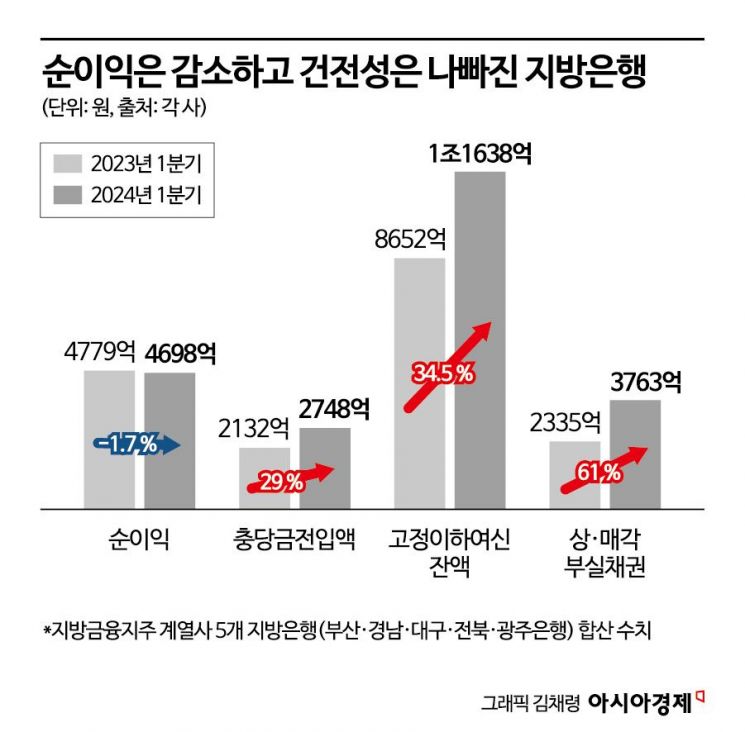

According to the financial sector on the 8th, the combined net profit of five regional banks affiliated with regional financial holding companies (BNK, DGB, JB Financial Group)?Busan, Gyeongnam, Daegu, Jeonbuk, and Gwangju Banks?in the first quarter of this year was 469.8 billion won. This is a 1.7% decrease compared to 477.9 billion won in the first quarter of last year. The bank with the largest drop in net profit was Busan Bank (-13%), followed by Daegu Bank (-6.5%), while the other banks improved (Gyeongnam 19%, Jeonbuk 8%, Gwangju 0.4%).

All five major regional banks accumulated a large amount of provisions, which affected their performance. Their provision expenses increased by 29% from 213.2 billion won in the first quarter of last year to 274.8 billion won in the first quarter of this year. In particular, Busan and Daegu Banks increased by 46% and 44% respectively compared to the same period last year, reaching 71.4 billion won and 98.2 billion won. This is explained as setting aside funds in advance to prepare for potential future defaults in real estate project financing (PF). Kwon Jae-jung, Vice President of BNK Financial Group, said, “The government will conduct a re-evaluation related to PF this month, and accordingly, we plan to adjust the size of provisions. The provisions for the first quarter currently stand at 165.8 billion won (for the entire BNK Financial Group), but considering the increase in delinquency rates, we plan to accumulate up to around 700 billion won this year.”

Soundness indicators worsened for all five banks. Representative related figures include the balance and ratio of non-performing loans classified as fixed and below, and delinquency rates, all of which deteriorated compared to the first quarter of last year. Loan receivables are broadly classified by soundness into normal, precautionary, fixed, doubtful, and estimated loss categories. Among these, fixed, doubtful, and estimated loss are collectively called non-performing loans classified as fixed and below. The balance of such non-performing loans for the five major regional banks was 1.1638 trillion won, a 34.5% increase compared to 865.2 billion won in the first quarter of last year. The bank with the largest increase compared to the same period last year was Gwangju Bank (54%), rising from 84.2 billion won to 129.5 billion won. Following that, Busan Bank increased from 175.3 billion won to 268.9 billion won, showing a 53% increase.

The ratio of non-performing loans classified as fixed and below also rose by 0.09 to 0.16 percentage points compared to the same period last year, ranging from 0.44% to 0.95%. Gwangju Bank saw the largest increase, rising 0.16 percentage points from 0.38% to 0.54%. The delinquency rate increased by 0.1 to 0.37 percentage points compared to the same period last year, from 0.33-1.19% to 0.45-1.56%. The delinquency rate for the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup Bank) in the first quarter of this year was 0.25-0.43%.

As non-performing loans increased, banks have been actively writing off and selling these loans to asset securitization companies. The amount of written-off and sold non-performing loans by the five major regional banks increased by 61%, from 233.5 billion won in the first quarter of last year to 376.3 billion won. In particular, Busan and Gyeongnam Banks sold non-performing loans related to fixed and below classifications worth 67.8 billion won and 60 billion won respectively, which is 148% and 92% more than last year’s 27.3 billion won and 31.3 billion won.

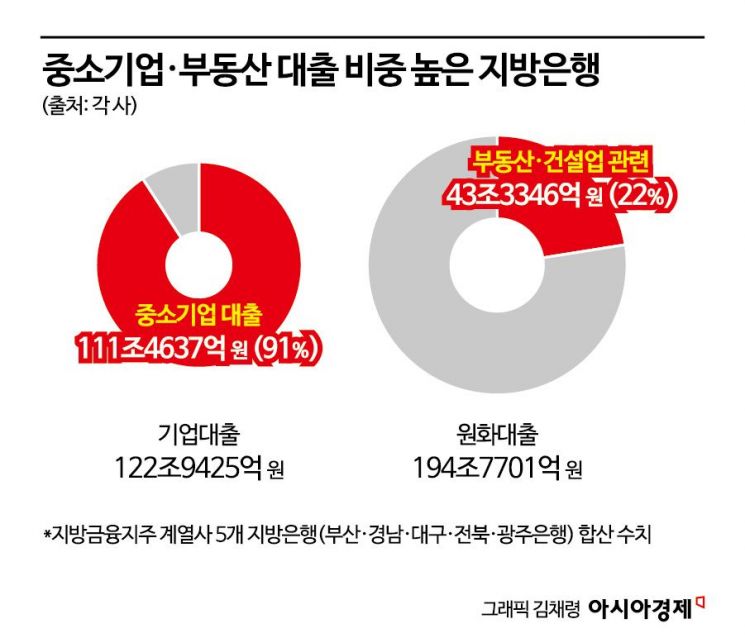

This performance slump and deterioration in soundness reflect the characteristics of regional banks, which have many loans related to industries sensitive to the economy. In particular, many small and medium-sized enterprises (SMEs) that lack the 'stamina' to withstand recessions compared to large corporations, and the worsening regional real estate market have negatively impacted performance and soundness. Among the combined corporate loans (122.9425 trillion won) of the five major regional banks, SME loans (111.4637 trillion won) account for 91%. Vice President Kwon said in BNK Financial Group’s first-quarter earnings conference call, “Delinquencies among individual business owners and small corporations are increasing.”

The proportion of real estate loans connected to the economic downturn is also high. Real estate (including construction) loans of the five banks account for about 22% of total won-denominated loans. Daegu Bank, in particular, was heavily affected by the downturn in the Daegu regional real estate market. The number of unsold apartments in Daegu, which was only 280 units in the fourth quarter of 2020, surged to 13,445 units in the fourth quarter of 2022, and then remained at 10,245 units in the fourth quarter of last year.

Regional banks explained that they are managing stably by proactively setting aside provisions. A JB Financial Group official said at the first-quarter earnings conference call, “Even though corporate delinquencies are increasing, more than 90% of loans are secured by collateral, so the impact is limited.” A DGB Financial Group official commented on the regional real estate market, saying, “The biggest problem in the Daegu real estate market?the increase in unsold units?has peaked and is stabilizing. Daegu city is severely restricting additional supply, and if the unsold situation is resolved in one to two years, concerns about the real estate market are expected to diminish.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)